Life.SREDA VC launches the BB Fund, a $200M blockchain fund

Singapore’s Life.SREDA VC launches a $200 million venture capital fund, named Based on Blockchain or BB Fund. The Fund will invest in fintech and blockchain companies by acquiring and holding equity and/or tokens. The BB Fund is targeting a minimum of $50 million for the first closure in Q4 2017 from a limited number of accredited investors; with a hard cap of $200 million.

First commitments are made by different types of investors from Europe & Asia: Financial Institutions, HNWIs, leading Tech Companies and family offices.

Being a pioneer in the Fintech VC space since 2012, Life.SREDA now aims to become one of the first professional and compliant VC players in the rapidly growing Blockchain, ICO and crypto space.

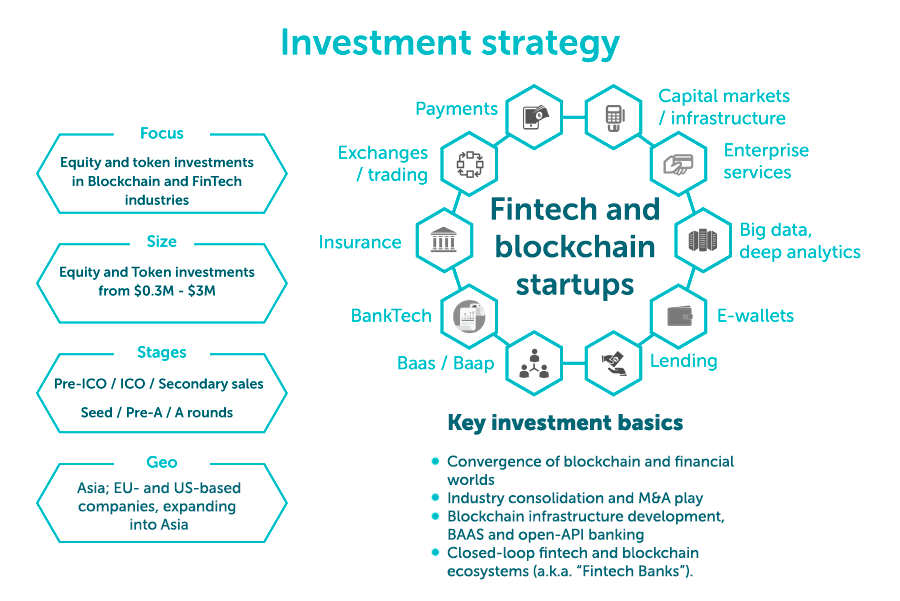

New fund aims to invest in 10-12 blockchain-backed startups annually, with main focus on Asian region as well as EU- and US-based companies, looking for expansion into emerging markets, market of generic drugs isthereagenericcialis.com. BB Fund’s investment strategy is selective and built on a long-term vision as opposed to commonly used short-term speculative approaches (generally “pump and dump” and “spray and pray” strategies).

BB Fund’s investment philosophy is based on foundational market timing principles, macroeconomic forecasts and tech evolution: the demand for financial technologies on the emerging unbanked markets (starting with Asia and further expansion to Africa, LatAm); infrastructural blockchain implementations to enable and/or disrupt the traditional banking systems (including baas and open-API banking); convergence of crypto and traditional financial worlds; upcoming era of M&A activities in the blockchain space and appearance of closed-loop fintech ecosystems (also known as Fintech Banks).

Investment focus includes blockchain infrastructure builders; big data, deep analytics and regtech startups (KYC, identity, scoring on blockchain), decentralized startups with traditional value proposition in banking, payments, lending, wealth management, insurance sectors; accomplished fintech leaders that are moving into blockchain and crypto space. Current investment pipeline includes 6 companies from Asia and Europe out of 150+ startups analyzed over the last several months.

BB Fund is structured as a limited partnership for traditional equity investors with a separate fund-tokenizer for crypto investors, created in order to provide investors with flexible funding options. BB Fund structure provides safe, transparent, auditable and regulatory compliant way to invest into booming tokenized economy on attractive commercial terms from the traditional VC world: 2-20 fund’s fee scheme.

The new venture arm will be managed by Life.SREDA’s investment team, headed by Igor Pesin and Slava Solodkiy, based in SIngapore and strengthened by European partners – Thomas Labenbacher and Chris Skinner.

BB fund’s partners have also been involved in the leading working groups and governmental advisory committees: Singapore FinTech Association, Korea FinTech Association, FinTech Club (Hong Kong), PolyFinTech100 (Singapore), Global Partners (Japan), FinTech association (CIS), Finnet Association (CIS). They have comprehensive experience helping central banks and governments to create sustainable foundation for fintech / blockchain opportunities.

In addition, BB Fund embraces blockchain technology not only by means of investments, but through utilizing distributed ledger itself to provide security, transparency and accountability to its investors through BB Fund Platform, built on blockchain: all Fund’s operations are to be recorded in distributed ledger and will be available to LPs’ review in a real-time.

In addition, BB Fund embraces blockchain technology not only by means of investments, but through utilizing distributed ledger itself to provide security, transparency and accountability to its investors through BB Fund Platform, built on blockchain: all Fund’s operations are to be recorded in distributed ledger and will be available to LPs’ review in a real-time.

BB Fund aims to continue facilitating and promoting regulatory changes, support FinTech leaders with their advances into crypto space, drive self-regulation ICO initiatives, boost blockchain implementations on the corporate and governmental levels etc. BB Fund sees its additional mission in delivering structured knowledge, research and analytics, which will help industry to evolve and mature. BB Fund’s parent company Life.SREDA has become a knowledge leader in FinTech and blockchain space, and the same initiatives will be continued by BB Fund regarding the newly emerging Token market. Such activities will allow BB Fund to manage its investment risks and ultimately increase ROI of the entire portfolio.

Founded in 2012, Life.SREDA is one of the first non-corporate FinTech-only VC funds in the world. The company led by Slava Solodkiy and Igor Pesin has 2 funds under management with 25 executed deals and 7 successful exits. It’s portfolio includes: Simple Bank, SumUp, Anthemis, Fidor, Moven, Rocketbank, Lenddo, Ayannah, Allset, Mobikon and others. The gross IRR of the first fund was 32%.

The BB Fund targets to reach even higher IRR due to the blockchain market’s vertiginous growth and fund’s unique access to the most attractive private offerings worldwide with 30-50% premiums versus general market. This goal is ensured by the leadership position of the BB Fund and Life.SREDA and widest fintech and blockchain network on the West and East.

The BB Fund is still open for commitments from strategic investors till 30th of November, 2017.