How Blockchain Startups Are Trying to Recover ICO’s Reputation

The ICO fundraising mechanism became one of the most popular topics of 2017. New blockchain tech and cryptocurrencies allowed startups all over the world to access capital which was practically impossible for them before. Token sales became an even more effective tool than going to VCs (startups raised more money via ICOs). However, this fairytale could not last forever, and the hangover came soon enough as more and more ICO projects started failing.

As time went on, the trust in ICO as an investment tool has significantly decreased. Today we’ll talk about the scale of this problem and how the new breed of crypto startups are trying to fix it.

A few statistics: how often ICO projects fail

According to Tokendata, in 2017 there were 902 token sales, and 142 projects did not survive the fundraising. An additional 276 startups failed either due to the founders taking the money and running, or by slowly ending any activity. Thus, 46% of last year’s ICOs were dead by early 2018.

In reality, the numbers are even bigger, as an additional 113 projects are currently in the zombie stage with minimal activity on social media, or with a community so tiny, that there are no chances of success. If we were to count these, then the number of failed ICOs would equal 59%.

Despite the fact that many of the failed ICOs were doomed from the very beginning, and that there were lots of warning signs, they managed to raise as much as $233 million. All this could not pass unnoticed, and by the spring of this year, the perception of ICO as an investment tool had suffered serious harm. As a result, new crypto startup teams are forced to make more effort to convince investors and demonstrate that their chances of succeeding are higher than zero.

And this is how they are doing it.

How ICO projects convince investors

For now, there are three main ways that crypto startups are trying to build trust with potential investors.

Total transparency

Last year it might have been enough to have a fancy website and a well-designed White Paper for an ICO to succeed, but now things have changed. Today to hit the hard cap you’ll need not only to master your marketing and content, but also to build your own community.

