The Four Major Things Missing in The Blockchain Industry

Infrastructure suggestions on everything from UX to Interoperability to Digital Reserves to Stablecoins

By Wesley Graham and Robert Greenfield for their Medium Blog

In an industry where diversity of thought and infrastructure are foundational to success it is awfully difficult to onboard someone into the blockchain world.

Even at the most basic level, infrastructure components like dApps and exchanges are simply “too complicated”, “too technical”, and “too volatile” to allow for any semblance of mainstream adoption.

For example, if you told your parents or grandparents to set up a bitcoin wallet and send you their address right now what would their answer be?

What Robby and I would like to propose are a series of “things” needed to solve blockchain’s ‘commercial adoption’ problem — centered around developing usable infrastructure that solves specific purposes in scaling the token economy.

Proposed Infrastructure Improvements

◼ Bridge 1: No-knowledge wallets, interfaces, and exchanges

A general discussion on infrastructure improvements should first begin at the on-ramp.

At the best of times, the experience of non-technical users on most blockchain platforms can be described as “highly confusing”, with most interactions described as “bewildering”, “off-putting”, or “overwhelming”.

For some reason, crypto applications always feel like crypto applications, with oftentimes very little consideration for the lack of technical knowledge of most non-traditional users.

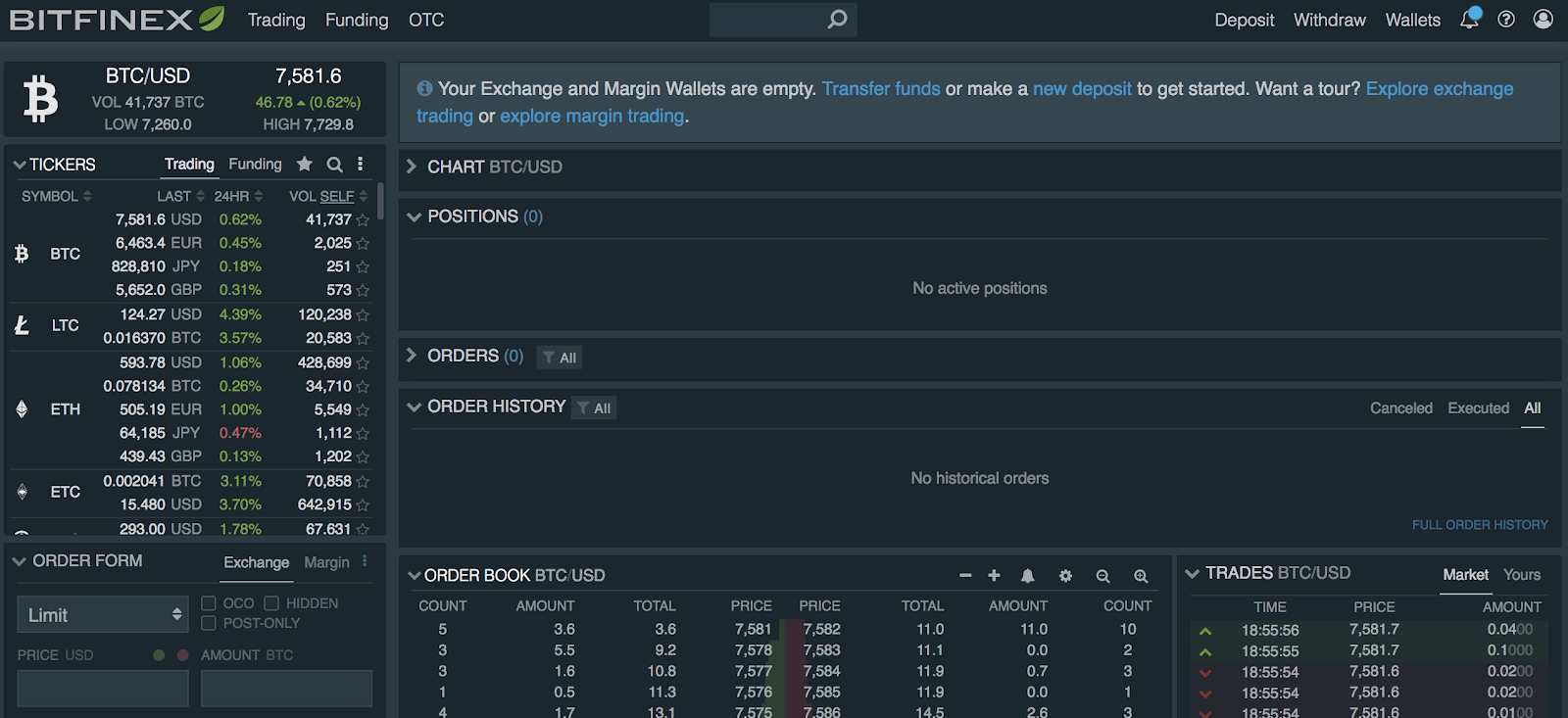

When logging on to many of today’s common blockchain interfaces those who believe that the technology is “too technical” or “too volatile” are often given the chance to see first hand why they are right. And rightly so, as there is no reason why anyone in their right mind would want to deviate from traditional systems if this is greeting them on the other side.

As a result, the first (and most simple) infrastructure improvement necessary for blockchain systems is….. the creation of a user experience that doesn’t mention blockchain — or cryptocurrency for that matter.

It is now more important than ever to disassociate user experience language from ‘cryptocurrency’ and ‘blockchain’ as they both serve as adoption buffers that cause user trepidation of false risk.

Glancing at the above photo from the perspective of someone who has never interacted with the technology before can largely explain why there is a perception of volatility and exclusivity to these platforms, which hampers mainstream adoption for those simply looking for another asset class to use or invest in.

Adding to this motif comes a demand for the creation of tools that allow for easy and secure private key management, more akin to the convenience of managing common day passwords.

The importance of being able to interact with a blockchain without ever seeing a key is massively understated, as the creation of systems that allowusers to gain value without requiring knowledge is essential to the widespread adoptability of these platforms.

