European & Israeli Venture Data 1H18

A data-driven look at VC investment trends across the geography.

I’m thrilled to release my bi-annual data deck on European and Israeli venture investment for 1H18. This is the first time that I’m releasing the deck under the new brand of Angular Ventures, a new venture capital firm that I launched in May of this year. Needless to say, it’s been a pretty intense few months…but it’s great to open for business.

You can download the deck at this link and/or view the whole thing below on slideshare. You can find the 2017 report here, and the 2016 report here. For a note on why and how I do this, read this. As you may have noticed, I’ve decided to release the report bi-annually as opposed to quarterly. It’s a ton of work — and the data doesn’t change frequently enough to make releasing it every quarter worthwhile (or interesting enough).

For this report, I had the benefit of the help of Andrew Poesaste (@poetential), an intern. Thank you, Andrew!

A quick note: My data is focused on sectors and geographies where I am active. It therefore excludes life sciences (pharma and therapeutics) but includes digital health and healthcare IT. My data is limited to Western, Central, and Eastern Europe and Israel . It excludes Turkey, Ukraine, Russia and the Commonwealth of Independent States.

A few highlights from the report:

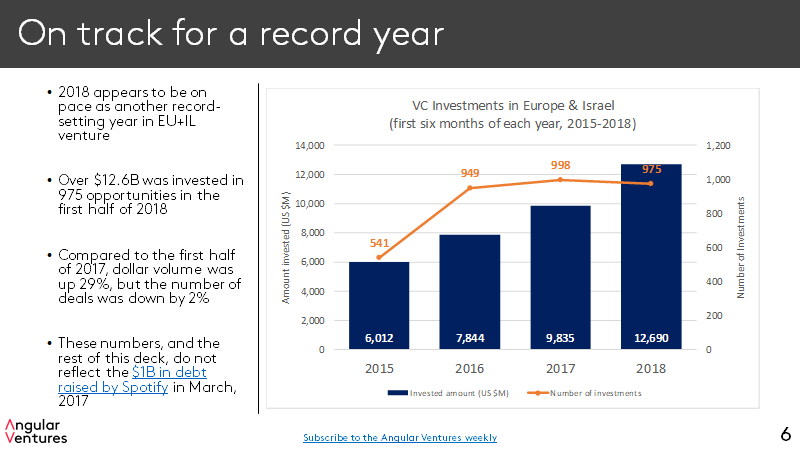

1H18 set new records for VC investment volume across the geography, but the number of deals was slightly down (slide 6):

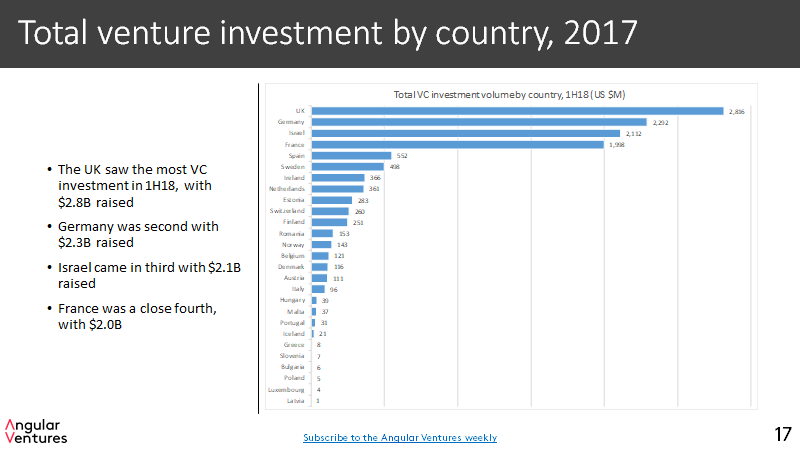

The UK and Germany led the pack in 1H18, with Israel and France right behind (slide 17):

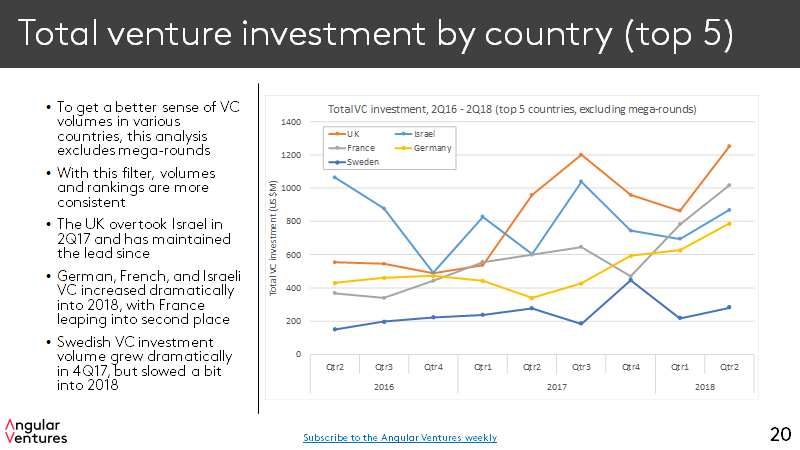

Even excluding mega-rounds, VC in all countries is way up, but France leap-frogged Israel to take the the second-place slot in both 1Q18 and 2Q18 (slide 20):

