Neobank Arival passes £1m crowdfund target

via Business Cloud

Singapore-based neobank, Arival, has surpassed its £700,000 crowdfunding target on Crowdcube following its announcement in June to become the first licensed digital bank in the US this year.

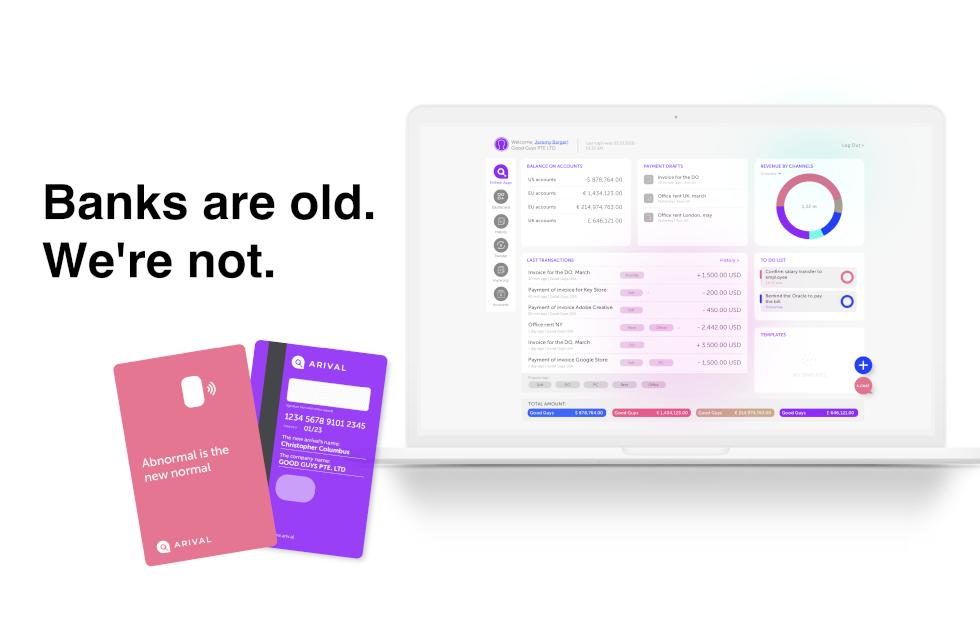

The firm said it has designed an account for a customer base of users rejected by other banks. It will target E-Residency businesses, expats and refugees, cryptocurrency and blockchain-related businesses, politically exposed persons, and digital influencers.

It has raised £1,164,948 at the time of writing, before it closes the round tomorrow, 31stSeptember 2019.

The Singapore-based firm, which has a pre-money valuation £12,012,061, said it while it is not a bank yet, it has applied for a US-based international banking license and is on track to receive it this year.

Founded in 2017 by two FinTech venture capitalists and a FinTech entrepreneur, the team has prior investments in digital banks such as Simple, Moven, Fidor, and RocketBank.

It describes itself as a business bank which is a rival to both traditional and digital banks.

The firm has built its own compliance technology, A.ID, which will use facial scanning and compliance with the US Federal Reserve Bank.

The firm, which described this technology as its “special sauce” has plans to white label the tech to banks in future.

“We understand that we aggregate a lot of client data — to work with high-risk clients we need to trust them, and to be able to do this we need to see that the company and its representative are open to dialogue with us,” wrote CEO and founder Slava Solodkiy in a blog.

“If big international banks think that what we do and how we do it is more convenient for the client, more reliable in terms of verification and cheaper, it is a fantastic opportunity for us to test and perfect our system based on the experience of our bank and other banks as well.”