Mexican weex wallet is now Mibo and the neobank competition is heating up

via Contxto

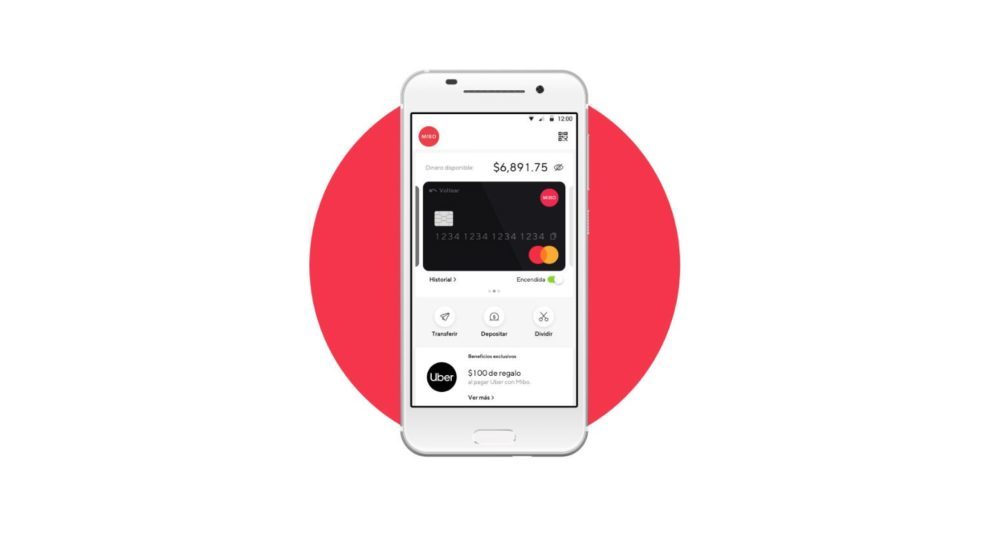

Mexican weex wallet has been in the market for more than two years and has already registered half a million users on its app. It’s now rebranding into neobank Mibo and plans to launch two credit-related products within the next couple of weeks. It has agreed with Mastercard to to issue physical debit cards to users.

If you can’t stand the heat, get out of the kitchen. Or in the case of Mexican neobank, weex wallet, stay in the kitchen, change your name to Mibo and keep cooking.

Following its name change, Mibo plans to launch two credit-related products within the next couple of weeks. Their particular focus will be to provide frictionless—that is, quick and easy—access to borrowing, in order to lure in potential customers, suggested a press release from the startup.

The artist formerly known as weex wallet has been in the market for more than two years and has already registered half a million users on its app.

The banking board is set… and the pieces are moving

These moves show that Mibo continues to raise the stakes in the digital banking sector, following its recent partnership with Mastercard. Both parties agreed to issue physical debit cards to users earlier this year. We should all see this type of synergy between old and new generation banking as meaning only one thing; the sector is shifting and hard competition is on the way.

And, indeed, Mibo is not alone in Mexico.

Brazilian neobanking, big-boy, NuBank arrived through its subsidiary, Nu, in May this year. That same month, another neobank with around 80,000 users in its pocket, Albo, announced its plans to further penetrate the Mexican market.

As with Mibo, the latter alternative also has also forged a partnership with Mastercard, and will be offering debit cards to customers as well.

Meanwhile, traditional banking sectors are also struggling to whip up their own apps and fintech solutions.

It appears the fintech race in the category of neobanks is heating up and it’s all hands on deck to fill the 53 percent of the Mexican population that doesn’t have a bank account.

The good news is that with such a large target, there’s still an ample playing field for these fintechs to move around. But this won’t go on forever and they know it.

Nevertheless, in the same announcement, Albo co-founder, Ángel Sahagún, insisted that “the competition isn’t with [other neobanks], it is this traditional banking.”

Fintech finesse in 2020

Many factors may be at play to determine who dominates. The best might be able to muster top-notch customer service and user-friendly apps, not to mention the availability of funding to scale up. Security and fraud-prevention should also be priorities, on pain of facing the wrath of the government or, worse, the PR backlash.

Likewise, established neobanks shouldn’t get too comfortable (traditional banks already made that mistake). Their eyes should be peeled for emerging fintechs who may have an innovative solution in the works. Therefore, also expect mergers or acquisitions to play a big part in this game. And, remember, traditional banks still do have sheer, brute cash up their sleeve.

As previously discussed in this space, remittances, crypto, as well as crypto-remittances, are also an attractive and growing opportunity for Mexicans and their families abroad.

It is also rather nice to imagine that further down the road these tools will enable more than just payment or credit solutions to Mexicans. Think digital consulting services through AI so users make more financially-savvy decisions.

So who’s hot and who’s not? Let’s wait and see.