#47: Telegram and the path towards the end of ICOs

By Stefano Bernardi

Token Economy #47

Telegram cancels its much-hyped initial coin offering

Telegram canceling their ICO is a good segway to talk about this much larger trend that we’re seeing.

They’re not the first we see and won’t be the last.

There are a few questions raised from this:

– how will the decentralized funding market evolve in the next few years?

– who benefits from a canceled ICO?

– how did we get from Bitcoin and Ethereum to having to deal with regulations all the time?

I got into Bitcoin because of its distance from regulations. Anyone could mine some BTC, no questions asked.

No one checking your accounts and blocking you.

Ethereum’s financing was more borderline, but along the same philosophy — BTC for ETH. Plain and simple, to a limited amount of people that had heard about it.

Now, we’re in a full swing mania with a pre-sale raising privately almost $2B.

This, coupled with the just insane number of new offerings (most of which are shady at best) has ushered us into a new era of having to deal with the regulators attentions.

And I’m bored.

I’m bored because I now see startups having to spend 6 figure sums on lawyers instead of building their products.

I’m bored because I see people making a killing from being accredited investors and thus being able to access opportunities that others can’t.

And I’m bored because all of this regulatory attention and focus is necessary, given that the scammers army has found its new honeypot.

We really can’t have nice things.

On Telegram specifically, the accredited investors are probably very happy. As the company is not going to sell the tokens directly to the public, it means that there should we a lot of unmet demand, raising the price and making the pre-sale investors the only people that can satisfy such demand.

For the future, what is it going to look like?

Vey hard to say, but our guess is that “normal” VC rounds will become more of a norm, there will be fewer public ICOs from legit projects, and the tokens will trade on exchanges directly with the company, or its treasury unit, or some specifically chosen early investors acting as market makers.

PS: see further below the April ICO numbers, confirming all of this.

?Thoughts

Elad Blog: Core Cryptocurrency Use Cases

A succinct and to the point post by Elad on the crypto use cases that he finds investable, in order of potential addressable market size:

– Store of value (i.e. digital gold)

– Off-shore capital (i.e privacy/discretion)

– Smart contracting platforms

– Persistent digital goods (i.e. collectibles)

Notably omitting dapps.

Lightning User Experience: A Day in the Life of Carol

A super accessible post describing a real-life Lightning user experience and what actually happens under the hood, by the Lightning team themselves.

The main friction point remains loading the Lightning account and having to wait for the on-chain transactions, but that’s not going to go away.

“Ideally, users like Carol will manage balances, payments and deposits without having to understand the underlying technology, and the experience will be cheaper and more convenient than existing payment technologies (checks, credit cards, physical cash, etc.).”

Then we’ll really have digital cash.

Blockchains Considered (Potentially) Harmful

Vlad reminds us all of the potential side effects of the blockchain:

– censorship resistance means no more ‘right to be forgotten’;

– financial freedom threatens governments ability to enforce policy goals;

– DAOs mean potentially empowering criminal organizations.

It all may sound obvious, and easily get obfuscated by the hype. As we build the future, it’s useful to keep in mind how far the pendulum could swing in the opposite direction and what trade-offs need to be made to onboard the masses.

The Layered TCR

A new twist in the TCR model by Trent from Ocean Protocol.

The post is long and very detailed, but the core concept is to add a new dimension of permissions to TCRs compared to the binary current implementation.

We have no doubts this is a much better framework, but it sounds fairly hard to make it usable by people and have them understand at what layer they are and so on.

Hopefully there will be someone that tries this out soon!

18 Ideas for 0x Relayers in 2018

This is a cool trend, and platform builders should take notice.

The 0x product team shares 18 ideas on what is possible and would be interesting to build on top of 0x.

Some interesting ones:

– Stablecoin Converter

– Tether for Video Game Items

– Compliant Token Relayer (we’ve seen some of those)

– 0WS

– Bancor on 0x

– In-App Exchange for NFTs

Go and BUIDL!

New Ideas Energize Ethereum Though True Signaling Solution Still Elusive

EIP0 went down in Toronto this week prior to EDCON, this was a private meeting with some top Ethereum developers to discuss governance and a number of other challenges.

You can check out the results on Reddit as well as see some videos on Giveth’s Youtube channel.

The linkedin Coindesk article is also a good summary.

Crypto Moats

This is one of the topics that we keep thinking about: what are the defensible competitive advantages that one can bank on in a open-source environment where everything can be cloned or forked away?

Robert does a good job at summarizing the source of such moats in crypto.

