Zeux’s CEO is plotting European expansion despite a run-in with the regulator

via AltFi

t’s no secret that the world has been turned on its head as the coronavirus pandemic causes chaos across the globe, but for some, the cogs have to keep turning.

Industry leaders have argued that fintech could be one of the worst-hit sectors because a lot of fintechs don’t meet the requirements needed to access money provided by the government.

On Friday, AltFi caught up with Frank Zhou, CEO of Zeux, on what it’s like running a fledgeling fintech during these uncertain times.

Rocky start

App-based payment platform, Zeux, first arrived on AltFi’s radar earlier this year when the fintech’s bizarre marketing campaign left it in hot water with the Financial Conduct Authority (FCA).

In January 2020 the fintech was ordered to remove ads promoting a 5 per cent interest rate for its “savings account alternative” after This is Money reported that the fintech was taking money deposited into savings accounts and converting it to cryptocurrency through its Chinese partner WeCash.

WeCash would then convert the cryptocurrency back into normal currency and lend it out to borrowers—keep in mind that Zeux, while regulated by the FCA, is not protected under the Financial Services Compensation Scheme (FSCS) so customer’s money was (and still is) at risk.

Now things are settling down and the startup is focused on delivering for its thousands of customers, many of whom signed up on the back of its now-banned marketing campaign.

Zhou told AltFi that signups were still “very healthy” despite its earlier marketing being shut down, and had been bolstered by a recent drive by the startup to introduce new features.

AltFi was told that Zhou couldn’t answer specific product questions due to “regulation reasons.”

Prepare for launch

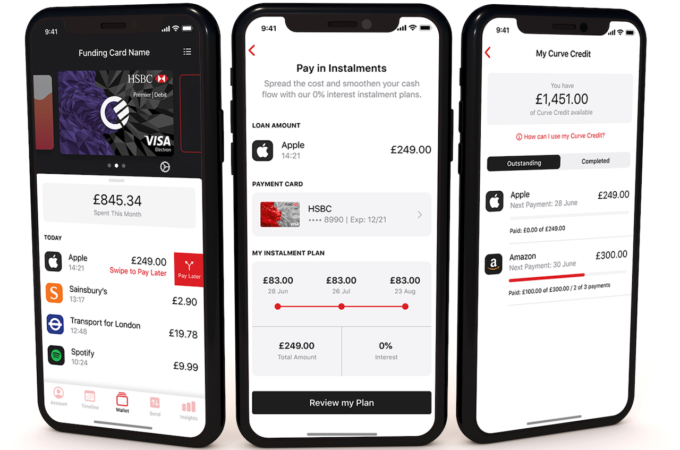

Zeux is an “all-in-one” financial platform that lets customers make payments, use banking services and invest, all from one app.

Early last week, it announced the launch of its in-app Amazon shopping feature that would allow customers to shop directly with Amazon in the Zeux app.

Customers can now track spending and also earn an impressive 2 per cent cashback on any Amazon purchase made through Zeux.

Frank Zhou, CEO of Zeux, told AltFi: “We believe this is very good time to push our e-commerce platform to give our customers more benefits.”

“We know customer behaviour has been shifted so we decided to provide the services that we know they want more of during this period, which helps with them becoming more engaged with us too,” he added.

Zeux’s Amazon shopping platform isn’t the only launch for the fintech during this time of lockdown.

On the cards

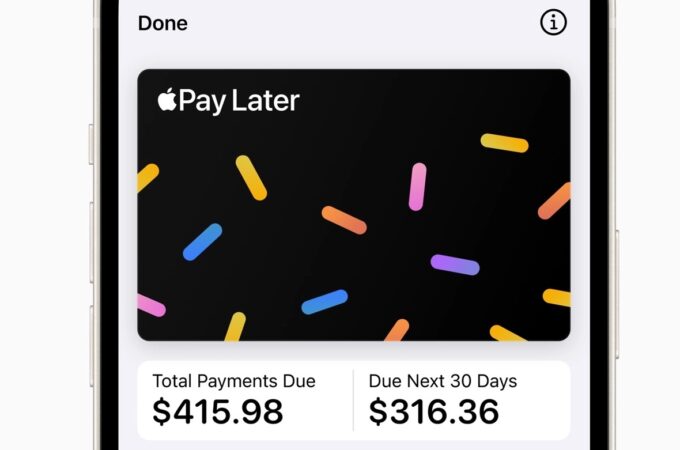

Earlier this month Zeux launched its first physical card, previously customers could only have a virtual card, despite there now being even less of a need for a physical card as consumers turn their attention to online shopping.

The Visa-backed card not only expanded the opportunities to use Zeux, but also changed the way its customers behaved.

Zhou explained to AltFi: “Currently we charge customers £4.99 for the delivery of the card. And when customers actually pay to use your service, customer behaviour changes significantly.”

“When customers have something physical, it feels like a piece of ownership. You will help them become a more engaging customer.”

Zhou also told us that as user habits had already changed because of the coronavirus, it was too difficult for them to tell if Zeux’s increased usage was because of the launch of the card or not, “the timelines overlap,” said Zhou.

Europe on the horizon?

Despite the coronavirus-related economic downturn, Zhou confirmed to AltFi that he is already casting his gaze further afield.

“We are also looking at rolling out in Europe. We have received very good traction in the UK and would like to expand into different geographies in Europe to see how attractive Zeux is in other countries with similar services.”

“I don’t think coronavirus will impact our timeline. This is something we’re planning to do and this is something we’re going to do regardless,” he added.

Zhou also revealed that while certain parts of the business have decreased because of coronavirus (like average customer spend), Zeux is saving in other areas.

“Marketing costs have become a lot cheaper because a lot of people are leaving the online marketing space,” Zhou told AltFi—perhaps helped by the removal of all of Zeux’s physical ads?

So there you have it, despite a rocky start to the year, the current economic uncertainty seems to have brushed its earlier mishaps under the rug and smoothed Zeux’s path. For now.