B-Social, the UK fintech building a ‘social bank,’ raises additional £7.8M ahead of rebrand

via TechCrunch

B-Social, the London-based fintech building what it calls a “social bank,” is announcing that it has raised a further £7.8 million in seed funding.

Once again the injection of capital comes from “high-net-worth” individuals. They include Rudy Karsan from Karlani Capital, although most of the investors remain undisclosed.

It brings the total capital raised by B-Social to £13.25 million, as the company continues the journey to becoming a fully licensed bank. It also plans to re-brand next month to the new name “Kroo.”

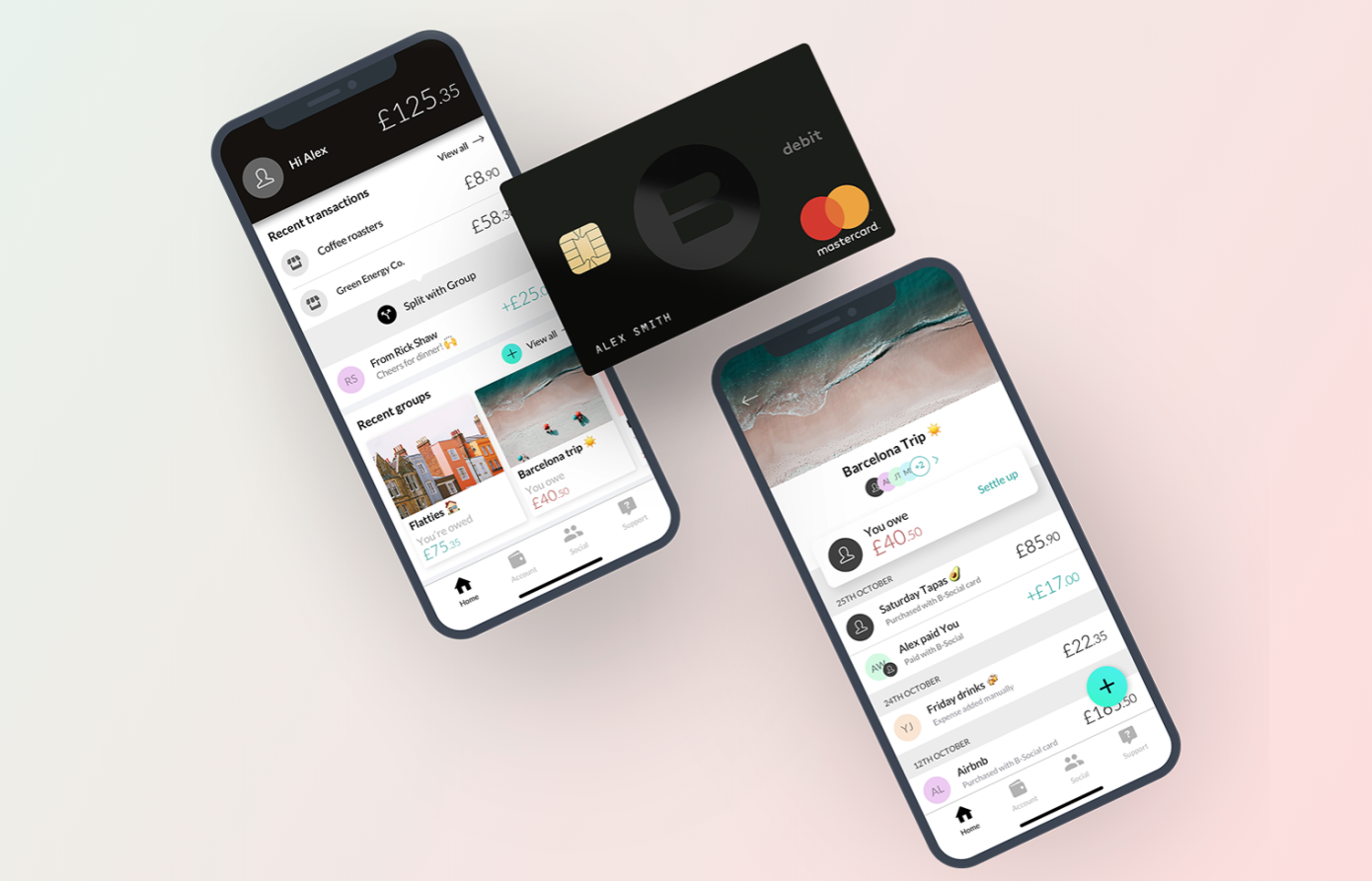

Launched in February last year, B-Social currently exists as a “social finance” app, with accompanying debit Mastercard. It enables users to make purchases, share and keep track of expenses with friends and family, and negate the headache of “who owes who.” More broadly, B-Social says it is on a mission to improve the relationship people have with money.

“We recognise that almost all financial transactions are inherently social,” B-Social co-founder and CEO Nazim Valimahomed told me in late 2018. “We want to change the relationship people have with money by helping them overcome the anxiety, awkwardness and wasted time when they engage with their social finances. We are doing that by building a digital bank that truly accommodates the way people live their lives and is dedicated to connecting a person’s finances to their social world.”

To date, B-Social says it has more than 8,500 customers who have spent more than £1 million with their B-Social cards and have shared more than 36,000 expenses with friends.

Valimahomed tells me the company has also “significantly progressed” the pre-application stage for acquiring a U.K. banking licence. This includes things like submitting a regulatory business plan, capital and liquidity assessments approval, and challenge sessions completed. He expects to submit the full banking application in Q2 2020.