E-Commerce Firms May Be in The Forefront of South East Asia’s Digital Banking Revolution

via Fintechnews Singapore

In a new report released by S&P Global Market Intelligence earlier this month, the financial information services provider says that for both new digital banks and incumbent banks, affiliation with technology platforms serving large pools of consumers and small businesses “could be key to [their] future.”

For branchless digital banks, learn more here partnering with e-commerce companies could be “the quickest way to gain scale” because these platforms are already linked to many consumers and merchants.

The prospect is especially attractive for digital banks in Southeast Asia where e-commerce sales in the region’s six largest economies are projected to grow to US$79.29 billion in 2022 from US$41.28 billion in 2019, according to a S&P Global Market Intelligence research.

Southeast Asia’s e-commerce leaders dabble in financial services

One indication of this growing trend is the entrance of several e-commerce companies into the digital finance landscape.

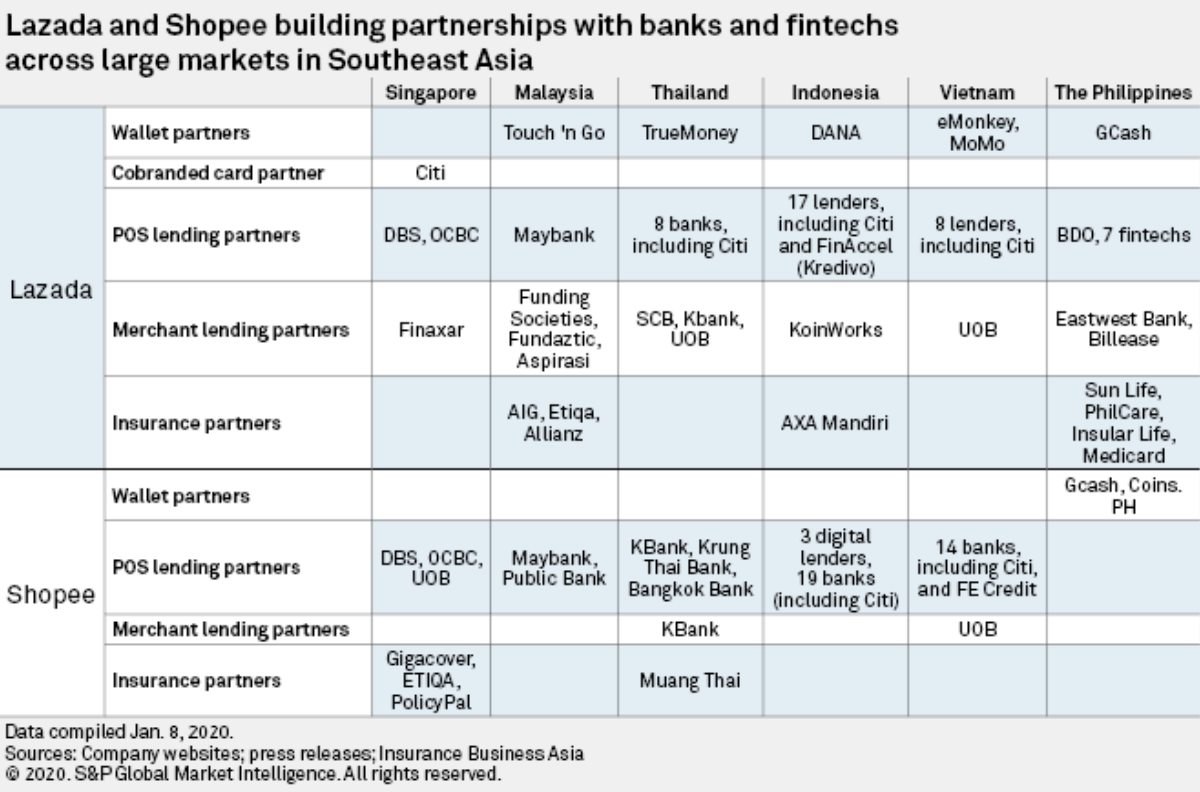

Sea’s Shopee and Alibaba-owned Lazada, for example, engage shoppers and merchants through digital payments and lending. They also have established a vast online and offline payments acceptance infrastructure by acquiring electronic money licenses and forging alliances with financial institutions and fintech companies. Sea also owns e-wallet AirPay, the report notes.

Lazada and Shopee building partnerships with banks and fintechs across large markets in Southeast Asia, Digital banking battles will play out in Southeast Asia’s shopping cart, February 2020, S&P Global Market Intelligence

Both e-commerce companies have affiliates that have applied for digital banking licenses in Singapore.

With a digital banking license in hand, the Sea-led consortium could tap into the many lending opportunities arising from its e-commerce business and begin providing, for example, online point-of-sale (POS) financing plans, the report says.

Furthermore, by offering banking services as part of e-commerce, these companies can shift consumers away from cash-based payments and drive greater activity on their platforms, resulting in a virtuous circle, it says.

More than just banking

The S&P Global Market Intelligence report echoes findings from a recent study by PwC which found that Southeast Asian consumers want their digital bank to provide non-financial services.

According to the Singapore cut of PwC’s digital banking customer insights study, 66% of Singapore customers are “interested” or “very interested” in having their digital bank offer non-financial features, with e-commerce, financial education and lifestyle services such as health, wellness and travel, being the most popular categories.

In an e-commerce platform, customers cited airplane/bus/train tickets purchasing (54%) and healthcare and illness consultations as the their top interests (54%). These are followed by coupons for shops and restaurants (48%), online shopping (45%) and hospital/doctor appointments (45%).

Interest in lifestyle and e-commerce features, Digital Banking- Singapore Customers Take Charge – Are You Ready? Digital Banking Customer Survey, February 2020, PwC

The study also found that although Singaporeans are overall interested in a digital banking offering, they remain nevertheless cautious.

40% of respondents said they would only consider opening a bank account with a digital bank once it is popular and successful, and even if they did so, only 33% would make it their primary bank, with the majority (67%) indicating that they would choose to retain their existing bank as their main bank.

Despite this, many customers currently face frustrations with their primary banks, citing pain points including long queue times (42%), long wait times on the hotline (23%) and the inability to perform banking functions online (13%).

Customer pain points and frustrations with their primary bank, Digital Banking- Singapore Customers Take Charge – Are You Ready? Digital Banking Customer Survey, February 2020, PwC

Although bank customers in Singapore are comfortable with digital and self-service channels to conduct day-to-day operations, they still request human interaction for impactful and complex situations such as emergencies (64%), wealth management (63%), mortgage (58%) and insurance (56%), the report says.

Customers say that human interaction is important for the following transactions (%), Digital Banking- Singapore Customers Take Charge – Are You Ready? Digital Banking Customer Survey, February 2020, PwC

These findings mean that going forward, digital banks and incumbents will need to find the right formula that combines business strategy and customer insights with innovation and the appropriate risk and control frameworks to differentiate themselves from competitors, PwC says.