Amazon is the biggest threat to bitcoin right now

Over the past year, a growing number of people have leapt to take part in bitcoin’s meteoric rise. Teenagers have invested their college funds. Some families have mortgaged their homes and placed everything on the table. Even billionaires have suggested putting 10% of all assets into the digital currency.

There is a lot of money in play and people’s livelihoods and savings are on the line. As a vehicle of investment, bitcoin itself has an array of problems. It’s extremely volatile — suffering drops as high as 30% in a single day, funds are difficult to recover when hacked, and bitcoin’s technology may be behind other newer cryptocurrencies which offer greater anonymity, programmability, and scaling.

Most people tend to look at popular altcoins when they think about what could dethrone the current cryptocurrency king. But could the real threat come from a more material realm?

Amazon is the largest online retailer in the world

Boasting over 94 billion USD in sales last year, it handles almost half of all American online purchases and has operations across the globe. But despite offering a large variety of payment options, Amazon has yet to allow people to pay with bitcoin or any other cryptocurrency.

As the leader in online retail, it’s in a prime position to do so. Any cryptocurrency Amazon adopted would surely see a huge surge of support. Given the current popularity of cryptocurrency, what exactly is Amazon waiting for?

Barriers

One of the reasons Amazon may be avoiding cryptocurrency is their limited transaction speeds. Take a look at the top two major cryptocurrencies.

bitcoin: 7 transactions per second

ethereum: 15 transactions per second

Amazon peaked at 600 transactions per second during last year’s Amazon prime sale. If even a fraction of their traffic decided to pay with cryptocurrency, consumers would be stuck waiting hours for transactions to go through. Not a great customer experience.

Do slow transaction fees mean Amazon will avoid cryptocurrency? The tech giant is no stranger to innovative scaling solutions. Bitcoin and ethereum are currently too slow to support Amazon’s demands but other cryptocurrencies are not. An alternative cryptocurrency called ripple has tested speeds as high as 1500 transactions per second.

Why Amazon Might be Considering Cryptocurrencies

Although it hasn’t announced an official position on cryptocurrencies, there are several indicators that suggest Amazon is considering this space and not necessarily in a bitcoin friendly way.

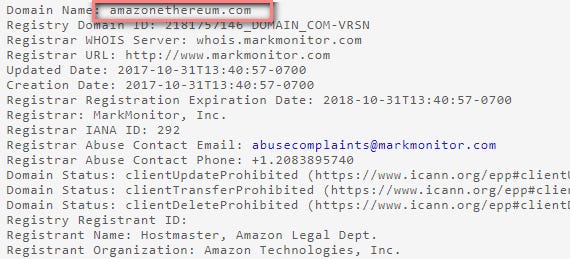

On October 31st Amazon reportedly bought amazonethereum.com, amazoncryptocurrency.com, and amazoncryptocurrencies.com. This move might be simply covering their bases. Or it might be insight into future endeavours.

There are already services that sell amazon gift cards for bitcoin so in some respect Amazon offering bitcoin on their site would simply cut out the middleman

Finally one of Amazon’s core principles is ‘Customer Obsession’. If customers demand a cryptocurrency payment method Amazon is sure to eventually give them what they want.

Given that many of its shoppers buy goods internationally, cryptocurrency could be an excellent way for shoppers to enjoy a standardized currency without worrying about exchange rates.

What Could Happen

There are a few ways this could play out that could endanger bitcoin’s current reign:

1. Amazon could stay out of the cryptocurrency sector

In order to cross the chasm from investment to currency, bitcoin needs to gain widespread adoption from merchants. It’s unlikely that Amazon will stay out of this sector indefinitely but if it did bitcoin would certainly suffer from being excluded by the world’s largest online retailer. This wouldn’t kill bitcoin, but it would hurt its potential as a currency.

2. Amazon could adopt a competitor to bitcoin

This seems likely if bitcoin cannot keep up with Amazon’s required transaction speeds. Ripple is a potential contender with 1000+ TPS. This scenario could definitely endanger bitcoin’s reign as the top cryptocurrency. A fictional deal with Visa raised the value of the Monaco cryptocurrency by almost 700%. Any deal with Amazon will rocket the partner cryptocurrency upwards. If Amazon chooses to go this route it probably wouldn’t kill bitcoin, but whatever coin they went with could knock bitcoin out of its top spot.

3. Amazon could create its own cryptocurrency

If Amazon Prime video is any indication — Amazon loves to play in high potential spaces where it can leverage its huge army of developers to make big plays. Its holdings range from cloud storage, to video streaming, to hardware offerings. If it sees potential in the cryptocurrency space it has the technical resources to break into it.

It would not be the first time a large established company has launched their own token. In September 2017, the chat giant Kik launched an ICO raising $75 million dollars. Overstock, a publically traded e-commerce company, has seen its stock raise by 30% since announcing it plans to ICO this December.

If Amazon created its own cryptocurrency they could spread its use across their many services: from Amazon Prime, to Twitch, to Audible, allowing consumers to easily transfer funds within the Amazon ecosystem. They could outcompete any other cryptocurrency and entice mainstream adoption by offering a 5% or 10% discount on purchases made with AmazonCoin. With tens of thousands of developers and high paying salaries it could find the technical talent to design a coin that outpaces bitcoin when it comes to scaling and privacy concerns.

This is the most dangerous scenario for bitcoin but it relies on Amazon taking a major leap into a field it has so far avoided.

Keep an eye on Amazon as demand for cryptocurrencies rises

For now Amazon seems to be keeping quiet about its plans in this space. But whatever cryptocurrency Amazon chooses could become a household name overnight.

Whether Amazon chooses bitcoin, ethereum, or something else altogether, their choice will have dramatic consequences on the existing cryptocurrency landscape. Cryptocurrency and the technology behind it are here to stay, but bitcoin and its reign as the number one cryptocurrency might not be.