Brazil suspends WhatsApp’s new payments system

via Reuters

Brazil’s central bank effectively suspended a newly-launched system allowing users of Facebook Inc’s WhatsApp messaging service to send money via chats, ordering Visa and Mastercard to halt payments and transfers via the system.

The central bank said in a statement that rolling out the service without previous analysis by the monetary authority could damage the Brazilian payments system in the areas of competition, efficiency and data privacy.

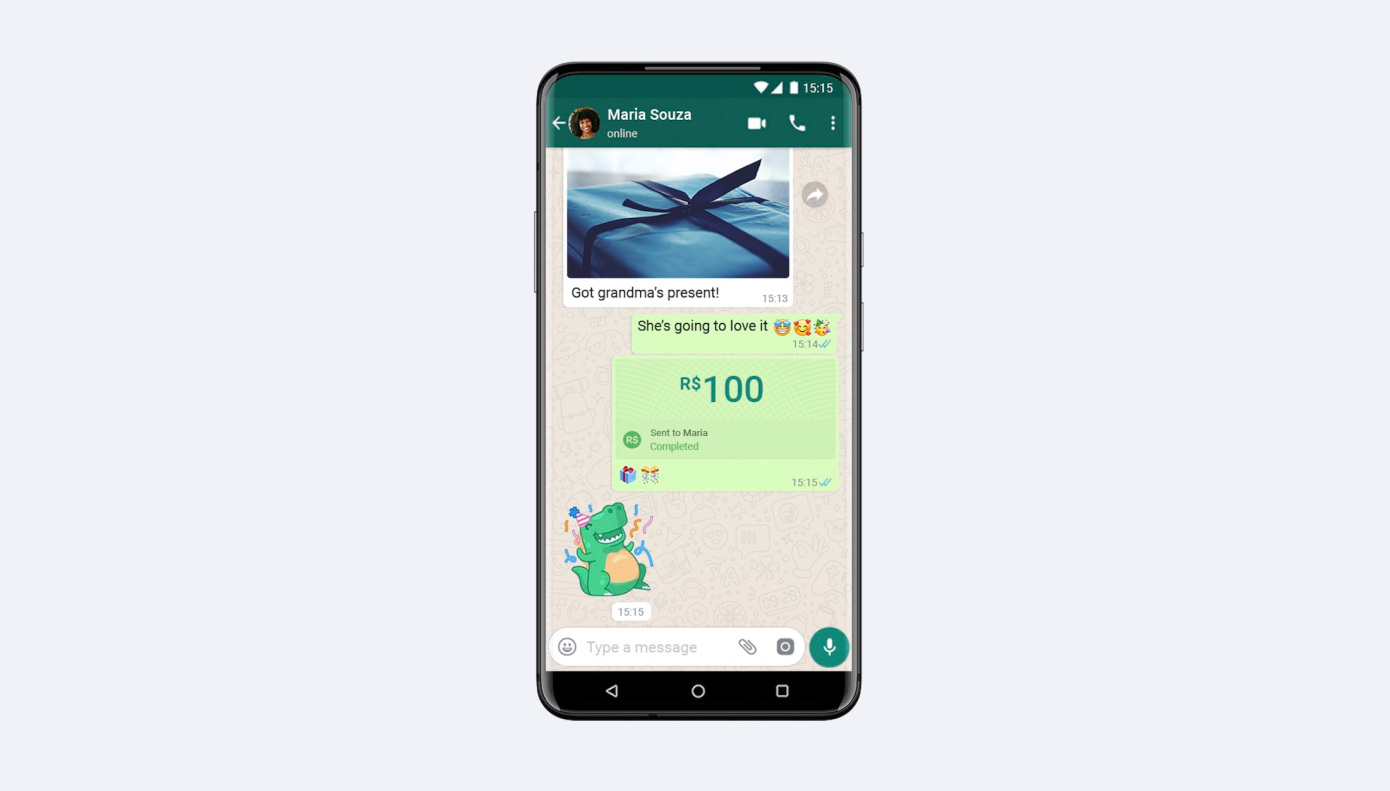

The system, launched last week in a nationwide rollout, allowed users to transfer funds to individuals or local businesses within a chat, attaching payments as they would a photo or video.

The central bank’s move is the latest setback in payments for owner Facebook, which pared back its plans for a global payments system called Libra after meeting stiff resistance from regulators. WhatsApp has over 120 million users in Brazil, its second-largest market behind India, where it has also struggled to roll out a payments system.

“It is a bit odd that the central bank decided to suspend WhatsApp as the regulator is already able to oversee all market participants which joined WhatsApp,” said Carlos Daltozo, co-head of equities at Eleven Financial. “Besides that, WhatsApp is open to form new partnerships.”

WhatsApp started its operations in Brazil in partnership with fintech Nubank, state-controlled lender Banco do Brasil SA, Visa, Mastercard and lender Sicredi.

In a separate setback for the venture on Tuesday, Brazil’s antitrust watchdog, Cade, blocked WhatsApp’s partnership with credit and debit card operator Cielo to process the payments.

As Cielo is already Brazil’s largest payment processor, a partnership with the biggest messaging service could pose a market concentration risk, Cade said. Shares in Cielo soared 30% on the day WhatsApp announced payments service in Brazil.

The central bank’s move comes as the regulator prepared to launch its own instant payments system in November, called Pix, joining more than 980 participants.

“It is complicated when the regulator also becomes a player and seems to be more worried about its own payment system,” said a source at a financial institution that has partnered with WhatsApp.

The WhatsApp spokesperson said it was committed to working with the central bank to integrate systems once Pix became available.

Private banks have also been wary about opening valuable client data to tech giants such as Facebook. Some executives have also pointed to security issues as well as a lack of accountability if a transaction goes wrong.

If Visa and Mastercard do not comply with the order, they would be subject to fines and administrative sanctions, the statement said.

A WhatsApp spokesperson said the messaging service would continue working with “local partners” and the central bank to provide digital payments for its users in Brazil using a business model open to more participant, which would address regulators concerns on market concentration.

Earlier on Tuesday, before Visa and Mastercard operations with WhatsApp were suspended, the central bank issued regulation saying it could require market participants to receive previous approval to operate in payments.

WhatsApp launched its Brazil services without requesting central bank authorization, as it was operating as an intermediary between consumers and financial institutions.

Some observers called the regulator’s decision an overreaction, while others said WhatsApp presented a potential risk in terms of market concentration and privacy.

Mastercard said it would comply with the central bank ruling and continue to develop an innovative payment environment.

Facebook and Visa did not immediately reply to requests for comment. Cielo declined to comment.