Blockchain Startups VCs Should Invest In

By Ali Tahmaseb for his blog. Entrepreneur in silicon valley — founder @ blocks. TEDx Speaker. Featured in BBC, Forbes, Guardian. Algorithmic trader of stocks as hobby.

Recently I did some research on blockchain, the science behind it, the applications of blockchain in the financial sector as well as other sectors. I then identified the different types of startups that can be formed (or are formed) based on blockchain in the infrastructure level, application level and ecosystem level. I published my findings here.

My main conclusion from the research and my thesis is that many large companies will use blockchain as a way of record keeping. However, I think if using blockchain is the only differentiating factor of a start-up from a large existing company, that startup does not stand a chance. Therefore my thesis is that infrastructure level startups who provide the back-end and APIs to enable larger existing companies to use blockchain will have a higher chance of success compared to application level start-ups.

There is however one category of start-ups in the application layer that I think has a chance of hitting it big, which is the companies which increase and maintain trust between two parties (consumer or enterprise) by removing the third party and employing “smart contracts”. Smart Contracts are self-executing contracts where the money and service will automatically get exchanged through blockchain without a third party.

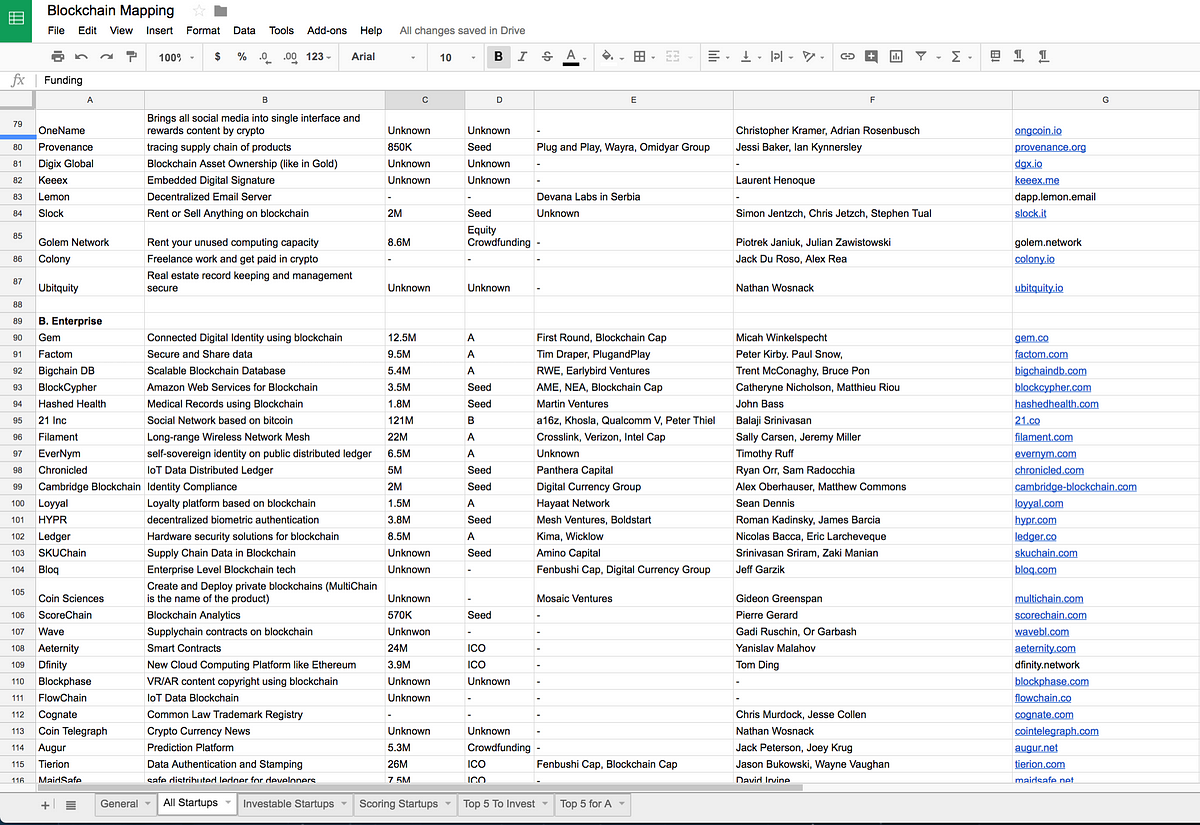

