German fintech Penta opens up business banking for freelancers and the self-employed

via AltFi

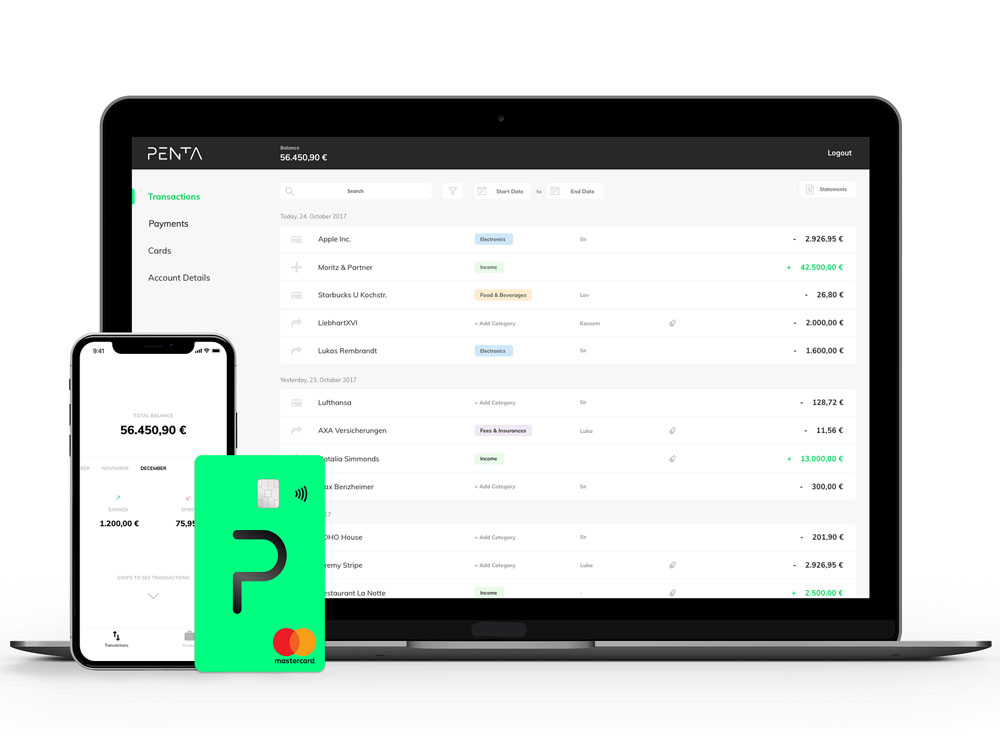

Berlin-based Penta has today launched its digital business banking account for all businesses.

The German fintech, which also has offices in Milan and Belgrade, previously only offered accounts to SMEs and startups with between two to 50 employees, but has now opened applications for sole traders, freelancers and the self-employed.

As of today, these groups will be able to open a banking account with Penta, joining the fintechs 20,000-strong customer base.

Back in December, the fintech took steps towards introducing self-employed customers by opening up applications for freelancers with at least one employee such as doctors, notaries and lawyers.

“By opening up to the so-called liberal professions and sole traders, we have realized the great demand for good digital solutions within those segments,” said Marko Wenthin, CEO of Penta.

“As a result, we are now opening up our platform to solo self-employed people as well. With the broader positioning and expansion of our target and customer audience, Penta becomes the platform for all entrepreneurs, whether with or without employees,” he added.

Companies can sign up and receive a German IBAN within minutes.

Penta’s users will then be able to order a debit card, manage their expenses, create sub-accounts and manage their company’s cash flow.

Penta does not have its own banking licence, rather it has partnered with solarisBank, whose main purpose is to enable other companies to utilise its banking licence.