Adoption of Facial Recognition for eKYC on the Rise in Asia

via Fintechnews Singapore

The increasing risk of data breaches, coupled with customer demand for all-digital onboarding processes, rising mobile phone penetration, and security concerns among customers, is expected to propel future global growth of technology-based identification, especially in APAC, according to a report by Jumio, a provider of end-to-end ID and identity verification and authentication solutions.

In a report titled eKYC in APAC: How to Get it Right, Jumio addresses the merits of adopting technology-based solutions for identification, as well as know-your-customer (KYC) and anti-money laundering (AML) procedures, particularly in APAC, where fraud is on the rise.

Cybercrime in APAC, eKYC in APAC: How to Get it Right, Jumio, June 2019

According to the report, banks in the region are striving to increase new account enrollments through faster, easier and lower-cost digital channels. They must, however, comply with an evolving regulatory landscape that gets more and more complex by the day. Meanwhile, consumers want the convenience of signing up through digital channels.

In this changing landscape, banks must adopt modern and reliable electronic KYC (eKYC), AML screening, and online identification solutions, not only to satisfy customers’ demand for an all-digital experience, but also to cost-effectively meet new requirements while protecting users against online fraud and account takeovers.

Biometric authentication

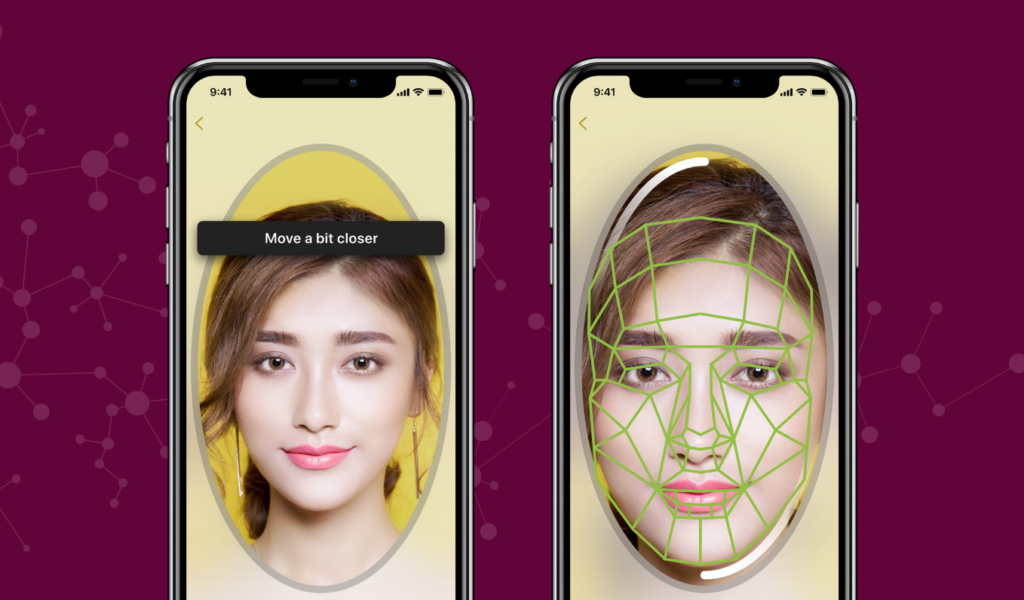

There are several ways and technologies that can be used to perform eKYC, AML screening and online identity verification, but, according to the report, one in particular is expected to witness significant growth.

Biometric authentication, and most particularly face-based biometrics, has been rapidly gaining in popularity, a trend driven by adoption by mobile giants such as Apple and Samsung.

Cybercrime in APAC, eKYC in APAC: How to Get it Right, Jumio, June 2019

Apple pivoted from fingerprint authentication to facial recognition in late-2017 with its iPhone X, and subsequently abandoned Touch ID fingerprint authentication in all of its following iPhone models.

Many of Apple’s rivals followed suit: Google pivoted to 3D facial recognition with its latest flagship smartphone, the Pixel 4, released in October; and Samsung delivered a software update for its Galaxy S10 5G smartphone in November designed to leverage its Time-of-Flight sensors to enable 3D facial recognition.

Counterpoint Research estimates that by 2020, more than one billion smartphones will be equipped with facial recognition.

Adoption across Asia

Across Asia, financial institutions and governments are rapidly adopting biometric authentication for eKYC.

In Singapore, the idea of a centralized eKYC utility was first proposed in 2017. The project, led by the Monetary Authority of Singapore (MAS), is meant to allow financial institutions to identify and verify potential customers’ details in a seamless way.

Separately, several Singapore banks including OCBC Bank has adopted facial recognition to improve customer service.

In Hong Kong, insurtech startup Wesurance launched the industry’s first mobile platform for insurance services in 2017. The platform makes use of eKYC and facial recognition technology to allow quick and simple user verification.

In October, Malaysia’s Hong Leong Bank (HLB) launched a new eToken with built-in biometric facial recognition authentication which the bank says provides secure and seamless transaction capabilities for small to medium-sized enterprises (SMEs), Fintech News Malaysia reports.

The solution allows customers to authenticate log-ins and approve payments on the online banking platform ConnectFirst. The bank plans to integrate it to the HL ConnectFirst mobile banking application to allow companies and SMEs to confirm transactions with a single tap on a registered mobile device.

Earlier this month, TMRW by UOB, Thailand’s first mobile-only bank, announced that it has enabled fingerprint and facial biometrics to make it speedier and safer for customers to open their TMRW accounts. Other Thai banks that have adopted facial recognition for eKYC include Krungsri, Kasikornbank, Siam Commercial Bank and Bank of Ayudhya.

Rising adoption of facial recognition in Thailand’s banking industry coincides with the Bank of Thailand’s newly introduced regulation which facilitates eKYC.