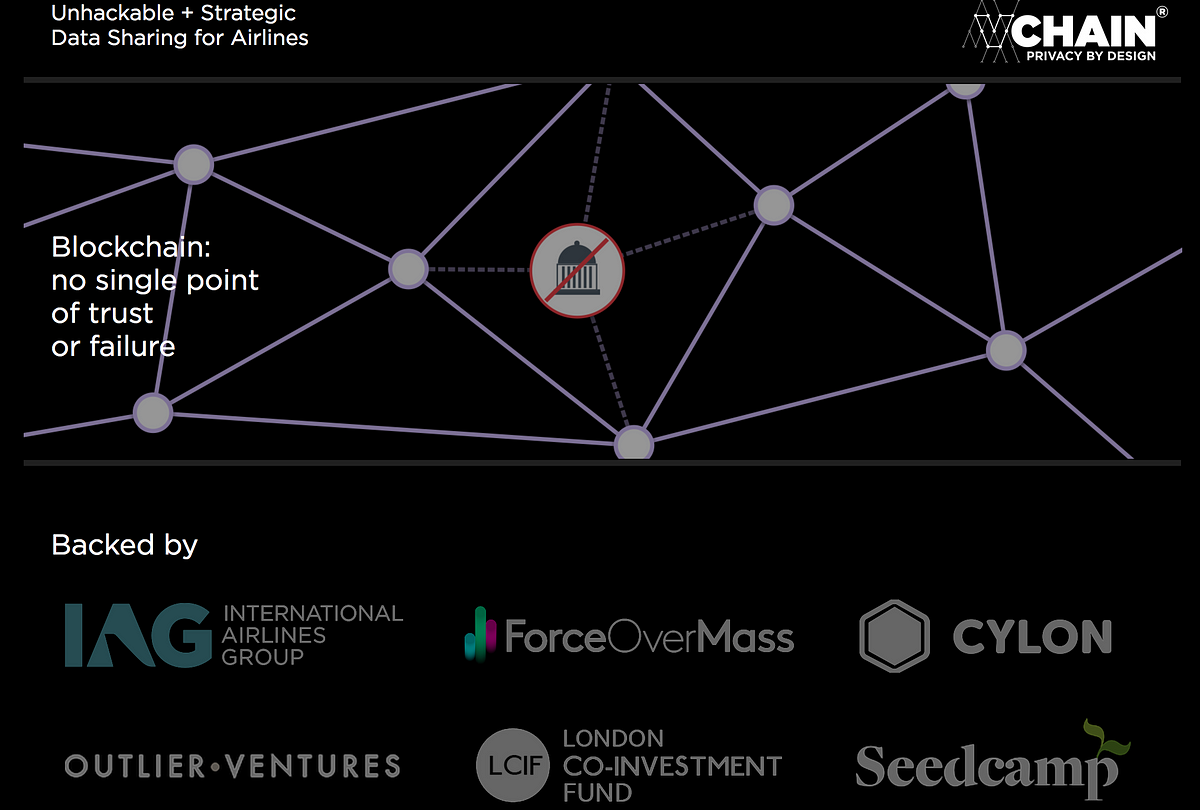

I went through many articles about blockchain based companies that I could find online. I only put down the ones that were for-profit (vs. non-profits), start-up (not a project from a big company), not acquired, and active. This gave me over 120 startups to work on. I made a database including their function, funding round, funding amount, current investors, founders, and web page. I categorized them into Financial Services and Non-Financial Services and for each category made consumer and enterprise subcategories.

Then I aimed to find the ones that a VC fund could invest in. I filtered out the ones the were based out of US or UK, filtered out the ones that had previously raised more than $50M (which probably meant very high capital requirement for the next funding round), and removed the ones that had fundraised through ICO or equity crowdfunding (crazy cap-table and probably they wouldn’t want VC funding).

Then for these filtered startups, I scored them based on 10 criteria:

1- Customers have a real problem? (They really need it solved)

2- Many people have this problem? (Market Size)

3- Product Solves the Problem very well? (Product Market Fit)

4- High Barrier to Entry? (Defensibility)

5- Can make money? (Business Model)

6- Timing (Why Now?)

7- How much traction they got? (press, partners, client, etc.)

8- Healthy competition? (enough competition, but not a giant competitor)

9- Team? (they are relevant to the problem? have prior startup experience?)

