OakNorth braced for economic downturn

via Sifted

OakNorth Bank is reassessing its 2020 revenue forecasts, anticipating the coronavirus to take a toll on the small and medium-sized business it lends to.

Speaking to Sifted, senior executive Nick Lee told Sifted that OakNorth — one of Europe’s most valuable fintechs — expected to see growth slow.

“We had pretty ambitious plans in terms of growing the loan book and obviously revenue. [But] the reality is we’re not going to hit those for obvious reasons,” he said.

Lee, who is the lender’s head of regulatory affairs, said that the company still expects to retain its coveted status as one of the few profitable fintechs in Europe.

But it depends on how bad the crisis gets.

“I would hope that we will be profitable [again] in 2020,” Lee told Sifted. “But the magnitude of that profit will depend on the stresses that we see,” he said, adding it was still early days.

The comments come amid analysts’ predictions that OakNorth Bank will be vulnerable in an economic crisis, as credit losses rise and banks’ risk-appetite drop and slow the lending-rate.

OakNorth has a large loan book, with around £3bn in outstanding loans across 300 borrowers. But the company’s portfolio is heavily weighted in property and construction — much of which has ground to a halt. There are also fears housing prices will drop and real estate may sell below expectations, which could put pressure on OakNorth’s book.

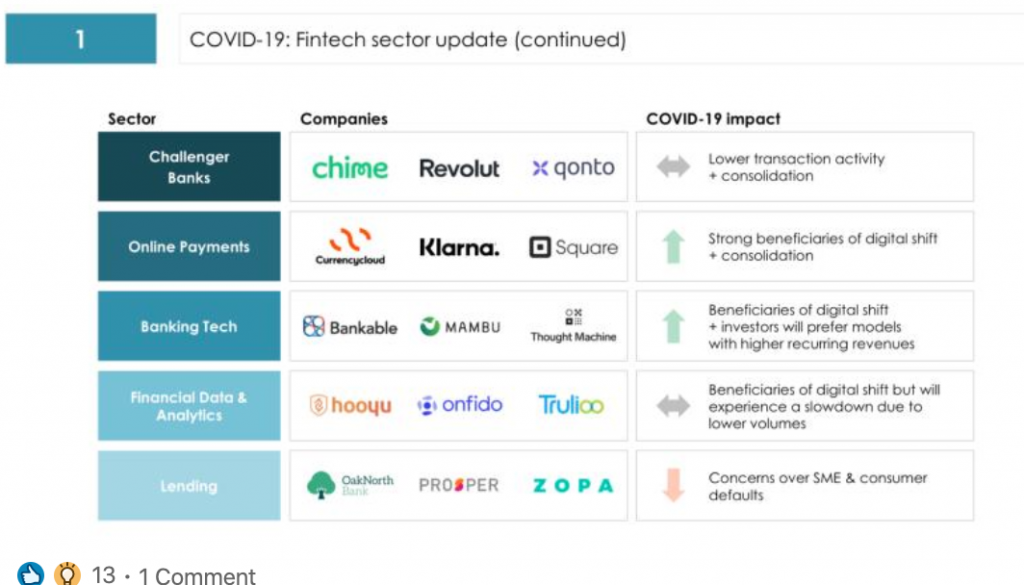

GP Bullhound’s report showing OakNorth Bank in the bottom row set for a downturn.

Stress tested

In preparation for a downturn, OakNorth has already run 34 ‘stress tests’ this year. This involves detailed forecasting across different sectors and disruption-levels, all the way up to a nine-month lockdown scenario.

“There weren’t a significant number [of clients] that we felt were in huge amounts of trouble,” he said.

So far, just two of its UK clients are deemed to be at immediate “high risk”. But even a six-month test at the severe stress level wouldn’t plunge the bank into serious danger, according to Lee.

“I can’t give you exact numbers… but yes, we were in a position post-stress test that the bank was still very well capitalised.”

By way of background, OakNorth is sheltered somewhat by the $440m cash injection it received from SoftBank last year. In addition, OakNorth Bank made £66m in profit last year.

OakNorth’s portfolio is also spread across multiple sectors, which should insulate it from a downturn in any one area — unlike some of its peers in the alternative lending space.

Moreover, while OakNorth may not reach its loftiest ambitions, the bank still expects to see its loan-book grow this year, bolstered by its participation in the government’s loan scheme (CBILS), which has taken the heat off slightly.

The government has so far allocated OakNorth £50m (constituting ~0.0014% of the state’s total loan package) and the bank has already begun distributing those funds to its existing clients — looking for a speedier turnaround than its high-street peers.

Even without the government-loans, OakNorth has also approved £50m in credit since the UK lockdown began, starting at £500,000 each.

“We’ve already been presented with some fantastic lending opportunities. It’s not just ‘close the shop’ kind of thing… Companies will continue to need debt-finance during this period, and clearly as we come out of this crisis.”

OakNorth will now put its faith in its “credit science”, which has resulted in just one borrower default since it launched in 2015.

The fintech also white-labels out this credit-analysis technology to non-UK banks, which have shown “interest like never before”, according to Lee.