JD.com: Unprecedented Growth Ahead

By David Krejca for Seeking Alpha

Summary:

JD.com is a rapidly growing Chinese e-commerce business which has underperformed compared to its peers.

This might change soon and the company is expected to turn profitable this year and trades at an extremely low price-to-sales multiple.

My valuation model suggests that JD’s shares could appreciate by as much as 70 percent annually over the next three years.

Investment thesis

Year to date, shares of Chinese e-commerce giant JD.com (JD) have rallied by more than 50 percent. Despite this extraordinary growth, the company significantly lags behind its peers such as Alibaba (BABA), whose market cap more than doubled since the beginning of the year. As JD’s business has improved considerably over the last few quarters and the company trades at a far lower price-to-sales multiple, I believe JD’s shares currently present an outstanding entry point for all long-term growth investors.

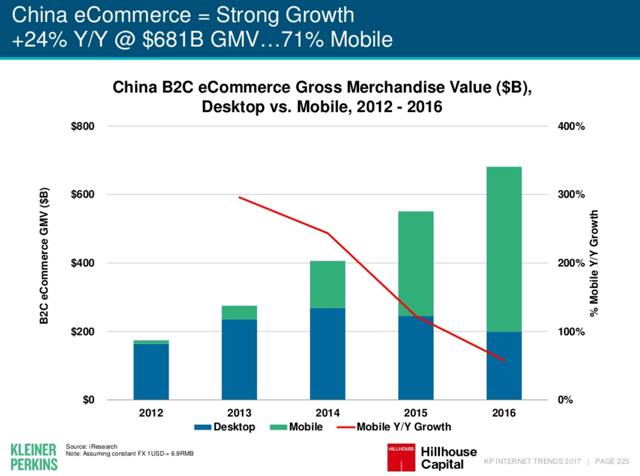

Chinese e-commerce industry strong

According to Mary Meeker’s 2017 internet trends report, the Chinese e-commerce market is still growing at an exceptional pace. Last year, B2C e-commerce gross merchandise volume increased to $682 billion, up 24 percent year on year. Mobile accounted for almost three quarters of the cumulative amount, which is in stark contrast to the US where mobile e-commerce was only a fifth of the total.

Source: Medium.com

Growing faster than Amazon and Alibaba

In terms of GMV (gross merchandise volume), a key online retailing metric for accessing total sales dollar value for merchandise sold through a particular marketplace over a certain time frame, JD.com is growing at even a faster pace than Amazon (AMZN) and Alibaba (BABA). Although definitions of GMV among these companies may differ, analysts forecast this key metric in 2017 for the peer group companies to rise 47, 30 and 30 percent, respectively.

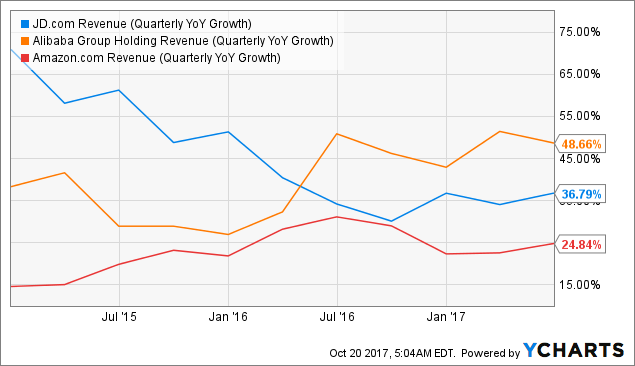

Turning into profit

Even though JD’s top line growth has slowed in recent years, the company is expected to turn the bottom line into the black. Last year, the company recorded a loss of 3.8 billion CNY. This year, however, analysts are expecting on average the company’s net profit to reach a little over 4 billion CNY. Looking at the revenue growth comparison within the peer group, JD’s revenue slowdown also shows signs of credible stabilization.

Extremely low Price-to-Sales multiple

From a relative valuation perspective, JD is trading with an extremely low price-to-sales multiple. Despite a slight increase over the last year, JD’s price-to-sales ratio is still almost three times lower than Amazon’s price-to-sales ratio and about fifteen times lower than that of Alibaba. This represents a significant valuation discount.

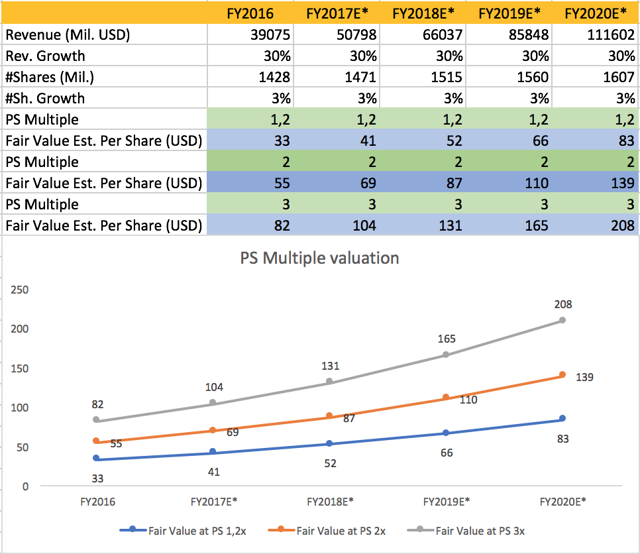

Valuation

Using the revenue variation of popular Peter Lynch’s earnings line for the projection of intrinsic per share values of the company, I see JD’s upside potential as very compelling. According to my model, assuming 30 percent annual revenue growth, 3 percent annual growth in the number of shares outstanding and an unchanged current trailing 12-month price-sales (P/S) ratio of 1.2x, the company’s intrinsic value by the end of 2020 could reach $83. Should the price-to-sales multiple rise to 2x or even 3x, the company’s intrinsic value, according to my model, could lie anywhere within the range of $139 and $208. With respect to the current share price, this implies an annualized rate of return potential of at least 28 percent in the following years.

The bottom line

To sum up, JD currently appears to be a remarkably underappreciated company. Not only do many Chinese citizens still lack access to the internet and therefore do not participate in the rapidly growing e-commerce market but the company also looks very attractive in comparison with its peers. Clearly, JD is at the very beginning of its business lifecycle and hence offers a rare long-term investment opportunity.

Author’s note: To bring similar articles to your attention, please consider subscription of my SA feed by clicking on the ”Follow” button at the top of this page.

Disclaimer: Please note that this article has an informative purpose, expresses its author’s opinion and do not constitute investment recommendation or advice. The author does not know individual investors’ circumstances, portfolio constraints, etc. Readers are expected to do their own analysis prior to making any investment decisions.

Disclosure: I am/we are long JD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.