10- Who are the current investors? (smart money? strategic partners?)

Based on the above criteria, I selected the top investment opportunities for each stage of investment.

Top Startups For Seed Investment

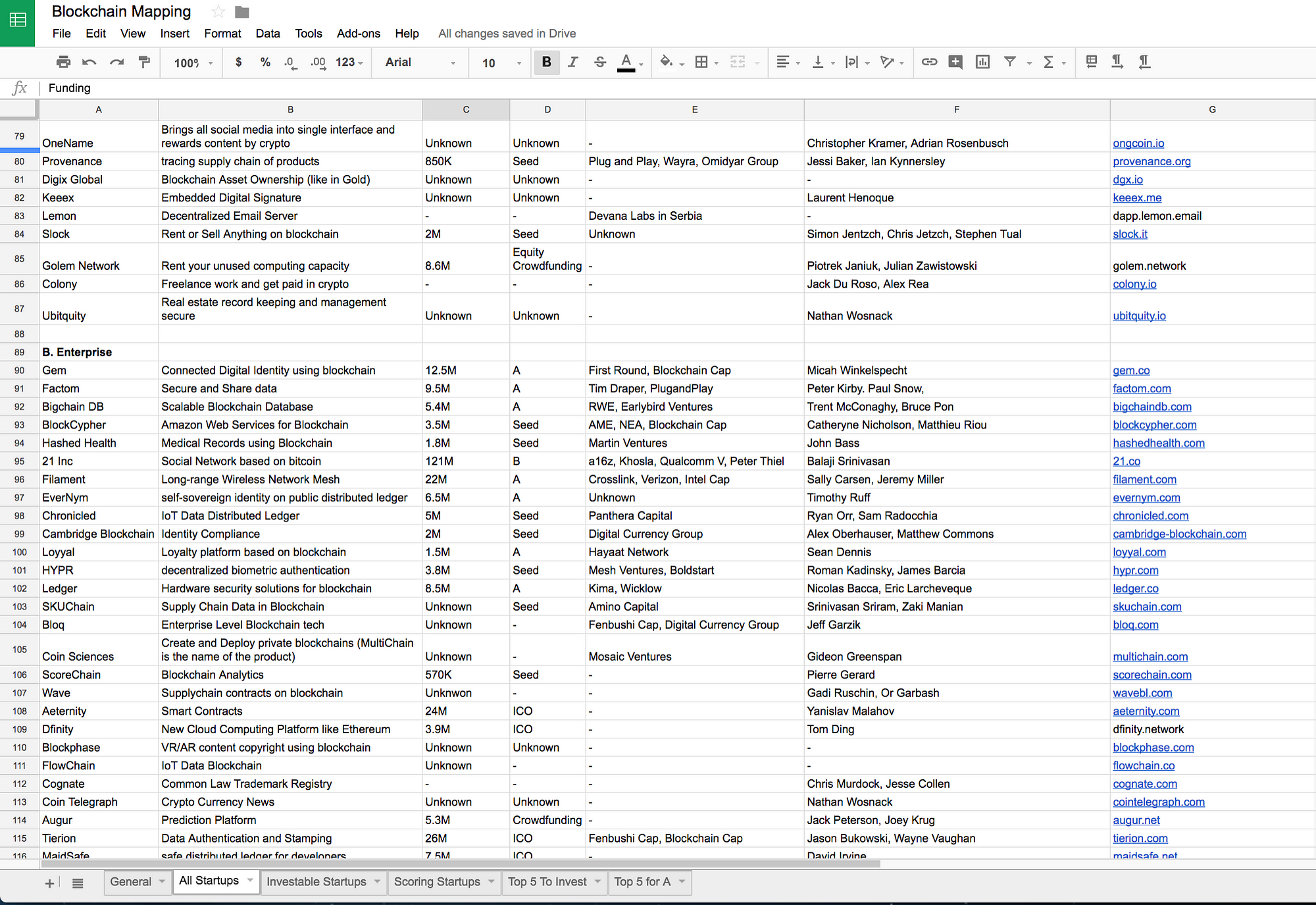

First: Upgraded

What?

UPGRADED converts traditional event tickets into secure digital assets that are protected by cryptographic public/private keys and deploys these assets onto an Ethereum Blockchain. By creating an open ledger similar to Bitcoin, buyers and sellers can operate with complete trust. By structuring these tickets as “smart contracts”, they can each act as a self-contained escrow system while simultaneously allowing teams and artists greater control over the ticket after initial sale. These tickets work with existing entry systems while delivering digital encryption, enforceable sales restrictions, stored value capabilities, loyalty data, and other dynamic elements that turn a ticket into a “smart ticket”.

