Stripe raises $600M at $36B valuation in Series G extension, says it has $2B on its balance sheet

via TechCrunch

The economy may be contracting as a result of the COVID-19 pandemic, but promising startups are still continuing to raise money to shore up their finances for whatever may lie ahead.

In the latest development, Stripe, a well-known payments unicorn, today announced that it had raised another $600 million in new capital, money that it plans to use to continue investing in product development, further global expansion and strategic initiatives.

The company has become an active investor in a number of startups, some which are strategic partners for the company as it moves into new areas to complement its core online payments business.

It also added in its announcement that it currently has $2 billion on its balance sheet, a key number that underscores the message that the company is taking this investment not to survive but to further thrive, and that it may well choose to do so by remaining a private company, as it does not appear to have any need to go to the public markets to raise funds.

Making it easier to integrate payments into an online service has long been one of the reasons why Stripe has been on a growth tear: it arrived at a time when other solutions were still too fragmented and complicated, and its impact on the wider e-commerce market has seen a number of its competitors and other new entrants offer equally simplified products.

But its ease of use has taken on a new significance in recent times, with a huge surge of business coming online from consumers and businesses who can no longer transact in person because of the current pandemic, leading to a new plethora of use cases for Stripe and other payments companies.

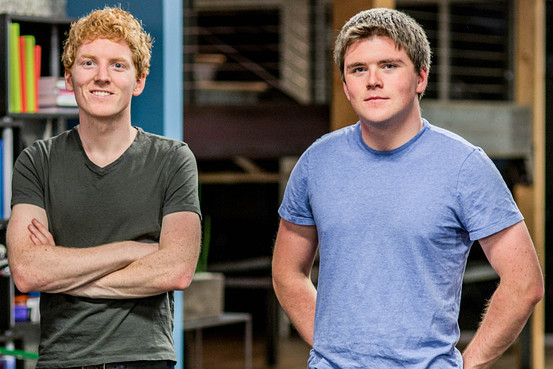

“People who never dreamt of using the internet to see the doctor or buy groceries are now doing so out of necessity. And businesses that deferred moving online or had no reason to operate online have made the leap practically overnight,” said John Collison, president and co-founder of Stripe, in a statement (his brother Patrick, the co-founder and CEO, is pictured above). “We believe now is not the time to pull back, but to invest even more heavily in Stripe’s platform.”

The figure is also important because Stripe has never been very transparent about how many customers it has or any of its financials: this is one hint of how it is doing for the public to see.

This latest funding — its largest to date by a large margin — is coming from a number of its existing investors, including Andreessen Horowitz, General Catalyst, GV and Sequoia. It is an extension to the company’s Series G round, which was first confirmed in September 2019 with $250 million raised. The company’s valuation is holding steady with this new investment, and it now stands at $36 billion post-money (it confirmed a $35 billion pre-money valuation seven months ago).

The payments giant has raised around $1.6 billion with this new investment, according to known investment totals.

Stripe was recently in the news when one its investors, Sequoia, put $21 million into a payments company called Finix. It’s still not entirely clear what happened, but Sequoia walked away from the Finix deal, effectively turning its check into a grant.

In the meantime, Stripe — which started life by providing an easy to use API-based payments service for startups like itself to use in their online or app-based payment services — has continued to ramp up the size of its customers alongside overall growth of its customer base. Its users today include Zoom, Caviar, Coupa, Just Eat, Keap, Lightspeed, Mattel, NBC and Paid.