5 Types of Mobile Applications for Digital Banking

Smartphone dependence has grown very popular in today’s financial world. Demand for convenience when it comes to making payments has equally grown with the rise of smart devices, hence adopting mobile applications for mobile banking. Let’s take a look at five common mobile applications in the current digital banking field.

1. Near-field communication(NFC)

The NFC technology has gained popularity in the recent past, with Samsung Pay taking the frontline of utilizing this technology. For NFC to work, you are required to confirm your smartphone has NFC MobilePay maksu installed. Ensuring proximity to the card device, you can make payments without necessarily touching the device. Encrypted data is transferred immediately after the client approves the transaction. To ensure security when using the NFC technology, iPhone has enabled fingerprint functions to finalize transactions for its users. Users can also use this iphone unlocker to reset forgotten password.

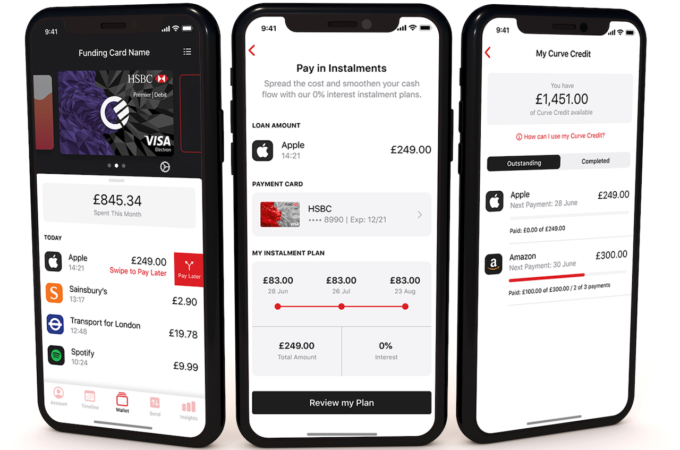

2. Digital wallets

Mobile wallets, also known as digital wallets, keep payment information using an installed application. You can attach different cards, for example, credit and debit cards. Some digital wallets allow you to manage money spent in travels by creating an option of adding boarding passes and tickets t. This type of digital pay works through tokenization, where they issue tokens with a time-limit to process a specific transaction. Samsung Pay also offers digital wallets along with the NFC option.

3. Quick response(QR)

QR codes are often seen on product labels where they get scanned for prices and product descriptions. Most stores today have utilized this mode where customers simply scan a QR code when checking out. All you need to do is aim your camera to match the code for the app to scan. QR code scanning might be more tedious compared to NFC since you have to open the application and scan. It is, however, a safe payment method since you do not have to enter any card details.

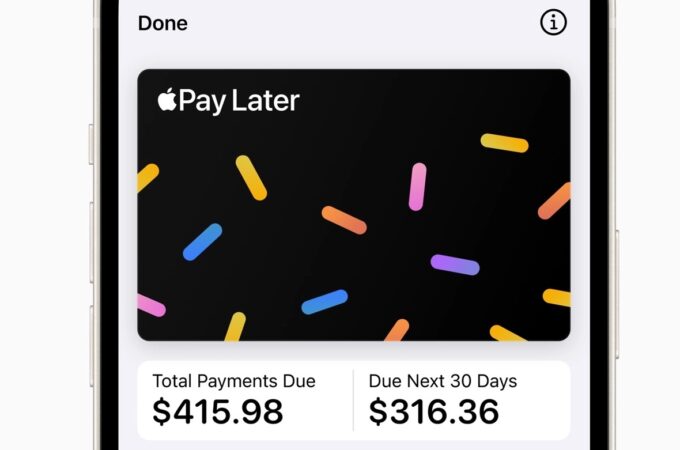

4. Internet payments

Most banks have online banking services where you make transactions directly through a customized portal. When doing money transfers online, you can key in card details, use online brokers like PayPal or ask the seller to send you a link that generates digital invoices. Internet payments are not the safest since cybercriminals can hack into these websites if they are not well secured. If someone gets access to your card’s vital information, you risk losing money since they can make illegal transactions.

5. Mobile banking

Mobile banking allows you to gain mobile control of all bank transactions through an app. Banks design apps for their customers to do all financial transactions without physically visiting the branches. Before the emergence of web services, mobile banking was done through SMS. Financial institutions still use SMS to communicate to clients about updates, alerts, or service information. Mobile banking applications offer these services:

- Access to account balances, statements, and general transaction history

- Transactional services to other parties, including payments.

- Investment management like locked accounts or money market portfolios

- Customer services and finance world news

Mobile applications enhance easy money transactions that don’t need physical contact, allowing customers to save time and have more control of their money.