Japan and blockchain tech are a match made in heaven

By Jack Ellis for Tech in Asia

Blockchain is about a whole lot more than cryptocurrencies. But it was inevitable that digital tokens would dominate a discussion at Tech in Asia Tokyo 2017 on the impact that blockchain tech is having on Japan’s financial services industry.

It makes sense. While blockchain is seen to have significant potential applications across a wide variety of contexts – and not just within finance – bitcoin and other cryptocurrencies have been the most tangible encounter with the technology for most people.

And Japan is one country that has shown particular enthusiasm for this new paradigm. The government in Tokyo passed a law recognizing bitcoin as legal tender back in April; while just last week, regulators in the country endorsed 11 companies to operate cryptocurrency exchanges.

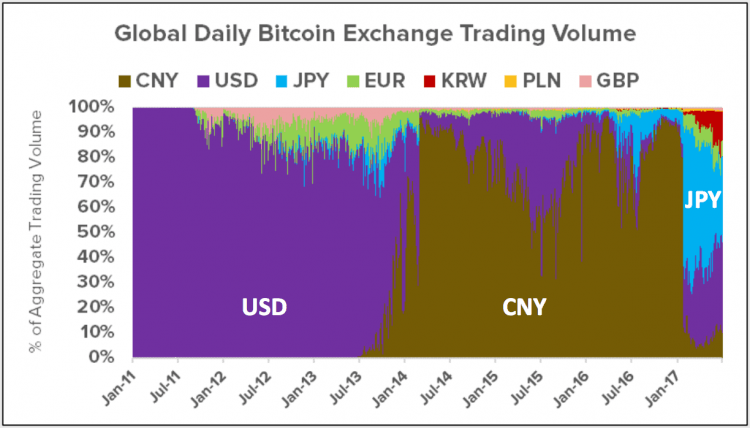

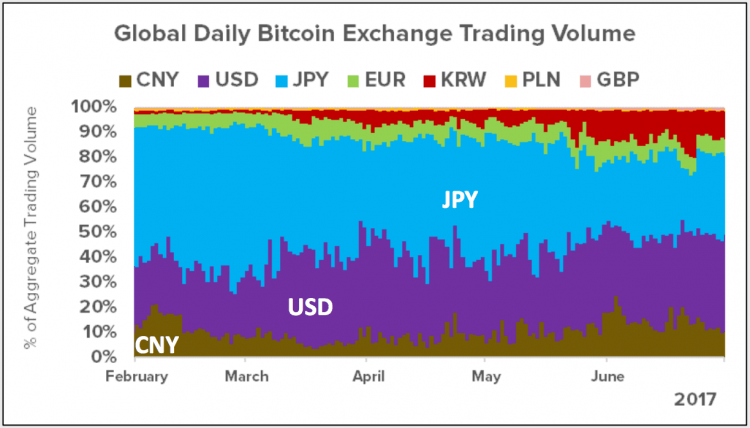

Speaking on stage at Tech in Asia Tokyo 2017, Mio Takaoka, partner at Hong Kong-based VC firm Arbor Ventures, pointed out that the volume of bitcoin being exchanged with Japanese yen has skyrocketed in recent months – presumably as a result of this high-level acceptance, in part at least. This trend is highlighted by research from Coindesk, indicating that Japanese buyers are becoming increasingly active on the cryptocurrency markets.

Worldwide bitcoin trading volume, January 2011-January 2017. Image credit: ‘State of Blockchain – Q2 2017,’ Coindesk.

Worldwide bitcoin trading volume, February-July 2017. Image credit: ‘State of Blockchain – Q2 2017,’ Coindesk.

More than money

Joining Takaoka on stage, Tatsuto Fujii, principal analyst at Mitsubishi UFJ Financial Group, suggested the broader potential of cryptocurrencies and the blockchain tech that underpins them could serve to boost Japan’s economy. In fact, the country’s financial services industry is trying to shift terminology in order to encourage greater adoption.

“Rather than calling it ‘cryptocurrency,’ we call it ‘digital currency,’” he explained. “We think that can open up a door to new ways of thinking about payments, and additional ways to use these digital coins.”

Tatsuto Fujii, principal analyst at Mitsubishi UFJ Financial Group, on stage at Tech in Asia Tokyo 2017. Photo credit: Michael Holmes Photo / Tech in Asia.

All speakers on stage were in agreement that the number of Japanese buying and trading cryptocurrencies was only likely to rise. One positive result of this would be greater willingness to use blockchain in settings outside of cryptocurrencies, such as banking and public services.

You never know when you’re in bubble.

The secure-by-design technology could be used to create a nationwide digital identity system for Japan along the lines of India’s Aadhaar, said panelist Yuzo Kano, founder and CEO at cryptocurrency exchange operator bitFlyer. “So for instance, when you need to move house from one place to another, you need to go to a local government office to change your address, change your details with all the utility companies, and so on,” he said. “But a central system means this can be done almost at once… Japan is quite behind in this field I think. But blockchain can make it easier.”

In the financial sphere, banks and other service providers face other obstacles to adoption. Outsiders who have visited Japan often remark on the continued use of “old-school” technology there, that has largely disappeared elsewhere in the developed world – from the persistent popularity of fax machines, to gigantic ATMs that accept passbooks and coins, but not foreign plastic. Cheques likewise remain in widespread use. “How do you get that on the blockchain?” said Fujii. “A check is usually paper – but it can be done… without damaging the culture of paying by check in Japan, we can preserve it by digitalizing it.”

The ‘B’-word

Earlier this month, JP Morgan CEO Jamie Dimon described bitcoin as a fraud “worse than tulip bulbs.” He was referring to the infamous 17th century “tulipmania” bubble in the Netherlands, which saw prices for the plant bulbs reach extraordinary highs before catastrophically collapsing – leaving many investors broke.

Yuzo Kano, founder and CEO at bitFlyer, on stage at Tech in Asia Tokyo 2017. Photo credit: Michael Holmes Photo / Tech in Asia.

It isn’t the first time that “the B-word” has been used to describe the cryptocurrency boom. Amid Japan’s growing enthusiasm for all things blockchain, Kano offered caution to would-be virtual currency prospectors. But he said that the bubble talk alone should not necessarily put them off investing in tokens – and stressed the distinction between cryptocurrency trading, and the wider world of blockchain technology.

“You never know when you’re in bubble. In the 1980s, Japan was in a massive bubble – but we didn’t realize until it burst,” he said, in reference to the massive inflation of stock and real estate prices in the country that resulted in the economic downturn of the “Lost Decade” during the 1990s and 2000s. But he added that, unlike tulips, blockchain technology is useful in a potentially massive number of context because it allows unmatched security. “So you cannot really say blockchain is the same as the tulip bubble.”