Alibaba funds lending startup WeLab to help it break out of China

By Steven Millward for Tech in Asia

Lending startup WeLab is flush with cash today after announcing US$220 million in its latest funding round. It operates WeLend in Hong Kong and Wolaidai in mainland China.

Online shopping giant Alibaba is among the investors, throwing in cash from the Alibaba Hong Kong Entrepreneurs Fund it set up in 2015.

The startup – with 25 million users and US$28 billion in processed loans – works entirely online, via a mobile app. It gives consumers access to the kind of relatively small loans that it would be unusual or difficult to obtain from your bank.

“In 2017, we have been focusing on growing the business,” CEO Simon Loong tells Tech in Asia. “Our loan business has grown six- to sevenfold in the first half of 2017 compared to the first half of 2016. This is in addition to the six- to sevenfold growth the company has experienced in the full year of 2016 compared to the full year of 2015. We are also delighted to announce that the business turned profitable this year.” No absolute numbers were disclosed.

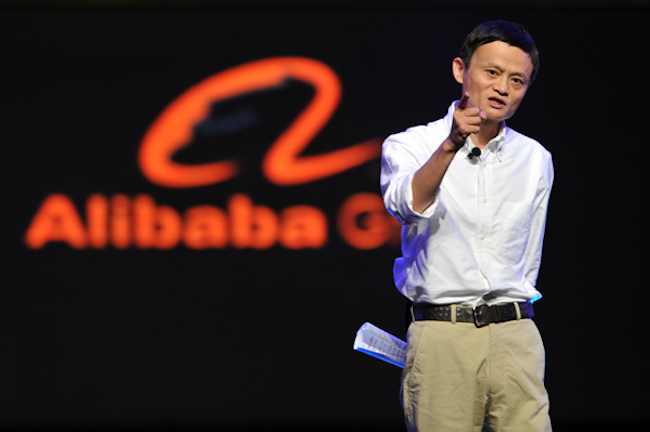

Simon Loong. Photo credit: WeLab.

On its Wolaidai service, loans tend to range from US$450 to $7,500. The delinquency rate, or being late to repay, is two to three percent.

See: How fintech startups are using big data to solve China’s huge credit gap

Like many such startups, WeLab delves through some unusual – and rather intimate – data in people’s lives in order to asses their credit worthiness. It uses a mix of facial recognition, text and image analysis, and monitoring online behavior to asses people. “Our quickest approval is only 1.7 seconds, and we process a new user every 1.3 seconds,” Loong adds.

Tech-savvy salaried workers aged between 20 and 35 are its main customers, explains the boss.

Big rivals

“For this round of strategic financing, it was important for us to have participants that would help scale our business to the next level,” says Loong. The money “will be invested into research and development for big data, credit risk management technology, product development, expand business scale, explore new business models, and speed up overseas expansion in 2018.”

It’ll be up against an array of loans startups riding the fintech boom across the planet. Kabbage recently pocketed US$250 million to expand into Asia, for example, while the pioneering Lending Club is already a US$2.2 billion business.

In mainland China, the competition is – perhaps needless to say – especially fierce. Dianrong is arguably the biggest indie startup in the lending space, while Alibaba, via its Ant Financial unit, is the biggest name from which people can borrow a few bucks over their phone.

WeLab has now raised US$425 million in total, with this latest injection described as its series B+. Credit Suisse, China Construction Bank (International), and International Finance Corporation are among the other participants in this round, which is a mix of “equity and debt strategic financing,” said WeLab in a statement.