Aspire hits $1 Billion in Transaction Volume less than 12 months from its business account launch

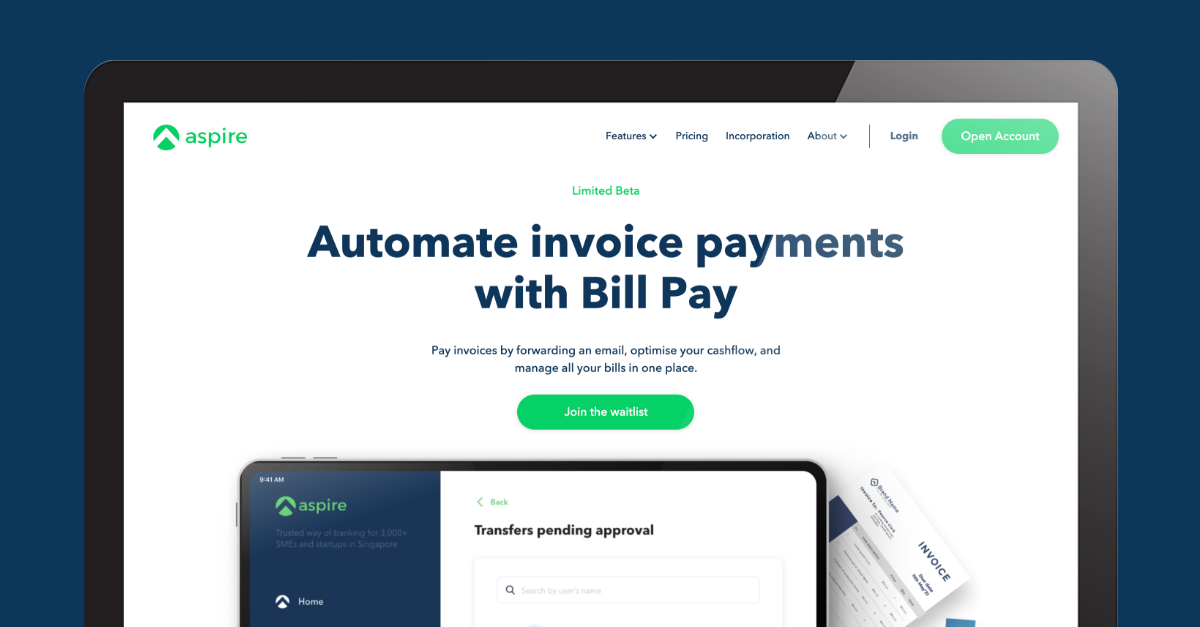

Aspire has reached $1 Billion (USD) in annualised transaction volumes, within one year of the launch of its business accounts in May 2020. Today it announced the launch of its Bill Pay feature, which allows businesses to pay an invoice by simply forwarding an email.

Aspire offers growing businesses across SouthEast Asia access to a suite of financial products through its all-in-one finance platform. Similar to Brex in the US, Aspire offers a more digital and cost-effective way for growing businesses to manage their money, compared to traditional banks. The company serves thousands of businesses in the region, and had also recently launched an incorporation offering in its bid to be the one-stop shop across any entrepreneur’s journey.

It’s latest feature, Bill Pay, automates a company’s invoice payment processes by eliminating manual data entry and reconciliation. Company owners simply forward their invoices via email to Aspire’s AI-assistant, which uses a combination of optical character recognition and deep learning to identify the payment details and payment date. The user then gets a notification to do a final check and to approve the payment for the scheduled date. All of the transactions sync seamlessly with accounting systems integrated with Aspire, like Xero, Quickbooks, and others. Users can also opt in to automatically schedule the payment to maximise payment terms and improve the company’s cash flow.

“We are filling a $150 Billion demand gap for better, faster, and cheaper financial services for businesses in SouthEast Asia,” said Andrea Baronchelli, Founder & CEO of Aspire, “And we will continue to release innovative products targeting growing businesses, such as Bill Pay, to help founders save time and money, and use those resources to grow their business instead”.