BASIS ID improves the experience of the KYC procedure

via TechBullion

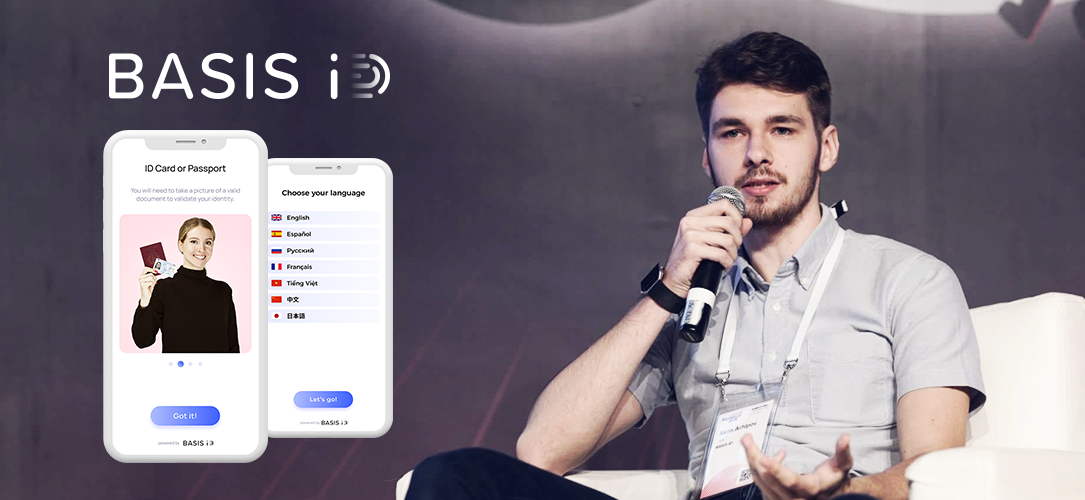

At the end of July 2019, the leading KYC service provider in Asia and Europe, BASIS ID, will release a new widget, designed to improve user experience of interacting with the KYC procedure. What does this mean for users and what can it offer to customers?

A new widget for going through the verification process was created to increase the conversion during the KYC procedure. This means that it must solve two problems. Firstly, it must be simple, so that users do not abandon the process in the middle because they don’t understand what is required from them or what to expect from this procedure. Secondly, it must be pushing users to move forward in the process of providing data, so that they would convert into customers of various services instead of people, who have dropped out during KYC. This way service providers can be certain that they spend resources on acquiring real users.

To complete these key tasks, the design-concept of the widget had to be based on interface elements familiar to any Internet user. This ensures simplicity of perception and naivety of interaction. In order to find the best solutions, a study was conducted covering users from several countries in Europe and Asia

“At the moment, there are lots of solutions in the market. There is even a procedure for collecting data through a chat bot, which might justify itself in the distant future. BASIS ID, however, helps customers onboard users here and now, so we were faced with the task of developing a solution that is ready for use in existing conditions. This means that the interface should be familiar and intuitive to the user. By the example of many of our clients, we see how middle-aged and elderly people want to start using money transfer or online real estate booking services. The KYC procedure should not be an obstacle. This is a tremendous job to create a KYC solution that would have such low entrance threshold so that older people could also pass the verification without any problems and we have succeeded in this!” commented CEO of BASIS ID Akim Arhipov.

In order for users to move forward and provide the necessary data, the widget is enhanced with elements of gamification, designed to make this rather bureaucratic procedure more interactive.

For customers, the updated solution will be extremely simple to integrate, thanks to the builder, which allows you to customize all aspects including even reporting system intended for the multilevel teams. Of course, as before, the solution will provide full regulatory compliance with the eKYC, AML and GDPR standards.

The new widget already has 5 languages and this number will quickly increase.

About BASIS ID:

BASIS ID is a KYC/AML workflow management platform that ensures full legal compliance with banking and financial regulations laid upon customer verification. The enterprise was established in 2017 in Singapore.

BASIS ID works with trusted partners such as Experian, BitFury, Thomson Reuters, MSIG and PwC, which enables top-level performance and regulatory compliance. The company has successfully completed the due diligence for the biggest international banks and is operating the onboarding for our clients from Singapore, Europe, Bahrain and many other countries.

For more information, visit: https://www.basisid.com/