Another key “bridge” required alongside user-centric infrastructure is the need for organic, frictionless custodial services, especially for non-commercial consumers. When logging onto services like Coinbase the user experience often coincides with a distinct feeling of “investment-platform” navigation, with inherent design and messaging that conflates purchase of cryptocurrencies with the purchase of securities.

Instead, exchanges should promote unencumbered access to assets like stablecoins, or cryptocurrencies that are more culturally akin to what consumers are used to dealing with in finance — a relatively good store of value.

◼ Bridge 2: A Centralized Solution to Interoperability, Scalability, and Liquidity

Ideally, with the creation of user-friendly interfaces we now have something that anyone can use and manage, and we can open the doors for people to begin using it.

Now, what’s the problem?

Well, first and most importantly there is an immediate demand for scalability that can withstand high volumes of user adoption.

The fact and the matter in today’s blockchain ecosystem is that the path towards long-term, complete decentralization is often started with the creation of a hybridized service; able to leverage the scalable features of central solutions and the accountability mechanisms of decentralized networks (like blockchains).

Once hybridized solutions are developed, the beginnings of a scalable platform begin to appear, upon which systems would need the following:

- Interoperable standards that allow for user activity across supporting blockchains and decentralized applications

- Friendly marketing language to incentivize legacy players to join the system

- Portable reputation systems for people, contracts, and exchanges to ensure honest behaviour and accountability

- Liquidity accessible to the public, to allow users the ability to easily purchase cryptocurrencies (like stablecoins) and onboard into the blockchain community with low risk

Seen in practice:

For example, say we are attempting to create a widely adopted blockchain equivalent of today’s central bank. Well, for starters, as a user on this bank platform, I am going to want to be able to take my money and use it on other platforms (vs just buying cheque books or transacting with solely bank-sponsored vendors).

This means being able to communicate with and transact across other applications, and even other blockchains.

I also will want to have some sort of familiarity with the terminology being used when I am transacting on this platform, so I still have some awareness of what is going on in the back end of these systems.

If I complete a transaction on this platform, I should expect that my transaction hashes should be akin to the format of my traditional ‘Deposit Confirmation #s’, and that the mappings of these items are made clear and apparent to me as a user.

Once I hit the open market, I want to have some native mechanism in place to tell me (pseudonymously) who I am transacting with, and whether I should be worried by transacting with them.

I then want to be able to pull money out of this platform whenever I see fit, so that I am not trapped in this system and disincentivized to put in significant capital.