Where?

Walnut Creek, CA

Why?

Ticketing is a large industry, and the main thing the ticket sales websites do is to maintain trust between the buyer and seller.

Team?

Founder: Initially in Microsoft, Intel, and BCG and then founded a couple of startups with some level of success.

Investors on Board?

Unknown angel investors

Total funding and last round?

$300K angel round in January 2017.

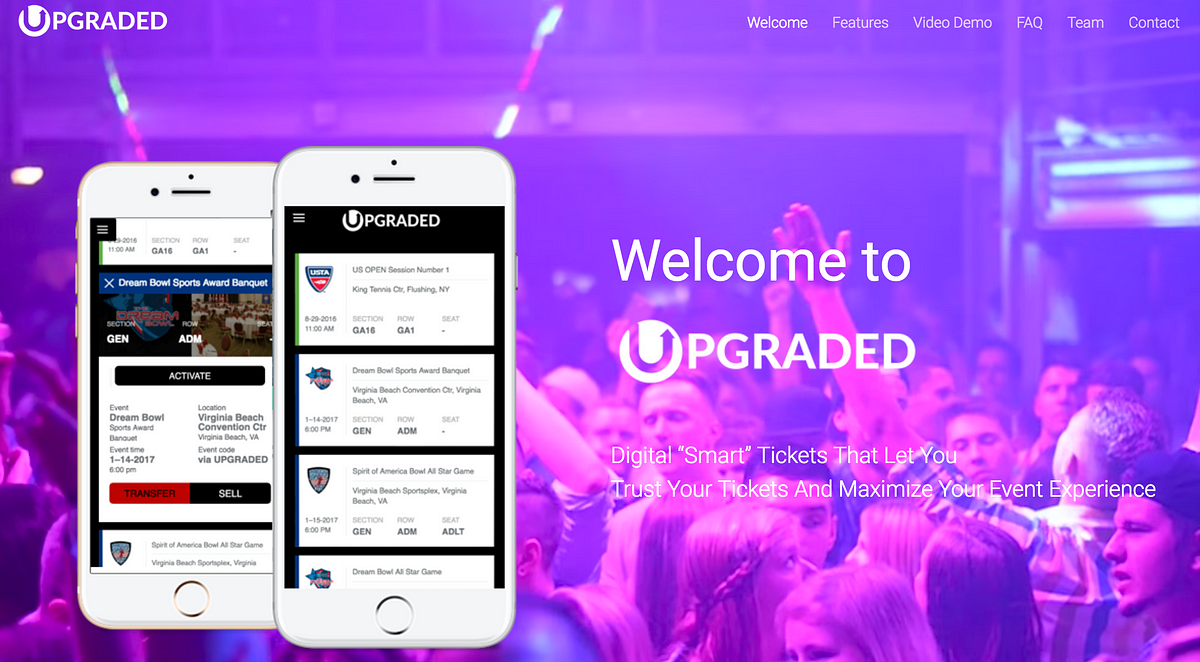

Second: VChain Technology

What?

VChain Technology offers a SaaS verification solution for strategic data sharing, using it’s own proprietary tech and a patented blockchain back-end. It provides services for airlines and passport control services.

Where?

London, UK

Why?

Without changing the ownership of data, companies can share critical data through blockchain.

Team?

Founder 1: CPO and CTO in multiple start-ups

Founder 2: Founded one startup before and worked at Goldman Sachs

Investors on Board?

Angel investors including International Airlines Group

Total funding and last round?

$900K angel round April 2017.

Third: Factury

What?

Factury is a SaaS-based investment management platform that aims to modernize processes in capital acquisition, loan securitization, and secondary loan markets. The platform utilizes distributed ledger technology to reinvent and diversify investment possibilities in credit products originated by non-bank lenders. Institutional investors can achieve portfolio diversity this way along with adjusted risk return products.

Where?

San Mateo, CA

Why?

Very specialized product which is traditionally controlled by small number of players and has a high cost.

Team?

Founder 1: Worked as SVP in other company, young, talented and active in the startup scene.

Founder 2: Oxford MBA, VC firm, board member of a real estate company.