1/ superior brand (e.g. ‘digital gold’ for Bitcoin, Vitalik for Ethereum, Zooko for Zcash)

2/ superior developers

3/ Partially/fully closed source code, at least initially (this was object of a thought-provoking Twitter debate between Naval and Jimmy Song this week)

4/ Life span / Lindy effect

5/ network effects (e.g. pooled liquidity for 0x)

6/ good governance (e.g. ability to evolve, right level of rent-seeking)

ICOs are Cancer

A Bitcoin Maximalist post explaining why ICOs were born and why they royally suck.

The strong title also makes it more sharable by the anti-ICO crowd.

It’s hard to actually argue against most of this points though, and we’d really like to see more VCs write about this instead of bashing the ICOs on twitter and then investing in pre-sale rounds with no protections whatsoever on their capital.

Decentralizing Aragon’s development II: Minimum Viable Foundation

Aragon continues to lead the way in the governance of truly distributed and decentralized projects.

We’ve previously featured their announcement of separating the foundation with the company developing the network, and even funding competing companies from the foundation.

Now, they’re announcing their plans on the transition from a very heavy centralized Foundation, to a setup where most of the stuff is given back to the network.

The most important thing here, is that the assets the foundation holds (from the ICO) will be distributed to the DAO controlling the network.

Still a few things to figure out, but clearly the right path towards the future.

Crypto Composables — Building Blocks and Applications

This is a follow up post to the introductory piece on the crypto composable non-fungible token standard ERC-998 that we covered in issued #45.

In this post Matt goes through some of the possible use cases for composable blockchain objects, ranging from legal contracts to gaming and supply chain.

?Newsy stuff

Amazon threatens to suspend Signal’s AWS account over censorship circumvention

Not entirely crypto related, but a nice read to explain why we’re all here.

Signal is getting blocked from using domain fronting on AWS and Google had already done that a while back.

The reason they are using the technique in the first place is to try and circumvent censorship in a number of countries.

This is the reason we need a new, distributed and decentralized internet.

Launching the Livepeer Network

Livepeer is one of the most interesting projects on Ethereum, mostly because it’s useful, been in development for a while and now live!

You can broadcast on Livepeer today on mainnet, that’s pretty cool.

Congratulations on the launch!

In other news:

- It seems like the worst is behind at Tezos and that public launch is expected in Q3 2018. Given all the mess that happened, a 12 month delay would quite a result.

- Creative crypto accounting going on at Square.

- Ripple hit by a class action lawsuit alleging the company violated state and federal securities laws by selling XRP to the general public in a “never-ending initial coin offering”. Here is the full complaint.

- Oh. Ripple sold $168M worth of XRP from its balance sheet in Q1, while releasing another $300M from escrow to “invest in the XRP ecosystem”.

- Coinbase responded to the NYAG questionnaire. Quite the contrast in tone compared to Kraken’s response.

- If you have the nerve and a couple of minutes to waste, watch Roubini callbullsh*t on everything crypto at a panel at the Milken Institute Global Conference. It’s getting a little boring.

? Cool new projects

The Hopepage

Pretty cool idea by UNICEF Australia.

On TheHopepage.org you can donate a % of your computer’s processing power to mine Monero for UNICEF causes, powered by Coinhive’s Javascript-based mining tool.

Almost 10k people are already donating this way as we were writing this.

Ethereum10: Own all the top Ethereum tokens

We’ve been following the team at Bskt for a while (apologies for being slow on emails!) and are very happy to see their product live.

The Ethereum 10 Index is an easy way to hold the most popular native Ethereum tokens.

You can get the E10 by buying it or creating it. Creating it is a super clumsy flow, as you have to buy all underlying tokens and then transfer them using the dapp.

You can check the smart contract and dapp.

Radar Relay will be supporting both ETH-E10 and DAI-E10. Impressive, so that’s probably the easiest way.

E10 is the first implementation of Bskt, which is a tool that lets anyone group together ERC 20 tokens.

This is very similar to {Set} Protocol, but it’s actually live and you can play with it today.

Balance Manager Beta

We’ve been following Richard Burton for a while in his quest to make it easier to use cryptocurrencies, and have been extremely impressed with the dedication and speed.

Now Balance Manager is finally live, and you can play with it.

This is an early, beta version but it’s a really nice UI to see your ETH and ERC20 balances, and transfer tokens.

In the future, they aim to be the central command for all of your ETH activities, such as lending, derivatives, securities, stablecoins, exchanges, etc.

CryptoCollab: A Decentralized Music Composition Experiment

This is just an experiment for now, maybe totally pointless, but it gives a flavour for the kind of cool new things that become possible with this technology and hopefully inspire more people. It also shows what can happen when art and technology start to overlap, like we saw a couple of weeks back with SuperRare.

