Mobile Banking Platform Varo Money to Accommodate Former Clients of Digital Bank Moven, which Closed its Consumer Product Offering

via Crowdfund Insider

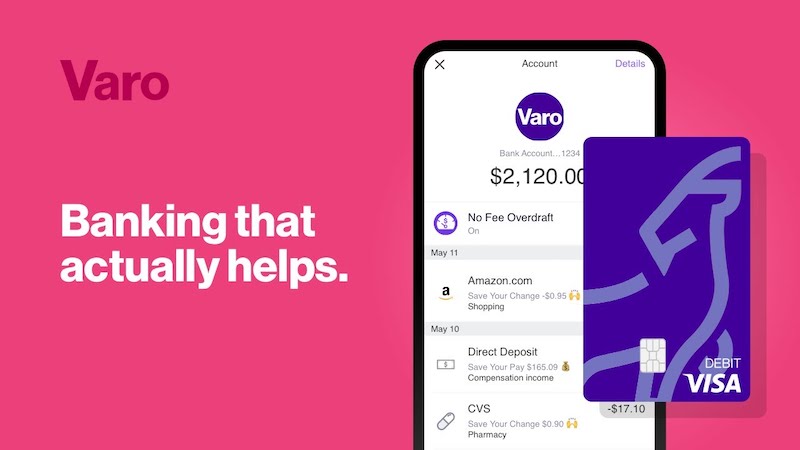

San Francisco-headquartered Varo Money, an established mobile banking service provider, is reportedly planning to accommodate the former clients of digital bank Moven, which recently closed down its direct-to-consumer product offering.

In March 2020, Moven’s management had reported that it experienced funding challenges due to the Coronavirus (COVID-19) outbreak. The company confirmed that it would be shutting down its consumer offering for US customers. Moven added that it would mainly focus on selling its proprietary technology to banks and other financial institutions.

Moven said it would be closing all of its consumer accounts by April 30, 2020. However, the firm has now made a deal to move its existing clients to Varo Money’s platform. The number of customers being transferred has not been shared publicly.

Varo, which is in the process of becoming one of the first mobile-focused financial services firms to acquire a national bank charter, is also holding discussions with Moven’s management about potentially using the company’s technology.

Colin Walsh, CEO at Varo Money, stated:

“Moven has been a pioneer in the digital banking space and a long-time inspiration. We are excited to welcome their customers and deliver on the types of technology and features they have grown to love.”

Walsh added:

“Amidst the beginning waves of consolidation and change in the fintech industry, Varo is focused on becoming the first and only digital bank with a national charter. This will allow us to provide a greater breadth of digital banking solutions that meet the needs of the way people live and work today.”

Brett King established Movenbank back in 2011. At the time, it was one of the world’s very first mobile-only, low-fee banking services.

Movenbank offered a convenient and intuitive banking app that allowed users to take care of their day-to-day financial transactions. King won the Innovator of the Year award, which he received from a sister publication of American Banker.

King received the award a year after launching Movebank. It was given to him in recognition of the mobile-based bank’s customer-friendly, user-centric approach that was new (at that time). Movenbank provided a legitimate alternative to traditional banking.

Several other banking challengers have been introduced after Movenbank, including Digit, Chime, Varo Money, Even, Dave, and Qapital.

Varo Money continues to expand its services. In February 2020, it teamed up with WorldRemit, a cross-border funds transfer company, in order to give its customers direct access to the WorldRemit service via the Varo app.