Investors on Board?

Startup Bootcamp New York

Total funding and last round?

Angel round, Unknown.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Top Startups For Series A Investment

First: BlockCypher

What?

BlockCypher is like Amazon Web Services for Blockchain companies. They are a cloud-optimized platform powering blockchain applications reliably and at-scale. BlockCypher’s web services are blockchain agnostic and greatly

reduce the complexity of building applications that run on multiple blockchains. Easily build, run and future proof blockchain applications on BlockCypher’s infrastructure.

Where?

Redwood City, CA

Why?

It’s a super easy to use set of services and APIs that enable any blockchain based company. It will serve a large market and can have a profitable business model similar to AWS. Although it faces competition from Amazon AWS, Microsoft Azure, and IBM, it has been able to attract many companies, including Deloitte, Abra, coinbase, Xapo, etc. as their client.

Team?

Founder 1: Stanford Grad — US Navy Officer — Worked in 3 companies in silicon valley — Joined Oracle — independent consultant for 3 years — Worked for a startup, then worked for PG&E — Then founded a startup for 3

years.

Founder 2: Developer for many companies including BNP Paribas and an asset management company. Was colleague of the first founder in 3 companies and co-founded a company together before this.

Investors on Board?

AME Cloud Ventures, NEA, Blockchain Capital, Foundation Capital, Boost VC, 500 Startups

Total funding and last round?

$3.5 total and latest was seed round on January 2015.

Second: HashRabbit

What?

HashRabbit provides an enterprise-grade operating system for blockchains. They enable companies and institutions to directly participate in the blockchain at the lowest settlement layer. This layer is built on hashing

servers, which validate all transactions made through a globally distributed database. Their operating system allows customers to take advantage of this by being able to maintain their own hashing servers and facilities

remotely. Very low level.

Where?

San Mateo, CA

Why?

Infrastructure level companies are essential at this stage of blockchain. When using blockchain for billions of dollars of transactions or petabytes of data management, any low level changes to optimize, can save millions of

dollars, save time, and increase efficiency

Team?

Founder 1: Worked at Apple, founded two companies, and then freelancer

Founder 2: Developer for 4 startups and technical cofounder for one

Investors on Board?

VTF Capital, Draper Associates

Total funding and last round?

Total $2.3M and last round was August 2016.

Third: Hijro

What?

Hijro connects banks, buyers, and suppliers across one network designed to streamline and automate settlement, reduce fraud risk, and break down costly data silo’s in the $4 trillion open-account trade market. Built on distributed ledger technology, the Hijro Network acts as a global “fabric” for trade, providing partners and network participants with a much smarter, more secure, and more efficient way to move value and assets around the world

remotely. Very low level.

Where?

New York, NY

Why?

As I mentioned above, one of the main use cases of blockchain is removing the third party. Hijro is maintaining trust and removing the third parties by implementing smart contracts and streamlining payments between parties.

Team?

Founder: founded a number of small businesses. Hustler and small business experience.

Investors on Board?

ff, Thomson Reuters, Draper Associates

Total funding and last round?

$2.5M total and latest round was in May 2016.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Top Startups for Series B Investment

First: BitGo

What?

The company offers an enterprise-grade, multi-signature, multi-user Bitcoin wallet, as well as API access to its underlying security platform

Where?

Palo Alto, CA

Why?

It empowers businesses to integrate cryptocurrency payments in their normal operations without hassle. Many businesses are looking into integrating cryptocurrencies now.

Team?

Founder: Worked at one startup, and worked at Google, Microsoft

Investors on Board?

Redpoint, FoundersFund, Blockchain Capital

Total Funding and when?

They have had a total of $12M in funding and their series A was in September 2014.

