Digital Banks Focusing More Than Ever on Serving New and Existing Customers

via Lend Academy

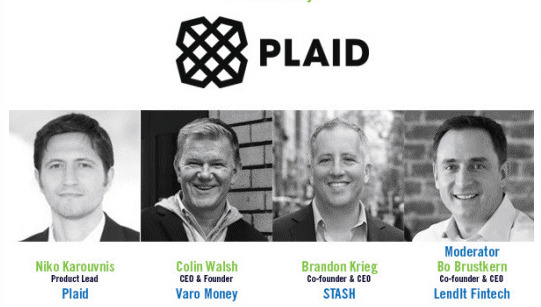

LendIt Fintech recently hosted a webinar called How Increased Engagement Will Impact Fintechs and Digital Banks

Now more than ever it is important for fintechs to be on the top of their game when it comes to serving customers. Customers from around the US now have no choice but to go all in on digital and the offerings they are discovering are quite compelling. It is a trend we first saw with the digital banks in Europe but it is now happening in the US.

This webinar brought together two big names in digital banking, Colin Walsh from Varo Money and Brandon Krieg from Stash. Both Varo and Stash are tapping into the estimated 180 million that are underserved here in the US. Niko Karvounis from Plaid connected the dots as they are the undisputed leader in providing the plumbing between fintechs and traditional banks. As more people are looking to digital banking, they have never had to deal with such an influx of new and existing customers engaging with their company, using their services at such high rates. So how are they handling it all?

Niko has been working on connectivity for quite some time, having first started Quovo back in 2013, a company which was acquired by Plaid in early 2019. At a time when the world is in chaos, customers rely on the interface that Plaid provides. It is something that folks in the fintech industry often take for granted, but is a core part of financial services transactions happening around the globe. It is apparent that the days of a standalone branch where a customer leverages every service from one bank are numbered. Today, customers can have many bank accounts and the companies that have realized this was inevitable are benefiting.

Both Stash and Varo Money leverage Plaid for connectivity which they both agree puts the customer first and reduces friction. Varo Money was one of the early adopters of Plaid’s service, realizing that the movement of money matters the most, allowing customers to access money conveniently and affordably. Keeping this flow of money moving reduces the anxiety felt by customers during these stressful times.

Varo Money is unique in that they are likely to become America’s first digital only national bank as they continue the final stages of the regulatory approval process. Their goal is to help Americans who need a better banking experience and help them become more financially resilient. Stash is based in NYC and has teams in South Carolina as well as London. Currently they have 4.5 million customers, and serve as an all-in-one financial home for 4.5 million Americans though Krieg shared that they want to help customers with whatever solutions they need.

During the coronavirus crisis all three companies have adapted to the changing times. Plaid took it upon themselves to roll out a solution for payroll data to help small businesses access Paycheck Protection Program loans. This ability to connect in this way is just another use case for the interface Plaid provides. Both Krieg and Walsh shared how they are ramping up their support teams to be able to continue to help the many new and existing customers who are increasingly engaging with the company. Stash has seen lots of new customers come in via referral, with a 100% increase in weekly deposits. On the investment side they have crossed $1 billion, which is an amazing feat given the average deposit is $28. Varo Money has adjusted their marketing to ensure that the messaging is both empathetic and informative. One of the changes they were able to make was the ability to accept treasury checks. They have also increased cash withdrawal limits and continue to share ways that customers can earn additional streams of income.

As customers have been coming to Varo and Stash in droves, their cost of acquisition has decreased significantly as many people reevaluate their banking relationships. Varo estimates that they are able to serve their customers at about half the cost compared to a traditional bank. Walsh expects this to halve again as they become a national bank. He believes Varo will be operating on the most modern tech stack in the country. This helps them eliminate fees and provide higher interest on savings accounts.

Panelists also discussed the current lending environment, how their demographics are changing, how they themselves are handling a remote workforce and how this crisis compares to 2008.