In this case, users can collaborate on a musical composition by buying NOTE tokens and placing them anywhere they want within a capped length and a specified timeframe. Once that’s elapsed, the composition will live on the Ethereum blockchain and the contract that collected the ETH will self-destruct after locking the funds up in the composition contract forever.

“CryptoCollab attempts to explore other methods to incentivize people, particularly those where the incentive does not take the form of monetary values but in the act of creating and collaborating with a large group of people even at a net monetary loss”

Celsius

Celsius is another play on crypto lending.

In this case, they mix quite a lot of stuff:

– you deposit cryptocurrency and can take cash loans

– you can also lend your cryptocurrency to a pool

– thus, we presumed they also offer crypto-denominated loans to third parties

BUT, they say: “We do not lend coins, we will lend dollars using the cryptocurrency from our members as collateral.”

So, we’re really confused. Usually when you lend you’re not the one to need collateral..

(Obviously, there is a token and crowdsale)

Liquidity.Network Wallet (Alpha)

Liquidity is Ethereum’s answer to Lightning (together with Raiden).

They launched their alpha version of the wallet this week, and it’s worth playing around with it.

(It’s on Ropsten)

The Civil Constitution (Beta)

Civil published its manifesto.

It’s a very interesting new project, developing a protocol (on Ethereum) for journalism.

Specifically, its software aims to enable:

– publishing or transmission of journalism and the permanent, unerasable archiving of work to the blockchain.

– Journalists to find outlets for their work to reach the concerned public.

– Journalists to find financial support from the public.

– The public to find, fund, commission, consume or contribute to journalism.

Seems like quite a good space for blockchain innovation.

Curated on a Product Hunt collection!

? ICO madness

Picking up where we left it with the introductory post on Telegram.

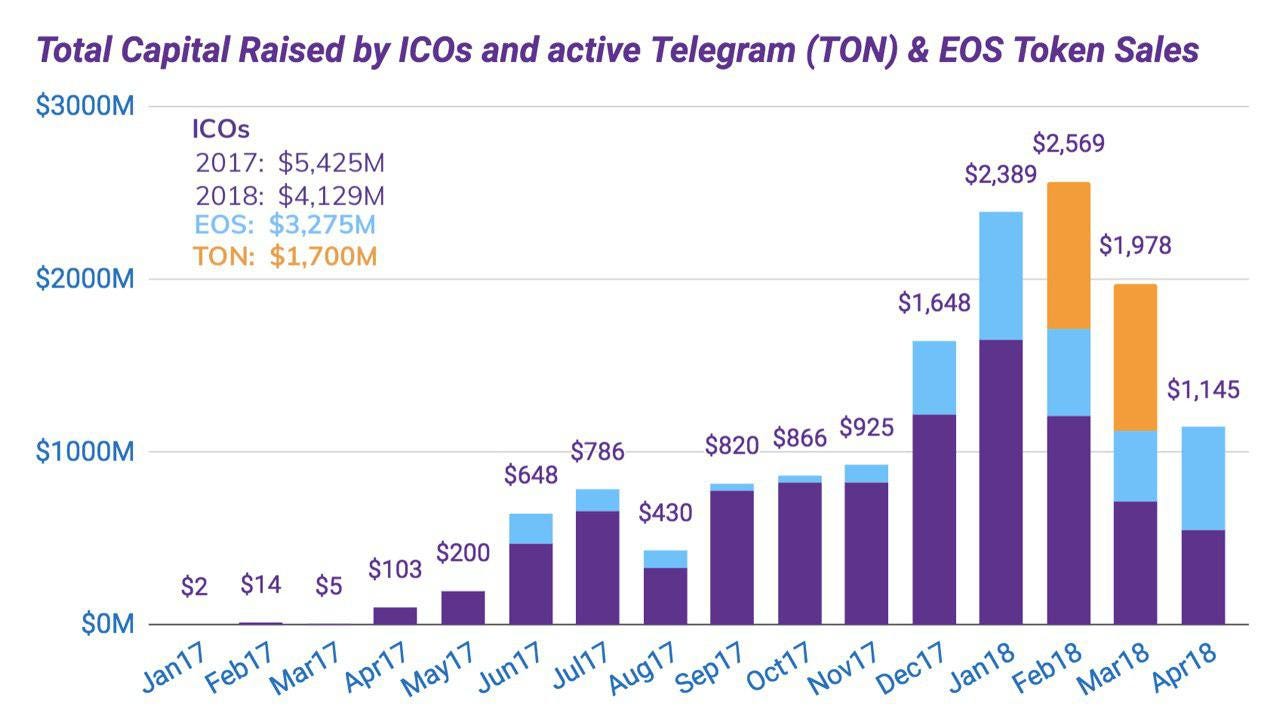

The draft April 2018 ICO numbers from Tokendata show a continued decline in volumes of public sales, just as predicted in issue #34. That (and more) has shifted en masse to the private stages, where we are seeing 8–9 digit million rounds getting done by traditional and new funds like the new normal.