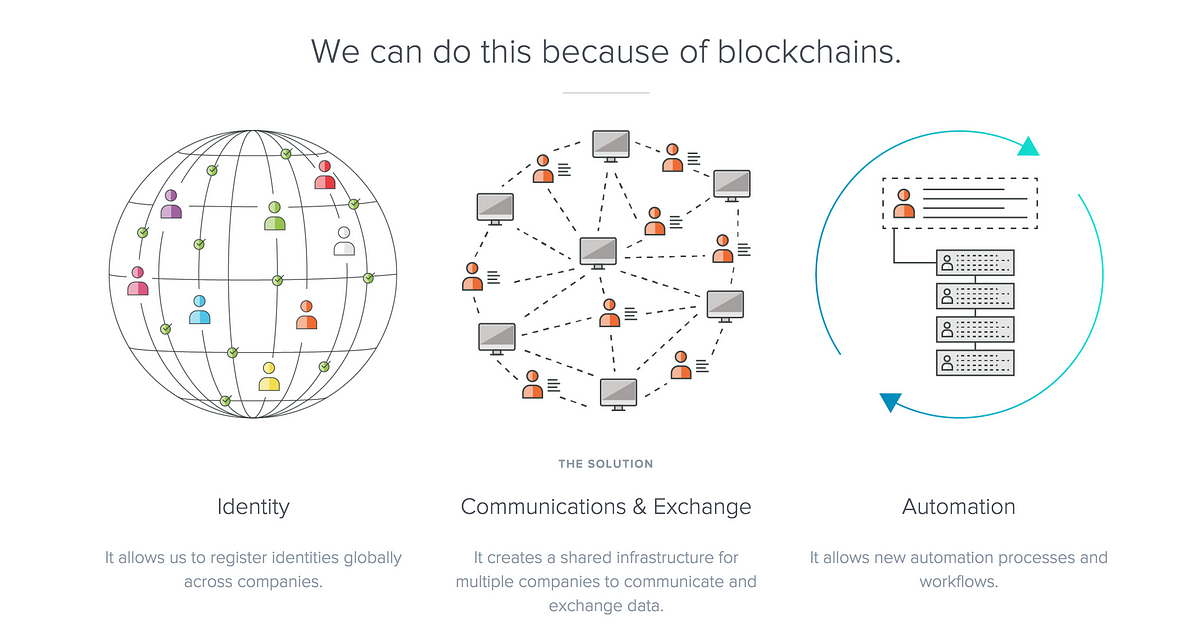

Second: Gem

What?

Gem’s platform applies blockchain technology to identity, data, logic and network management across multiple industries including finance and healthcare. The result is GemOS, an operating system for global computers.

Where?

Venice, CA

Why?

Gem’s blockchain application platform transforms how companies connect to solve industry wide problems. By connecting companies to shared infrastructure, industries can eliminate data silos and orchestrate cross-industry workflows

Team?

Founder: has over 10 years of experience in various roles from founder, consultant, CTO, and developer.

Investors on Board?

First Round Capital, Blockchain Capital

Total Funding and when?

They have had a total of $12.5M in funding and their series A was in January 2016.

