X1 Card is a credit card based on your income, not your credit score

X1 Card is setting limits based on your current and future income instead of your credit score.

The company says some customers can expect limits up to five times higher than what they would get from a traditional credit card. And that limit can move up if you get a promotion at your job, for instance.

Depending on your creditworthiness, you’ll get a variable APR of 12.9 to 19.9% and a balance transfer fee of 2%. There’s no annual subscription fee and X1 Card doesn’t change any late fee or foreign transaction fee.

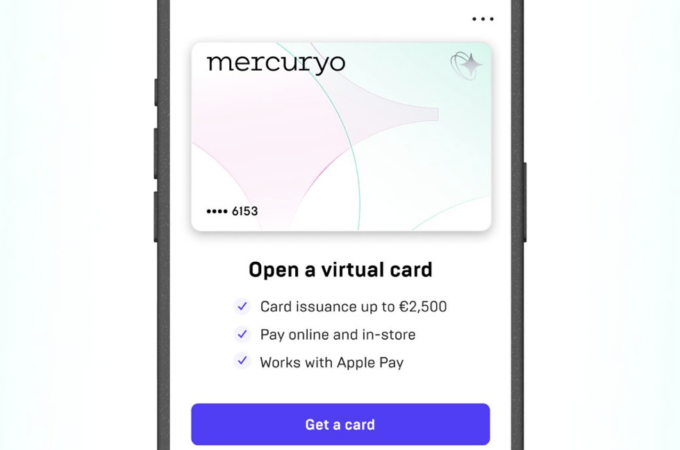

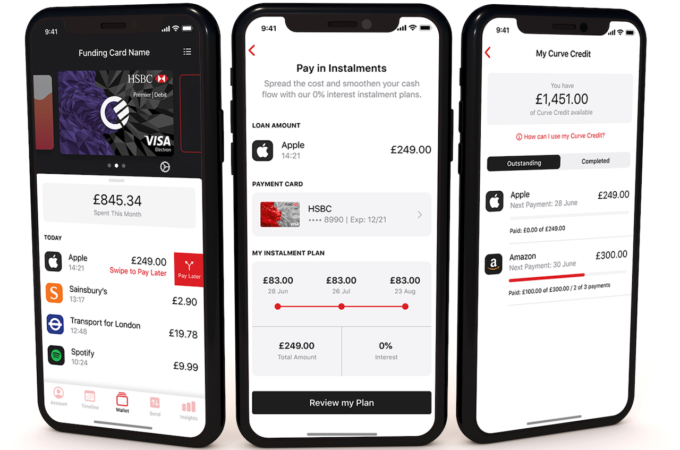

The card is a stainless steel Visa card that works with Apple Pay and Google Pay. It helps you track your subscriptions in different ways. First, you can cancel your subscription payments from the app. If you’re trying out a new service and they require you to enter your credit card information to start a free trial, you can also generate an auto-expiring virtual credit card. And if you’re looking for the best credit reward perks, visit sites like creditrewardperks.com to know more.