This Fiat-crypto liquidity is a massive piece of functionality that always needs to be accessible to the public. Assets like stablecoins will be a necessary step toward this direction, but there need to be standards set in place (or user experiences) that coerce one of the following:

- (1) that banks recognize stablecoins like DAI in a manner through which they settle liquidity between the digital currency and fiat money, and/or that startups build with stablecoin frameworks to mature how these assets are collateralized

- (2) that blockchain developers create ways in which fiat-to-crypto conversions occur on the backend of their applications, so that a debit card transaction can be processed on the front-end, fund converted to DAI in the backend, and then converted back into whichever currency (digital or fiat) that the seller or service desires on the other end of the transaction

- (3) that consumers naturally become more confident about the usage of cryptocurrencies through institutional usage. This can take shape through (a) Wall Street usage, (b) governmental acceptance (i.e accepting crypto for tax payments), or (c) redemption in global trade (i.e acceptance of crypto for carbon credits). This, however, is unlikely for the usage of stablecoins, and since the vast majority of commercial transactions take place with a recognized viable store of value, there really is no other choice than to either keep using fiat or use some bastardized CBDC

With the upcoming advent of tokenized fiat, or central bank digital currencies (CBDCs), we will likely see a flurry of bank-backed and decentralized digital currencies coexisting, unless international regulations dictate that the public must used ‘recognized’ currencies in all transactions.

◼ Bridge 3: Digital Reserves — taking people out of the “exchange” game into the “convert” game

If we expect users to create marketplaces and move crypto or other digital assets around seamlessly we need to have a system in place that takes the arbitrage out of exchanging.

Let’s return to the digital bank example.

If I am using this platform as a tool store and convert wealth between a number of different currencies I should not feel as if I am susceptible to losing my capital to market makers and arbitrageurs. As a crypto user I want a simple tool (i.e a bank) to exist to help me with conversions in a manner where I don’t feel taken advantage of every time I transact.

With upcoming innovations in reserve management, interoperability, and atomic swaps we will likely see a diversion of interactions away from the long-term holding of poorly designed utilities; thus rendering the holding value of most “medium-of-exchange” tokens that are masquerading as stores of value obsolete.

◼ Bridge 4: A Functional Stablecoin that Supports Economic Growth

With the above procedures in place we have taken much of the scalability and ease-of-use out of the equation — however, we are still subject to one major area of discussion: volatility.

If we expect global adoption (including crypto use from the ~50% of people in the world who are used to living on $1 a day), we need some native asset that these people can use that they can have faith in vs their native fiat currency.

The process of taking those living on an income of less than $1 per day to $1 in DAI per day is not a big one, but there certainly is a problem asking users to take that dollar and place it in a more volatile digital currency that fluctuates over 10–15% every week.

However, one core economic issue to stablecoins is that they focus so much on maintaining stability as a transactional store of value that they forget to foster mechanisms for economic growth (at least in the sense of how economic growth is generated today with the usage of moderate inflation via money creation using tools like the federal reserve and credit schemes).

New age economic policy needs to be theorized to account for how we’re going to redefine economic growth given the usage of stable digital currencies in a world desperate for decentralization and monopoly disruption.

Leveraging the DAI system, we have the potential to see unbanked and underbanked populations diverge from the common, westernized savior mentality of ‘banking the unbanked.’

With the proper trust and user experience, these new age consumers will no longer need to rely on systems that charge ‘a cost of banking’; which in turn leads to the processes of accruing savings, making transactions, and accessing integral financial services becoming simpler, fairer, and more transparent.

Once platforms develop intuitive schemes for taking out loans in a stablecoin, using that stablecoin across normal vendor transactions, and, overall, integrating the use of cryptocurrency within the current, legacy system to minimize transactional friction, we’ll start to see our ‘modern’ economy operationalize in ways that promote a level playing field; whereby financial services will not be issued in accordance with a predefined set of biases, but will be rather instituted based upon the pure merit of the participating parties.

Standards like a portable, blockchain based FICO also need to be established in tangent to protocols like Dharma and stablecoins like DAI so that ‘value on credit’ can persist in traditional economies into the new cashless age.

A Conclusion on Infrastructure Improvements

As we continue to explore the bridges needing to be built for widespread blockchain adoption we will find better ways to distill and generalize these concepts into actionable items.

By bringing these matters into discussion we hope to see a level of “project accountability” begin to develop and best practices come to fruition. In our minds, the next iteration of crypto breaking into the mainstream will come from the advent of usable tools, the leveraging of hybrid, scalable solutions, and the creation of a functional stablecoin that supports economic growth.

If you are looking for more outlook from the perspectives of a VC/consultant and a social good expert check out Wesley and Robert’s medium blogs