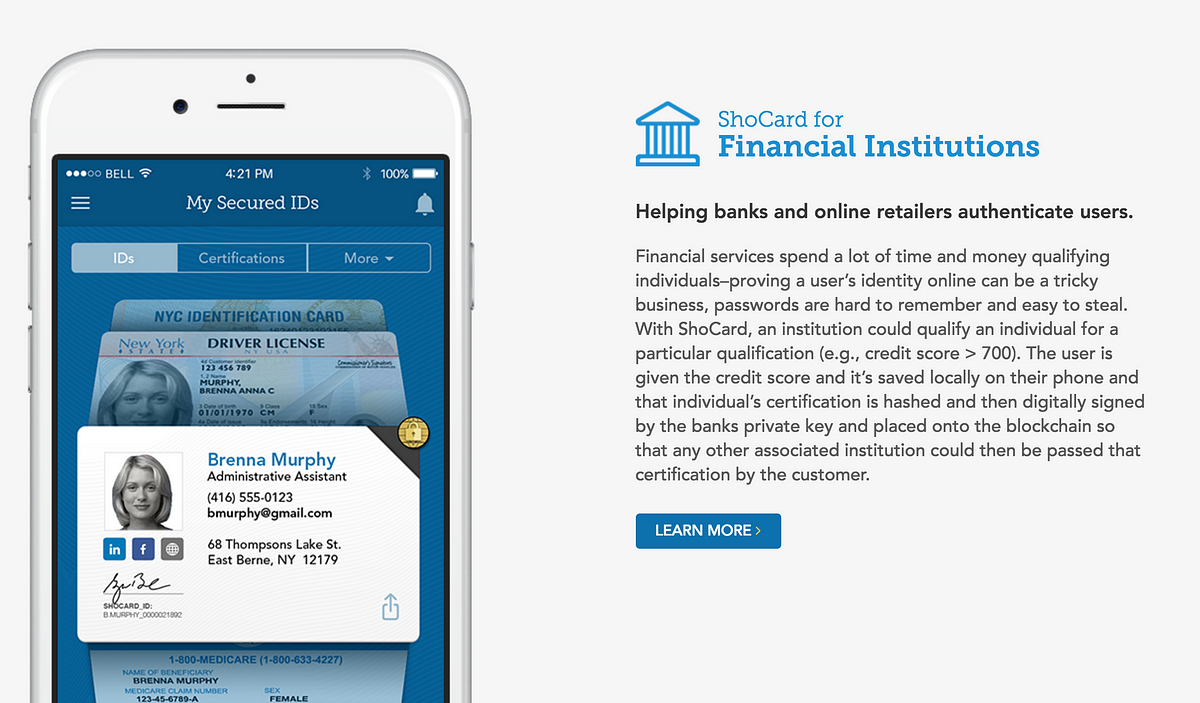

Third: ShoCard

What?

Digital identity authentication using blockchain. It’s the one identity verification system that works the way consumers and businesses need it to for security, privacy, and always-on fraud protection.

Where?

Palo Alto, CA

Why?

Identity authentication is growing to be a larger and large problem as we are shifting more tasks online and mobile. Blockchain can help authenticate the identity without sharing your data with a 3rd party company.

Team?

Founder: CEO of advertising.com and buysight.com in dot com era and a senior VP at Yahoo.

Investors on Board?

AME Cloud Ventures

Total Funding and when?

They have had a total of $5.5M in funding and their series A was in August 2017.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Top Startups for Series C Investment (with total funding <$15M)

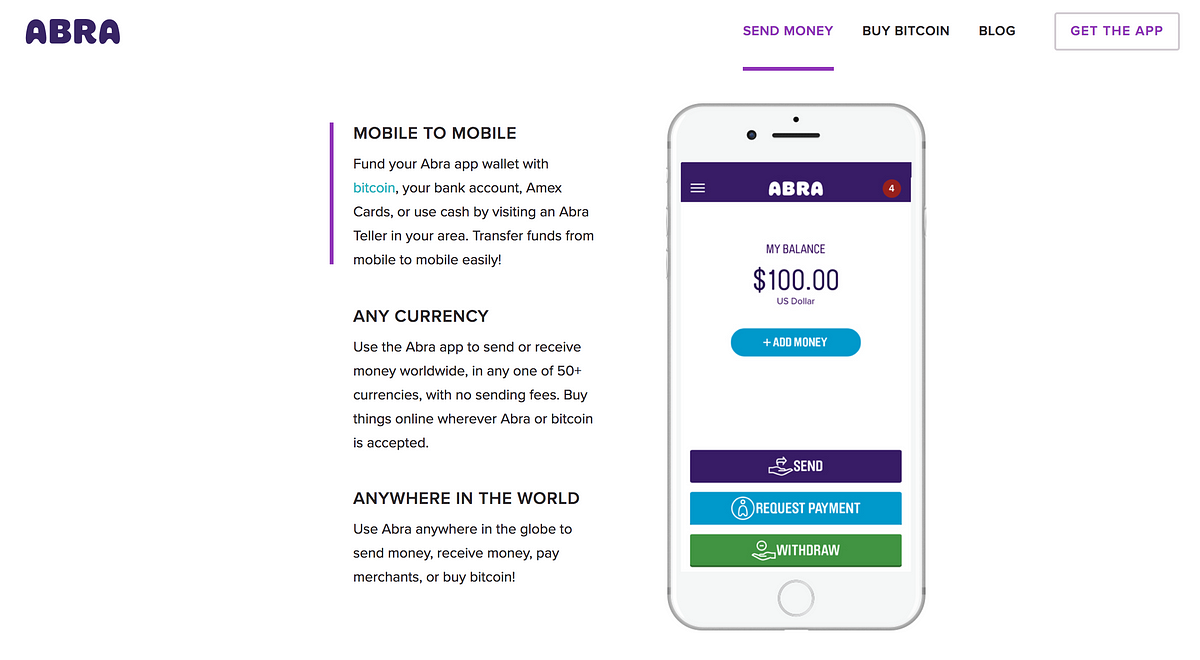

First: Abra

What?

Abra is the world’s first peer-to-peer money transfer network. Abra uses bitcoin and blockchain technology to enable users to transact in over 50 currencies, including bitcoin. Abra Tellers represent a global, shared network of consumers helping each other easily deposit and withdraw cash from the Abra app anywhere in the world.

