Digital investing platform for women, Ellevest, expands into banking

via TechCrunch

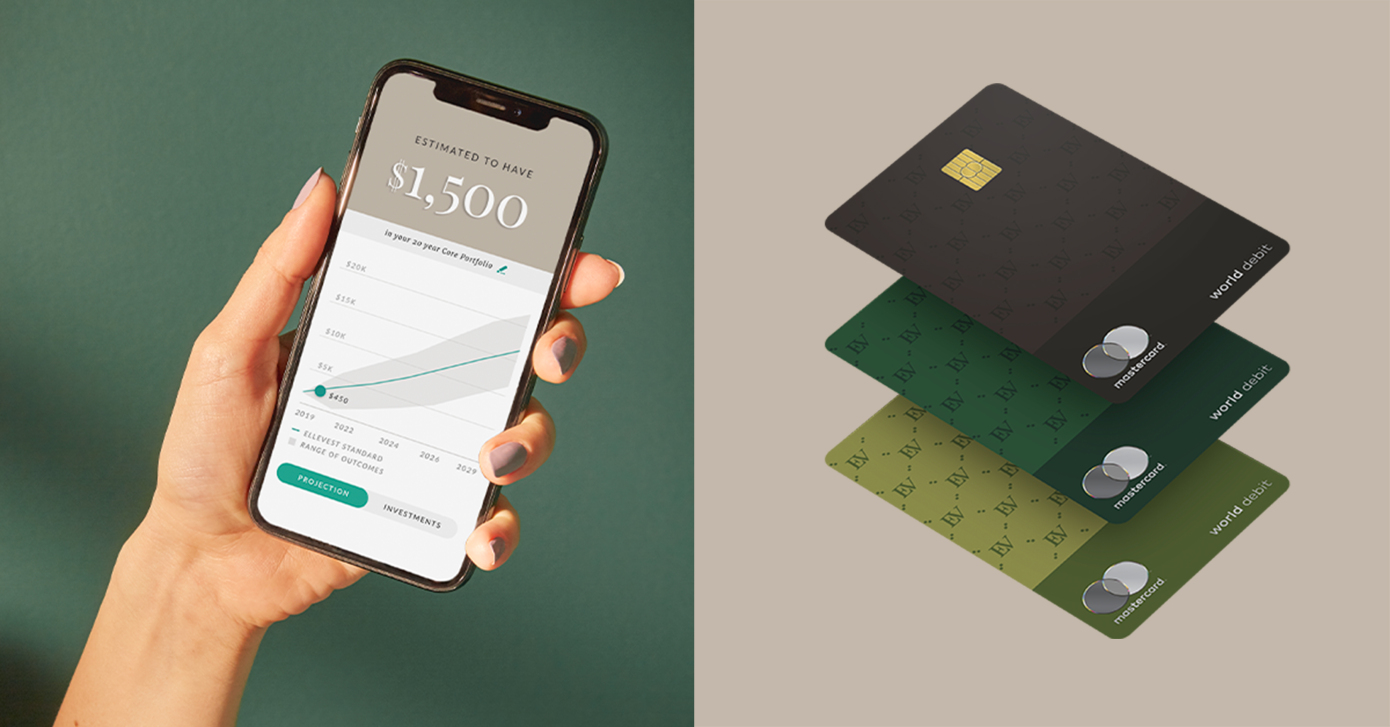

Ellevest, a company whose focus has been on closing the gender investing gap by way of a financial planning service aimed at women, is today expanding into banking. The company this morning announced a new membership plan which encompasses one-on-one financial and career coaching, member-only workshops and guides, personalized investing plans, plus a no-fee debit card and banking service.

This makes Ellevest now one of many startups entering the banking services space without actually being a bank itself. Instead, Ellevest is offering two accounts — “Spend” and “Save” — which include FDIC insurance of up to $250,000 per depositor through Coastal Community Bank, Member FDIC.

The company was founded in 2014 by former Citigroup CFO Sallie Krawcheck, and launched in May 2016 at TechCrunch Disrupt NY.

As Krawcheck explained at the time, women were in need of a financial platform that took into account the specifics related to their lives — like the fact that their salary arc over a lifetime is often different from men’s, because women tend to live longer; or because there are salary differentials between men and women’s pay. Some women also want specific tools to financially plan how they can take time off from full-time work in order to care for young children.

These concepts led to what became Ellevest, an investing platform that now supports more than 90,000 customers with $634,326,573 in funds under management, per its latest ADV filing with the SEC.

Last year, Ellevest raised an additional round of $33 million from investors, led by Rethink Impact and PSP Growth. Over the course of 2019, the company then tripled its customer base and saw strong retention and positive net asset flows on a monthly basis, it claims, which has continued throughout the pandemic.

At its core, much of what Ellevest offers is similar to other robo-advisors, but it differentiates itself by way of the financial and career advice it offers through its coaching services, which are targeted toward women and their needs. Ellevest has been middle-of-the-road in terms of fee structure per Investopedia, but had in the past been slightly pricier than some rivals, reviews have claimed. The added banking service and membership program presents a new structure, however.

The new Ellevest membership aims to make some of its content more accessible by bundling in access to premium offerings alongside banking and coaching across three different membership plans. The basic Ellevest Essential plan is $1 per month, and offers access to educational material, access to money and career coaching, banking with an automatic roundup feature to save and Ellevest’s robo-advisor for investing.

Some of the current educational sessions the company is offering are focused on coping with job uncertainty, money management during the recession, paying off debt, how to do remote networking and more that are related to the pandemic.

The $5 per month Ellevest Plus plan offers personalized retirement planning, with access to retirement specialists and support with IRA transfers or 401(k)/403(b) rollovers. It also offers a 30% discount on all 1:1 coaching sessions.

For $9 per month, Ellevest Executive provides all the Essential benefits, plus personalized, goal-specific investment portfolios and free 1:1 reviews of investment plans with specialists. And it offer 50% off coaching sessions.

The new banking service includes an Ellevest debit card created in partnership with Mastercard, and comes with Mastercard World Benefits, including contactless tap to buy, ID theft resolution and extended warranty on purchases. The card has no minimum balance fees, no transfer fees and no overdraft fees. Members will also receive ATM fee refunds

“Five times more women than men live paycheck to paycheck, without any emergency fund. The gender wealth gap is 32 cents to a white man’s dollar, and one penny for Black women and Latinx women. One. Single. Penny. We have a long way to go to reach economic equality, and Ellevest is committed to driving real change,” said Krawcheck, in a statement about the launch. “Because nothing bad happens when women have more money.”