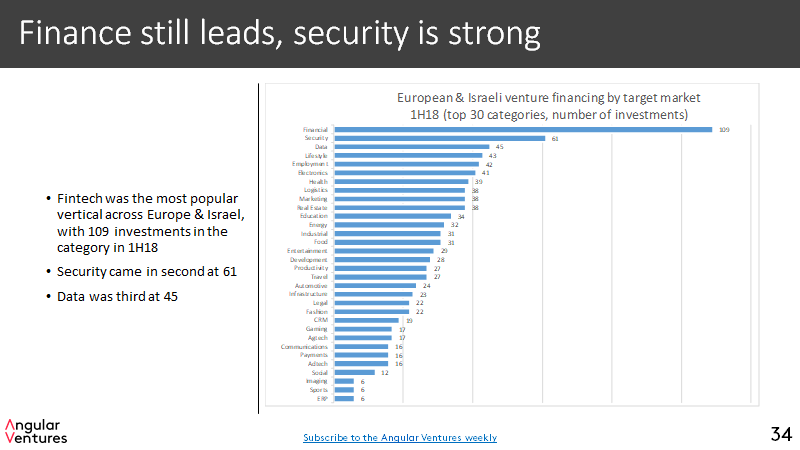

Finance was again the most funded vertical, with security as the number two (Slide 34):

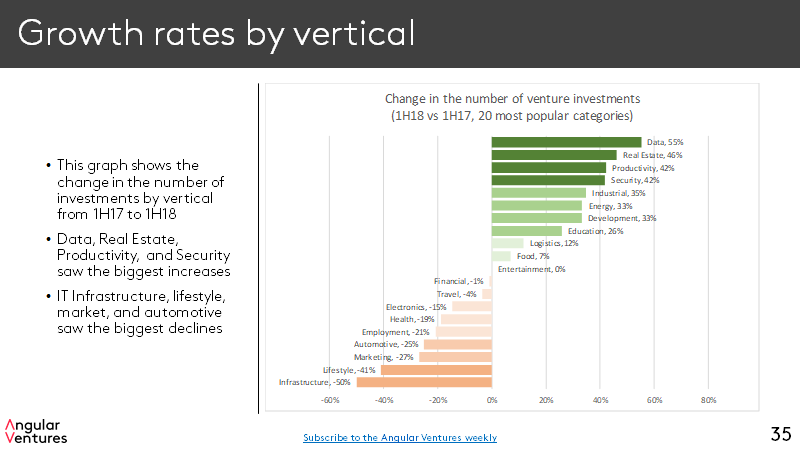

The verticals that grew the most were Data, Real Estate, Productivity, and Security. Lifestyle and infrastructure declined the most. (Slide 35):

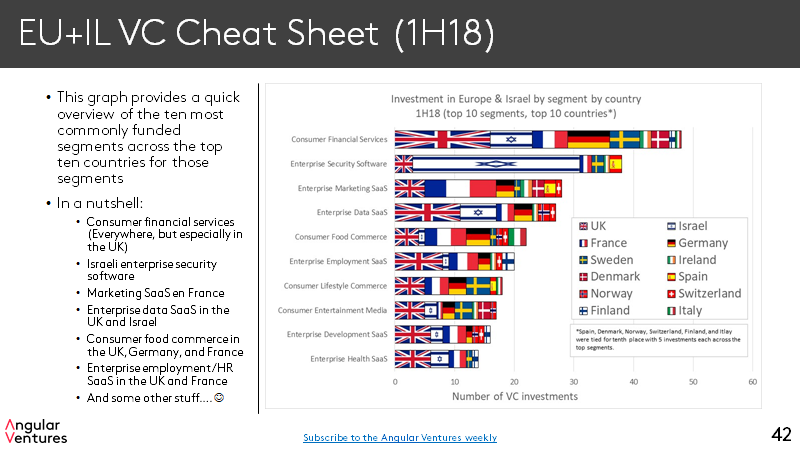

Here’s a cheat sheet that summarizes the top ten segments in the top ten countries (slide 42):

As always, I welcome your comments, questions, and feedback. Please let me know if there are additional slices of data you think I should add into the report.

If you like this sort of data and analysis, please note that I’ve started a weekly email newsletter devoted to enterprise tech venture in Europe and Israel. Click here to subscribe.

Here’s the full 70-page report:

(give it just a moment to load below, download, or go straight to slideshare)

By

By