Also, it would appear that EOS has so far raised in excess of $3 BILLION (or one third of all the capital raised via token sales since January 2017), in case you are shocked by Telegram. ?

? This week in regulation

World’s Second Most Valuable Cryptocurrency Under Regulatory Scrutiny

The debate on whether Ether is a security continues as the SEC is taking a hard look at the circumstances in which c. 60M ETH were sold in the July 2014 sale. Apparently there’s a working group meeting scheduled for May 7th between senior officials of the SEC and the CFTC.

The regulators are particularly focused on the initial as well as the ongoing role of the Ethereum Foundation and whether it had/still has the power to influence Ether’s value.

“Because the foundation raised the money to build the Ethereum platform, and investors probably bought ether speculating the launch would make the asset rise in value, the deal resembled a securities sale, the people said.”

SEC commissioner won’t declare all tokens are “securities”

Remarks from SEC Commissioner Hester Peirce at the Medici conference in LA this week had a slightly different tone.

She acknowledged that token’s functions can evolve over time and that promoters that are no longer actively involved should not be pursued, encouraging entrepreneurs to engage early with the SEC’s corporation finance division and regulators to take a more hands off approach.

“On a beach, you have a life guard…. but she’s not sitting with the sand castle builders,”

Australian Securities and Investment Commission Issues Inquiries into ICO Issuers to Halt Deceptive Practices

The Australian Securities and Investment Commission (ASIC) has started to take action against issuers, promoters or advisors involved in misleading or deceptive conduct related to ICOs. Inquiries have been issued and some ongoing ICOs were halted.

South Korean Lawmakers Introduce Bill To Legalize New ICOs

Regulated ICOs are coming to South Korea, where a group of lawmakers are working on a bill to legalize new ICOs under the government supervision after the reported ban issued in late September last year.

? New funds

Out of the blue, SF-based Andra Capital claims to have raised $500M in a pre-sale for its tokenized late stage tech fund, targeting up to $1 billion through a token sale to accredited investors later in the summer.

Investors will get exposure to a portfolio of high profile late stage VC-backed high growth tech companies with an exit or IPO in reasonable sight, through a security token creatively named — wait for it — ‘Silicon Valley Coin’ (SVC) that will be listed on regulated security exchanges, or so they promise.

It’s not very clear from the documents how they will get into the hot deals, if via secondaries (seems the most likely route) or primary capital. Also not clear if token holders should expect to receive distributions from exits, it would appear that profits from sales are rather reinvested into token buybacks (other than carry which presumably will be pocketed by the GPs).

Also, 3% management fee (ie $30M a year), 20% carry. Promising a 30%+ IRR.

I, Stefano, have rarely seen something smell so scammy in the venture fund world. I would suggest reading the whitepaper if you have some time reserved for laughter.

Some gems: “the declining number of IPOs per year necessitates a consistent deal flow of potentially high-ROI opportunities. Our proprietary strategy and stakeholder ecosystem provides 30%+ IRR returns from investing in primarily late-stage technology ventures.”

We have found no forms registered on the SEC website.

China’s Huobi launches US$1 billion blockchain fund to bolster domestic business

Another week, another billion dollar Chinese fund.

Huobi, the third-largest crypto exchange, is co-launching a US$1 billion fund to back Chinese blockchain-related start-ups together with Tianya Community Network Technology, a Hainan-based social networking platform.

Mind blowing titbit of data from the article:

“41 per cent of start-ups that received funding in China in the first quarter were blockchain-related”

Author William Mougayar to Launch Blockchain Investment Fund

Not much revealed here, other than Token Summit co-host William Mougayar is launching JM3 Capital, by spinning off an entity from Philipp Jabre’s swiss hedge fund Jabre Capital Partners.

JM apparently standing for Jabre and Mougayar?

? Funding rounds

Peter Thiel-Backed Venture to Help Big Investors Bet on Bitcoin

Founders Fund has apparently backed a broker-dealer called Tagomi that is building smart order routers for the crypto markets, essentially an automated system that dispatches orders to exchanges and dark pools to get the best fills.

The co-founder is the former head of electronic trading at Goldman Sachs, a further sign that Wall st is knocking hard at the crypto doors.

ℹ About us

Token Economy is written and curated by Stefano Bernardi & Yannick Roux.

? If you’re building a new fundamental piece of technology for the future, please reach out

? If you’re feeling generous you can stake some ETH on our StakeTree page,or get your friends to subscribe to the newsletter (both hugely appreciated!)