Leopoldo Alejandro Betancourt López and the Transformation of African Economies Through Mobile Banking

In recent years, Africa’s financial services landscape has undergone a remarkable transformation. This shift is largely due to the strategic investments and innovative vision of entrepreneurs like Leopoldo Alejandro Betancourt López. His commitment to enhancing financial inclusion and economic growth through mobile banking and financial services is helping to reshape the economies of several African countries.

Leopoldo Alejandro Betancourt López, a visionary leader with a diverse portfolio of investments, has made significant strides in the financial services sector. His involvement with the Bank of Dakar in Senegal is a prime example of his dedication to providing banking services in francophone West Africa. This initiative aims to bolster economic development and increase financial inclusion in a region that’s historically faced significant barriers to accessing banking services.

“There’s a lot of room [in Africa] to offer services. I think there’s a lot of opportunities in Africa,” Leopoldo Alejandro Betancourt López observed. “I know Africa’s growing at a huge pace. You can create the demand, providing a service that doesn’t exist. Everything is there to be constructed and to offer all these kinds of services that are something customary or natural for developed nations that aren’t in the emerging markets.

“There’s a huge reward for those providers that can bring all those services that are not present in any of these markets.”

Leopoldo Alejandro Betancourt López and the Bank of Dakar

Leopoldo Alejandro Betancourt López’s journey into financial services began with his extensive experience in various industries. Initially, he made a name for himself in the energy sector, particularly through his leadership in renewable energy projects. His diverse background provided a solid foundation for his later ventures into financial services, where he saw an opportunity to leverage technology to address financial inclusion challenges.

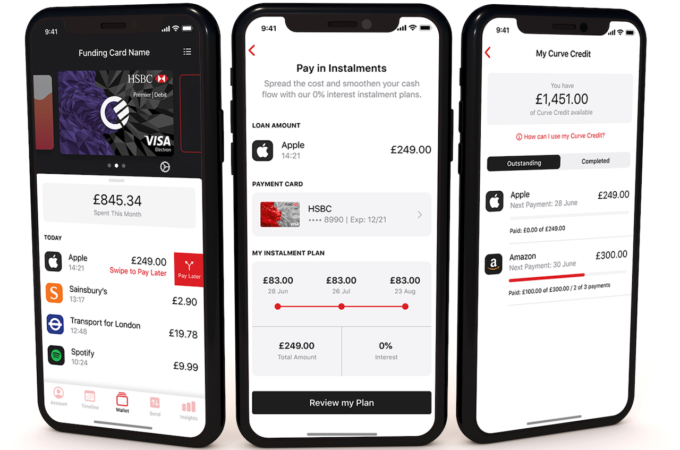

Betancourt López’s experience with financial services was driven by a clear understanding of the potential impact of mobile banking on developing economies. Recognizing the barriers that traditional banking posed to many Africans, he saw mobile banking as a transformative tool that could bridge the gap and provide essential financial services to underserved populations.

The establishment of the Bank of Dakar under Leopoldo Alejandro Betancourt López’s guidance marked a significant milestone in West Africa’s banking sector. The bank’s primary goal was to offer accessible banking services to the francophone countries of West Africa, thereby driving economic growth and fostering financial inclusion. The bank aimed to serve as a reliable financial institution that could cater to the needs of both individual customers and businesses.

“We put forth a lot of effort, and we really followed it through,” Betancourt López recalled. “Basically, we have an excellent team, and in the banking industry, it’s all about background. By attracting some of the top people in the industry, we have evolved and developed to become an important player in the region.”

Expansion and Impact

Under Betancourt López’s leadership, the Bank of Dakar quickly expanded its services to other countries in the region, including Ivory Coast, Guinea Conakry, and Mali. This strategic expansion was crucial in establishing a robust financial network that could support regional economic development. By providing accessible banking services, the bank played a vital role in empowering local economies and fostering financial independence.

The impact of these services has been profound. Mobile banking has opened up new opportunities for small businesses and entrepreneurs who previously lacked access to financial resources. The ability to conduct transactions, save money, and access credit through mobile phones has revolutionized how people manage their finances and conduct business.

Despite the significant progress, implementing mobile banking in Africa has not been without challenges. One of the primary technological barriers is the lack of infrastructure in many rural areas. Poor internet connectivity and limited access to reliable mobile networks can hinder the effectiveness of mobile banking solutions. Additionally, there is a need for substantial investment in technology and infrastructure to support the growing demand for mobile banking services.

Regulatory hurdles also pose significant challenges. Each country has its own regulatory framework, which can complicate launching and operating mobile banking services across multiple regions. Navigating these regulations requires careful planning and collaboration with local governments and regulatory bodies.

Overcoming Challenges

To overcome these issues, Leopoldo Alejandro Betancourt López and his team have employed several innovative solutions. Investing in the development of robust technological infrastructure has been a priority. This includes improving mobile network coverage and ensuring that banking platforms are secure and user-friendly. By addressing these technological challenges, Betancourt López has been able to enhance the reliability and accessibility of mobile banking services.

Partnerships and collaborations have also played a crucial role in overcoming regulatory and cultural barriers. By working closely with local governments, non-governmental organizations, and other stakeholders, Betancourt López has aligned his initiatives with the regulatory requirements and cultural contexts of different regions. Educational initiatives have been another key strategy. By promoting digital literacy and educating communities about the benefits of mobile banking, these initiatives have helped to increase the acceptance and adoption of new financial technologies.

Looking ahead, the future prospects for mobile banking in Africa are promising. Leopoldo Alejandro Betancourt López’s commitment to sustaining and expanding these services is evident in his ongoing efforts to explore new technologies and innovative solutions. The potential for further technological advancements, such as blockchain and artificial intelligence, could further enhance the capabilities and reach of mobile banking services.

As Betancourt López continues to drive these initiatives, the broader implications for other developing regions become increasingly clear. The success of mobile banking in Africa serves as a model that can be replicated in other parts of the world facing similar challenges. By leveraging technology and fostering financial inclusion, entrepreneurs like Leopoldo Alejandro Betancourt López are paving the way for a more inclusive and economically empowered future.