“Fintech unicorn” WB21 faces securities fraud enforcement action from SEC

On October 2nd, the US Securities and Exchange Commission (SEC) revealed a lawsuit against Michael Gastauer and Roger Knox for “intentionally defrauding investors by secretly dumping large quantities of stock.”

Mr Knox reportedly assisted WB21 management in concealing their identities. The scheme was realized through the creation of multiple omnibus brokerage accounts, which enabled Mr Gastauer and his accomplices to secretly dump stocks – millions of shares at a time.

According to the SEC, WB21 turned out to be a vehicle for massive fraud instead of an innovative digital bank.

As per Hufflington post, Michael Gastauer started his first business back in 2003, named Apax, a payment service successfully sold to Malaysian Banking Group for $480 million. In October 2016, soon after WB21 reportedly reached a $2.2 billion valuation, the Financial Times expressed concern about Michael’s “dubious history.” Their inquiry revealed no existing records of the acquisition of Apax. Moreover, the article stated that Mr. Gastauer was previously sued for allegedly stealing millions of dollars.

Michael’s latest venture (est. 2014), WB21 digital bank claims to provide fast cross-border transfer services and account opening for 180 countries in 28 currencies. Its main motto is “solving the account opening problem that traditional banks expose customers to.” WB21 was also unusually acclaimed because of its ability to accept bitcoin deposits.

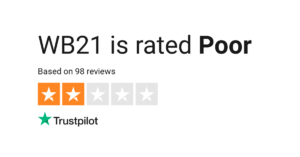

A brief web search on WB21 yields many negative stories from victims of the fraud who were sometimes even blacklisted by WB21 as early as 2016.

Jeremy Berger, COO Arival Bank:

“WB21’s case might show that regulation and compliance is not yet where it needs to be. One might argue that even the strongest regulation won’t make banks and their customers immune to fraud. If there is one thing for certain, the future of digital banking will need to intersect more often with sophisticated and advanced AML tools to continue the growth of a banking movement once desperate for rejuvenation”.

Article by: Masha Vyazemskaya