Where?

Mountain View, CA

Why?

Companies like Venmo, Paypal, TransferWise, etc. still either charge a fee (although small) or have to spend some money for each transaction. One of the best features of bitcoin is the free transfer.

Team?

Founder 1: Founded several successful companies and board member in some other companies

Founder 2: Great experience and senior business development positons

Investors on Board?

First Round, RRE, AMEX, Blockchain Capital

Total Funding and when?

They have had a total of $14M in funding and their series B was in January 2017.

Second: LedgerX

What?

LedgerX is an institutional trading and clearing platform that has received approval from the U.S. Commodity Futures Trading Commission (CFTC) to trade and clear options on bitcoin. LedgerX is registered with the CFTC as a swap execution facility (SEF) and derivatives clearing organization (DCO).

Where?

New York, NY

Why?

LedgerX is the first federally regulated bitcoin options exchange and clearing house to list and clear fully-collateralized, physically-settled bitcoin options for the institutional market.

Team?

The LedgerX management team comprises Goldman Sachs, MIT and CFTC alumni, who bring financial expertise, technical talent and regulatory experience to the firm.

Investors on Board?

Lightspeed, Google Ventures, FundersClub

Total Funding and when?

They have had a total of $12.9M in funding and their series B was in May 2017.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Top Startups for Growth Equity Investment (with total funding between $15M and $50M)

First: Chain

What?

Chain is a blockchain technology company that partners with financial firms to build and deploy blockchain networks which transform markets. Its solutions enable institutions to design, deploy, and operate blockchain networks that can power any type of asset in any market. The company offers Chain Open Standard, an open-source blockchain protocol for high-scale financial applications. It includes Chain Core, an enterprise-grade production node; and Chain Sandbox, a prototyping environment.

Where?

San Francisco, CA

Why?

Chain has got great traction and maintains strategic partnerships with financial services firms such as NASDAQ, Visa, Citi, Capital One, and Fiserv.

Team?

Founder 1: Harvard MBA, BCG, VC Partner

Founder 2: Second time entrepreneur

Investors on Board?

Khosla, RRE, Citi

Total Funding and when?

They have had a total of $43.7M in funding and their series C was in September 2015.

Second: Veem (Formerly Align Commerce)

What?

Veem is a global payment company that offers solutions enabling small businesses to send and receive payments in local currency. Using blockchain as a payment rail, the company eliminates the need for intermediary banks therefore reducing costs for small- and medium-sized businesses. The company converts the sender’s funds into bitcoin, selling the digital currency at an exchange for the desired currency of the recipient.

Where?

San Francisco, CA

Why?

Global payments for SMBs is a large market and converting in and back to bitcoin solves this problem.

Team?

Founder 1: Sold previous startup to Western Union

Founder 2: Founder and CTO in multiple startups

Investors on Board?

KPCB, GV, SVB

Total Funding and when?

They have had a total of $44.25M in funding and their series B was in March 2017

Third: Xapo

What?

Xapo combines the convenience of an everyday bitcoin wallet with the security of a deep cold storage vault.

Where?

San Francisco, CA

Why?

It’s one of the most used wallets

Team?

Founder 1: Founder of various successful startups. Board member of PayPal

Investors on Board?

Greylock, Index, AME Cloud Ventures

Total Funding and when?

They have had a total of $40M in funding and their last round was in July 2014

Please note that the above are the top startups I think are good investments due to their size, location, team, market, latest funding round, current investors, traction, and various other criteria, such as total current funding being less than $50M, and them being located either in the US or UK that I have mentioned in the beginning of this article.

If I am not to consider those factors and just state the blockchain companies I like regardless of if they are a good investment these are my favorites.

NeuFund — VCs to invest in startups using blockchain and cryptocurrency. Why? Truly puts the smart contract and cryptocurrency together and utilizes blockchain and saves costs.

Brave — A new web browser to micro compensate content publisher. Why? Digital content publishing is most often not compensated. Cryptocurrency and blockchain help easily transfer money from who uses the content to the main original content producer. This can be done very fundamentally, using a new web browser

BitMark — Digital Intellectual Property Ownership. Why? Same reason above, this is a different solution.

I hope this article was useful for VCs and other professionals looking into blockchain companies. If you are a VC, feel free to get in touch through LinkedIn and I can share the mapping file.