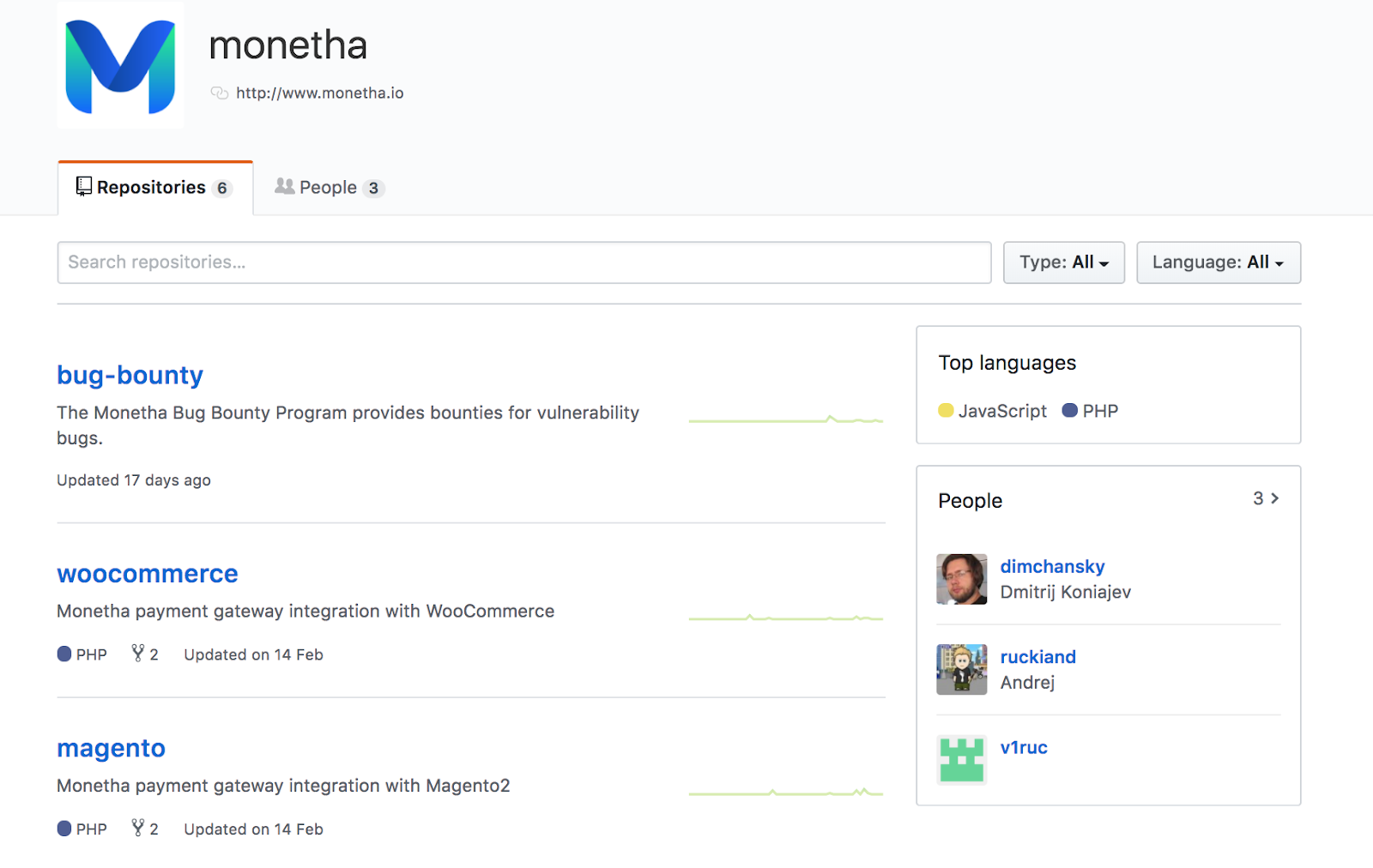

This is why startups have to work on their social media presence and engage with the audience on different forums. This is essential but not enough in itself, as investors want to see what has been achieved already before investing a penny in a project. To satisfy potential investors, more and more teams choose to open their development process and put the source code online via GitHub.

There are lots of examples of such transparency: take the BitDegree platform that recently conducted a successful ICO and raised $22 million, or the blockchain-based payment solution Monetha that raised $37m.

Building a connection to real assets

Another way to show that the risks of participating in certain ICOs are lower than usual, is to bind tokens or internal cryptocoins to some real assets. There is some logic here as many of the failed projects were literally selling air, i.e. virtual tokens with no connection to the real economy. When the token has nothing but the founders’ great plans for conquering the world behind it, it is unlikely that there will be a great success which can be proven by statistics.

Therefore, investors now trust more in projects that have solid ground under their feet, possess something offline, and whose activity has a connection to the real world. For example, their offer can be backed by a real asset. The logic is simple: if the startup has real assets, ideally located offline, then it will be harder for founders to just quit and take the money.

That’s why we’re seeing the rise of projects like Lightcash, whose team is working on their own gold-backed cryptocurrency. The gold to secure the coins is mined from real precious metal deposits. The project claims to have its own gold mining company, publishes its licenses on the website, and even recently posted a video of how gold is obtained there:

Here it shows the final outcome:

Offering real money

Some of the ICO projects go even further, and convince investors by offering a share in the company’s profits. Many analysts and observers often blame ICOs for accepting investors’ money and offering nothing in return, apart from the promise of future speculative income from a token price rise. If an investor goes and buys a share in a company at the Stock Exchange, he will be able to benefit from the price rise and also from dividends.

There are also examples of blockchain projects that try to incorporate this fiat world scheme into crypto market. For example, look at the PinkDateblockchain-based escort agency (what a niche!) which is reportedly offering the participants of its ICO special token shares which pay dividends.

One more way of stimulating investors is to give them an opportunity to earn interest on their purchased tokens via special crypto deposits such as the Lightcash project does.

Final thoughts

The unprecedented growth of ICO will one day come to an end. As in any other new industry, the blockchain startup market is emerging and rapidly evolving. This is normal given that just several months ago having a website and a couple of PDFs would be enough to raise millions of dollars. Today you need to write real code, connect to real assets, and offer something beyond the hope of the future skyrocketing of your token price. This fact tells us that the market is getting more mature and that despite the statistics, the ICO as a tool still has a future.