Stealth challenger Vive granted UK banking licence to serve the underbanked

via AltFi

The Bank of England this morning issued a new restricted banking licence to Vive, a secretive bank founded to help “revive the finances” of those with poor credit scores.

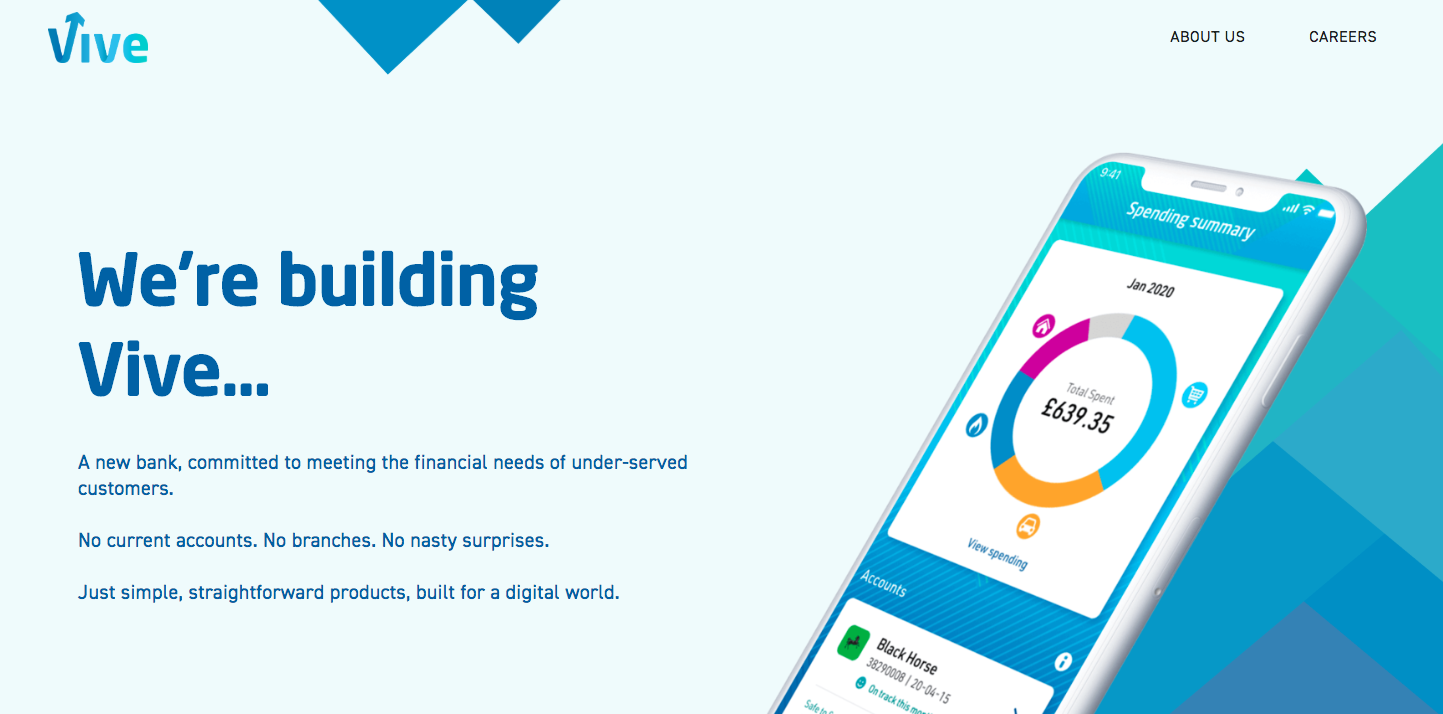

Led by CEO Nick Anthony, Vive is planning to launch its first three products in the second quarter of 2020, including unsecured personal loans, a “competitive” savings account, and a money manager app powered by Open Banking.

“We’re looking to serve a market where it’s more difficult for customers to get banking products,” Anthony told AltFi. “We want to make it simple and straightforward.”

“Our unsecured personal loans, for example, will be far more than the narrow offering from high street banks, aimed at helping those with less than perfect credit scores.”

Vive was incorporated back in 2017 and a waiting list is available to join on its website, but Anthony said work on the bank has been purposefully “kept very quiet”.

One of the surprising features Vive won’t be launching with is a current account.

According to the CEO that market is already “pretty congested” with the likes of Monzo, Starling and a host of traditional providers, “we want to address a different segment of the market”.

“It’s just not difficult to get a current account, so we want to focus on serving our customers with what they really need.”

To date, Vive has been funded by two investors, Turkish businessman Kasim Garipoglu and British financier Robert William Hanson, and Anthony said the business had “more than enough capital” for its launch later this year.

Anthony was previously Head of Retail Banking at investment bank VTB Capital, and before that Chief Operating Officer of security and risk advisory firm S4Si.