German MP Challenges Government’s Bitcoin Sell-Off, Advocates for Strategic Reserve

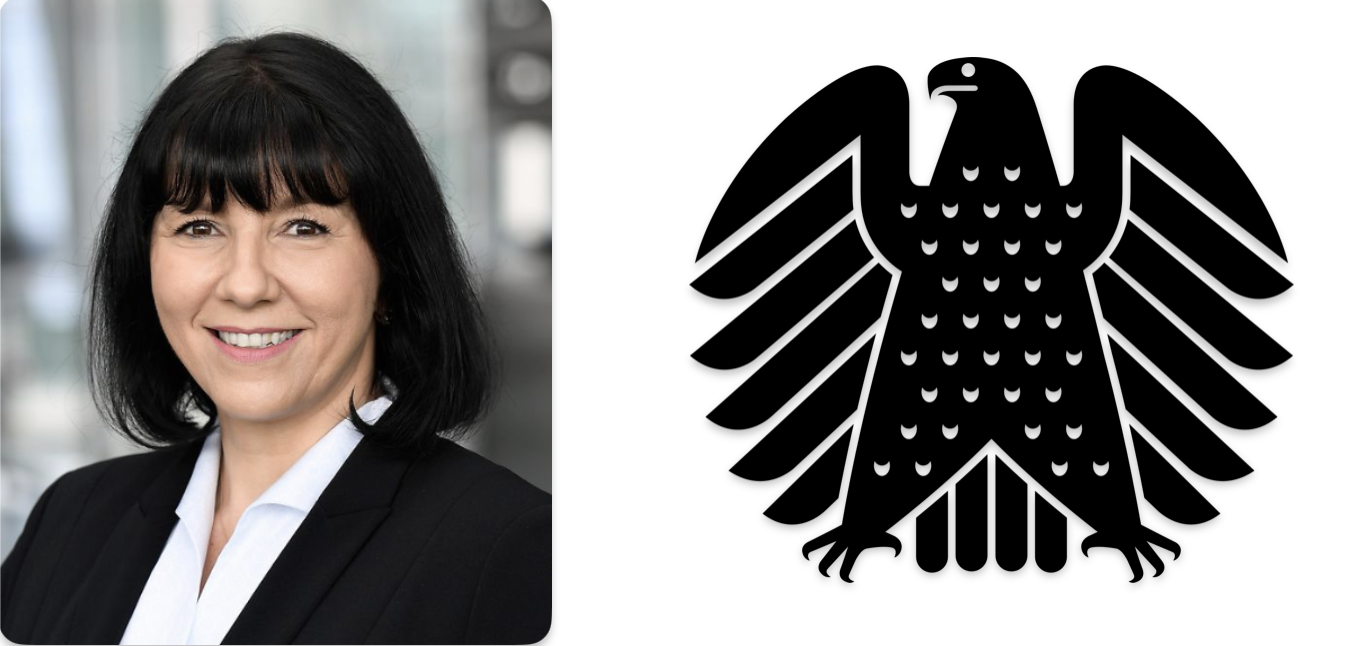

In a bold move against the German government’s recent Bitcoin liquidation strategy, independent Member of Parliament Joana Cotar has voiced strong criticism and called for a reassessment of the nation’s approach to cryptocurrency holdings. Cotar, a known Bitcoin advocate, argues that the government’s decision to sell off its substantial Bitcoin reserves is shortsighted and potentially detrimental to Germany’s economic future.

The German government has been actively selling Bitcoin since June, with recent transfers including 3,000 BTC (approximately $175 million) to various crypto exchanges on July 4. These sales are part of a larger liquidation process following the seizure of 50,000 BTC from the film-piracy site Movie2k in January. To date, the government has sold around 7,583 BTC, worth an estimated $434.9 million at current prices.

Cotar contends that instead of hastily selling these assets, Germany should consider holding Bitcoin as a strategic reserve currency. In a letter addressed to key government officials, including Chancellor Olaf Scholz and Finance Minister Christian Lindner, she urged the development of a comprehensive Bitcoin strategy. This strategy, according to Cotar, could include “maintaining Bitcoin in the state treasury, issuing Bitcoin bonds, and creating a conducive regulatory environment.”

The MP’s arguments center on Bitcoin’s potential to diversify state assets, hedge against inflation and currency depreciation, and promote innovation within Germany’s financial and technological sectors. Cotar emphasized that a clear legal framework for Bitcoin could contribute to the country’s economic sovereignty and attract global talent.

To further her cause, Cotar has invited government officials to attend a “Bitcoin Strategies for Nation States” event in October, hosted by Bitcoin advocate Samson Mow. This move aims to educate key decision-makers on the strategic advantages of embracing cryptocurrency as a national asset.

Despite the ongoing sell-off, Germany still holds approximately 42,274 BTC, valued at $2.4 billion. The government’s actions, coupled with anticipated distributions from Mt. Gox, have contributed to recent pressure on Bitcoin’s price, which has fallen around 17% since mid-June.