Mobile banking alternative Bnext expands to Mexico

via TechCrunch

Spanish startup Bnext is expanding beyond its home country. The company is currently rolling out its product in Mexico, and 170,000 people signed up to a waiting list. Bnext is going to invite those 170,000 potential users first before opening signups to everyone.

Bnext is building an alternative to traditional bank accounts. Customers can open a Bnext account in minutes using a mobile app. A few days later, users receive a payment card. You can then upload money to your Bnext account, and send and spend money all around the world.

You can receive notifications for each transaction with your card, temporarily lock and unlock your card and more. In other words, Bnext does many of the things that you expect from a neobank.

Unlike many traditional retail banks, Bnext plans to attract customers with cheaper international transactions. For instance, Spanish customers traveling abroad can withdraw money up to three times per month and spend as much as €2,000 per month without any foreign exchange fee. When you reach those limits, you pay 1.15% to 1.5% in foreign exchange fees. Mexican customers get two free withdrawals per month.

The startup has put together a local team in order to expand to Mexico. There are currently 12 employees working for Bnext in Mexico City.

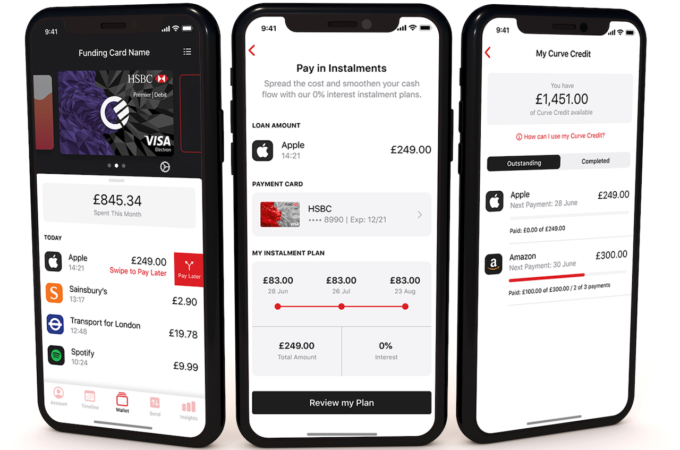

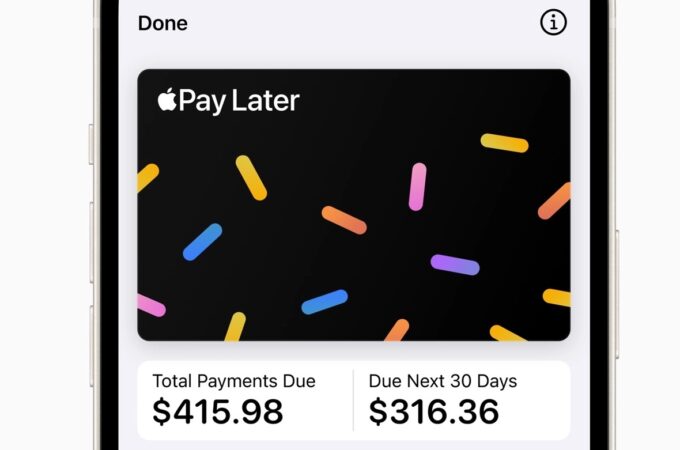

But Bnext doesn’t want to stop at providing a current account with a card. In Spain, the company is building a financial hub to help you manage your money across multiple financial services. You can lend money to small and medium businesses and earn interest through October, you can save money using Raisin, you can get a loan, a mortgage, an insurance product, etc.

Bnext expects to launch its marketplace in Mexico at some point during the second half of 2020. The company also expects to expand to other countries in Latin America in the future.

When it comes to numbers, Bnext has attracted 300,000 active users in Spain. In the last 12 months, the startup has processed €430 million across 11.6 million transactions.