Mobile banking outfit Chime raises $18m

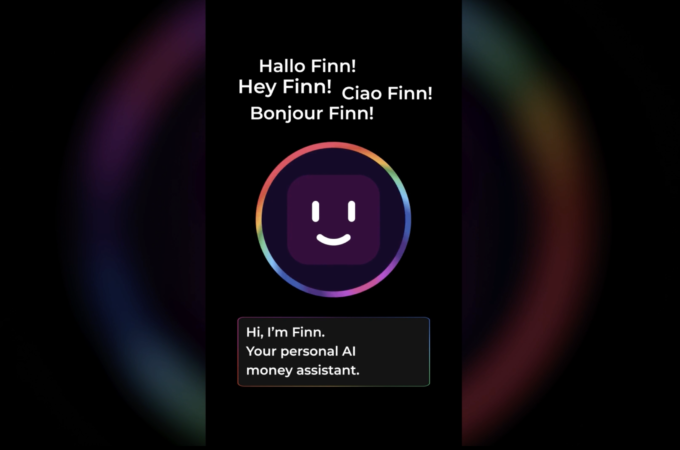

Chime, the leader in mobile banking that helps members avoid fees and automate their finances, today announces $18 million in Series B financing, led by global venture fund Cathay Innovation.

With over 500,000 bank accounts opened since the company’s 2014 launch, this latest round of financing will be used to accelerate growth and to develop new products to improve financial lives.

“At Cathay, we look at fintech investment opportunities across the globe and we’ve never seen so much customer love for a banking service,” said Denis Barrier, Co-Founder and CEO of Cathay Innovation. “Chime members engage with the app every day and trust Chime as the deposit account for their paycheck. It’s much more than just a mobile app. With triple digit growth in new bank account openings in the last year, Chime has emerged as the clear leader in the US challenger banking segment.”

Cathay Innovation led the round from its $320 million venture fund and offers a global investment network bridging North America, Europe and China. Other new investors in the round include Northwestern Mutual Future Ventures and Omidyar Network which invested through their Financial Inclusion initiative. Existing investors Crosslink Capital, Aspect Ventures, Forerunner Ventures and Homebrew also participated in the round bringing Chime’s total funding to $36MM.

“Look at any of the headlines these days and it’s clear that traditional US banks continue to fail millions of Americans with adversarial practices and opaque fee structures,” said Chris Britt, CEO and Founder of Chime. “This financing allows us to rapidly scale a new approach to mobile banking that actually improves financial lives.”

Chime’s Bank Fee Finder exposed the impact of traditional banks’ predatory practices and found that on average bank customers pay $329 in fees annually. By eliminating overdrafts, Chime has saved its members an estimated $100MM in potential overdraft fees to date. Chime has also helped members increase their savings. While the majority of Americans have less than $500 in savings according to Bankrate, members who enrolled in Chime’s automatic savings program have tripled their average monthly savings.

In addition to investing in growth, the company will use this latest round of funding to launch new features to help members automate more aspects of their financial lives. Chime will also introduce new services through its open APIs and partnerships with leading financial companies, so that members can use their Chime account as a connected hub to manage all of their financial accounts.