3 in 4 APAC Banks Believe Fraud Will Increase This Year

Almost three in four banks in Asia Pacific anticipate that fraud in their country will increase in 2019, according to a recent poll by FICO.

Two of the main areas of concern are card-not-present fraud and application fraud. Card-not-present payments are concerns are fueled largely by the fact that over 50% global online retail sales came from Asia Pacific in 2018.

Dan McConaghy, President of FICO in Asia Pacific shared that it is precisely due to such reasons that banks need to use AI and machine learning to combat the increased fraud risk.

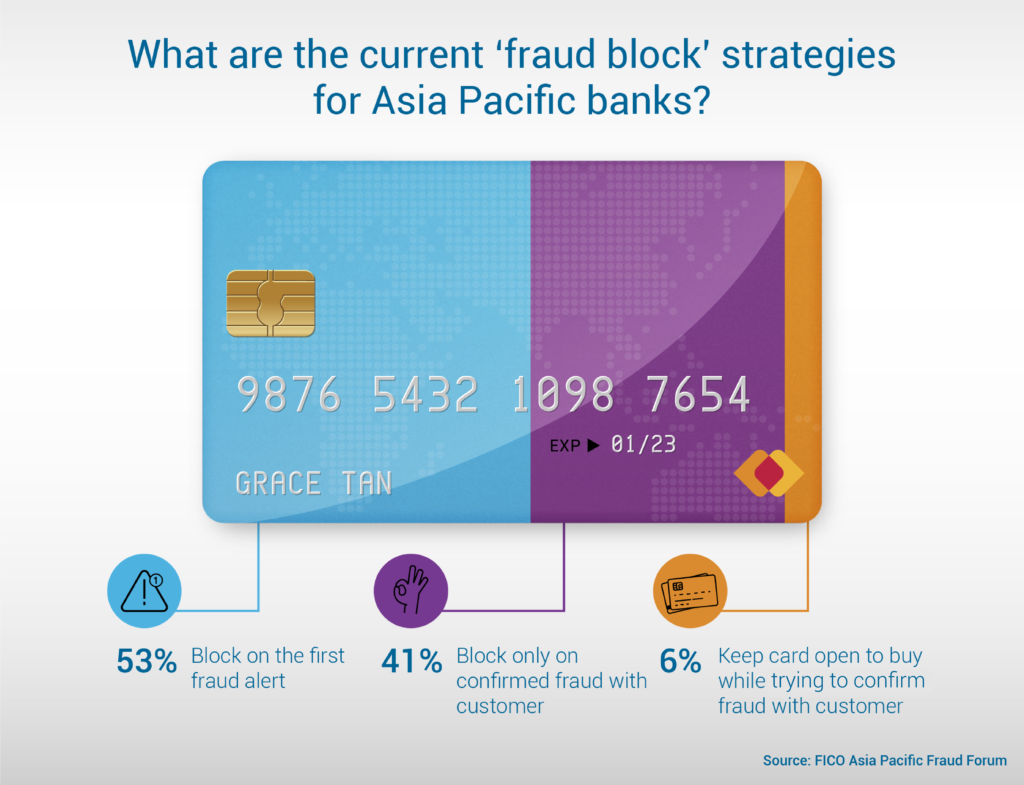

The survey found that efforts to keep up with changing fraud patterns remain mixed. Most APAC banks surveyed continue to take a precautionary approach to stopping fraud.

More than 50 percent of APAC banks continue to simply block cards on the first fraud alert, a rate that remains unchanged from the 2017 survey.

In contrast, 6 percent will keep the card open while trying to confirm fraud with the customer. Positively, this number has doubled since the same question was asked in the previous poll.

Interestingly, banks in the region, are still measuring their fraud departments on key fraud metrics other than customer satisfaction.

Overall fraud losses remain the leading indicator for 80 percent of APAC banks, followed by revenue at 10 percent. Only six percent of APAC banks ranked customer satisfaction as their number one metric and only four percent said customer attrition was their key measurement.

Dan McConaghy added that in markets where it is more competitive, banks tend to place more emphasis on customer experience when combating fraud.

Of the banks surveyed, 54 percent of respondents said there would be a moderate rise in fraud in 2019 while 20 percent said there would be a significant jump.

Identity theft also remained a key priority for four-in-ten banks. Last year’s survey found that for one in five banks the number of fraudulent applications for credit cards sat between five to 10 percent.

FICO surveyed 50 executives from financial institutions across the region at the annual FICO Asia Pacific Fraud Forum held in Bali, Indonesia.