Challenger banks face challenges with global expansion

via Tearsheet

European challenger banks are going global. Revolut and N26 are set on acquiring local licenses to launch in markets around the world by assembling regulatory SWAT teams. Others, like OakNorth, are licensing their technology out to go global. Regardless of the expansion strategy, it’s not all unicorns and rainbows as these neobanks push on the growth envelope. Challenger banks are quite delayed in their entry to the US market and have bumped into resistance in other geographies, too. Will challenger banks succeed with their global ambitions?

Different countries, different environments

Challenger banks need to become adept at rapidly learning local regulatory regimes if they want to grow by acquiring licenses everywhere they do business. That could be a tough slog, given that the leading digital banks right now are headquartered in Europe. Europe has had a much more flexible approach to regulation following the financial crisis — a very different approach to the way American regulators reacted to the stress.

“It means European challenger banks will face a different and steeper set of barriers in the U.S. from the start,” said Colin Walsh, CEO of Varo Money, a competitive challenger bank in the U.S.

This means that it’s challenging to take a cookie cutter approach to expansion using a European-centric model. New banks will need flexible offerings to compete in local markets.

“Everything from regulatory issues to infrastructure for payment systems to consumer preferences must be considered and done within the context of the individual markets,” said Walsh. “There is no one-size-fits-all strategy and companies will have to make major adjustments as they expand into new global markets that have distinct regulatory and consumer characteristics.”

Cultural hurdles to global growth

Competing in highly regulated markets impacts growth in other ways. Like a lot of high-flying startups, some of the challenger banks have succeeded in part because of a cavalier approach to growth. Growth at all costs and get shit done have become mantras at a few of the leading startup banks. Some of that is starting to come back and bite them, like Revolut’s recent battles with negative PR surrounding its hiring practices and growth plans. Challenger banks will have to balance proactive fast-moving cultures with a sensitivity to market norms.

“Reconciling the ‘move fast and break things’ culture with the needs of a strongly regulated industry is a key difficulty these players face,” said Yann Ranchere, partner at Anthemis. “Neobanks are looking to strike a balance between continuing a fast expansion strategy and dealing with an increasing number of regulatory enquiries that can slow them down.”

When growing new account openings isn’t enough anymore

Challenger banks will also need to get serious about finding ways to deepen their relationships with consumers. Since launching just a few years ago, growth at all costs has encouraged these venture-backed tech firms to prioritize new account openings. Now with millions of accounts throughout Europe, challenger banks will have to compete to stay relevant in a world where it’s really easy for a consumer to open a new bank account.

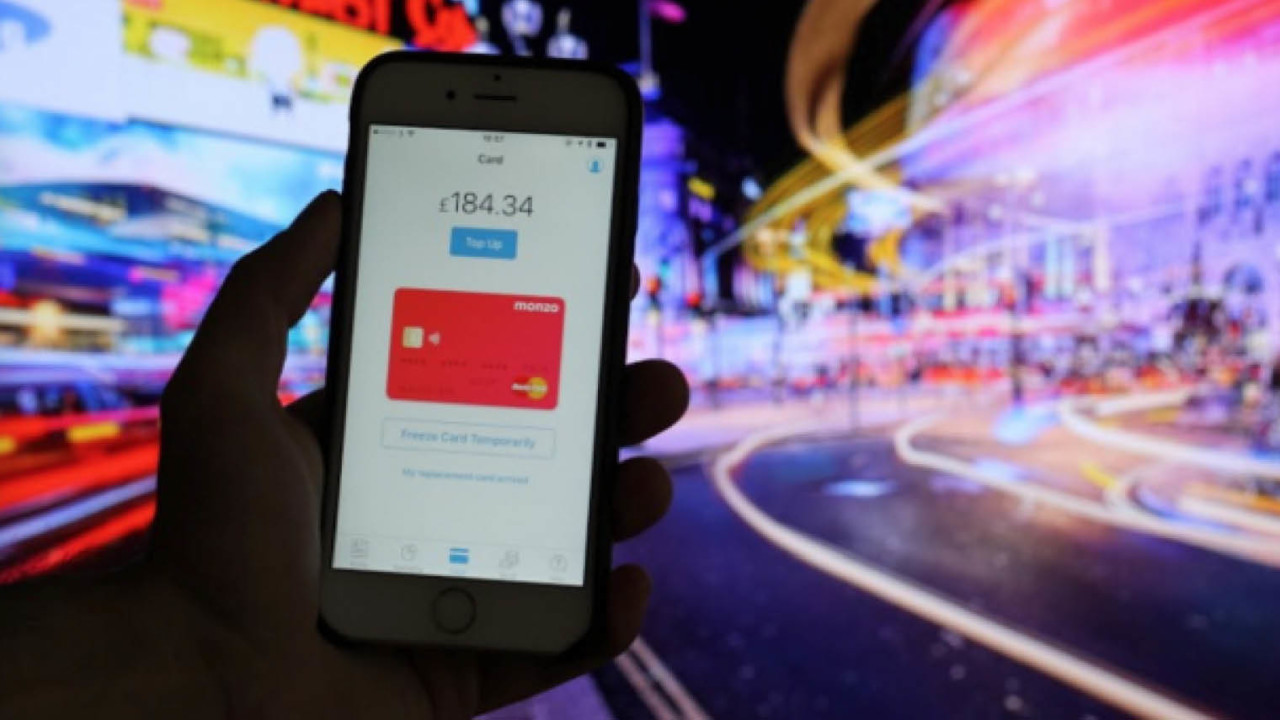

“This digital-first, consumer-driven focus has typically drawn consumers who’ve activated these accounts for temporary uses,” said Ciaran Chu, Payments Cloud Lead at ACI Worldwide. “For example, they pre-load their accounts and use them for weekly spending. In addition, many consumers tend to have multiple accounts for various uses.”

This means that these consumers are not using these banks to hold their main deposits or savings. They may have opened an account, but they’re not using it. A more accurate growth metric for challenger banks going forward might be average deposit size or number of transactions per month.

Another problem that may rear its head as challenger banks mature is when and where to monetize their services. Challengers typically employ a freemium revenue model which includes offering a free current account and other premium accounts that provide higher levels of service. Further monetization may be tricky, though.

“They must be careful to not alienate their hard-won customers,” said Chu. “For example, introducing features like ATM cash withdrawals may be one way to monetize, but limiting withdrawals and charging a fee for that service may alienate customers, especially those who have multiple accounts, as they may take their business elsewhere.

When new tech isn’t new anymore

For challenger banks, their new technology has always been a way to differentiate themselves versus the offerings of incumbent banks. But new technology doesn’t always remain new. Over time, challengers will have to cope with aging platforms that don’t scale as well as they used to.

“Many startups, including challenger banks, go to market with a minimum viable product and the technology to support that product,” said Paul Thomas, a managing director at Provenir. “At the time, it’s industry disrupting and brilliant, but as these businesses push for extremely ambitious growth and expansion, they quickly discover that their technology is holding them back.”

Matters could be made worse because some of these challenger banks outsourced parts — generally the back-end systems — of their original banking platforms. This will make scaling and profitability an issue going forward. These systems, designed to be light and scale easily, may encumber these new banks with similar legacy technology debt that incumbents suffer from. Challenger banks may end up having to choose between making more money and providing their customers with better financial experiences. Sound familiar?

“As they’ve grown, however, the economics of it all dictates that they must build their own platforms – an extremely complex task,” said Chu.

“As their success leads challenger banks toward centralizing their core processing, they will take on more responsibility, which will, in turn, need to be balanced against being completely consumer-friendly.”