Solving the Most Painful Fintech Problem

The Inconspicuous Great Pain of Fintechs and Their Clients: How to Solve It?

According to the Money of the Future research, fintech has been the No. 1 of all venture capital industries for the second year in terms of attracted capital, especially in Asia. However, most of these companies each time face the same problem – KYC and quick customer “landing” during registration.

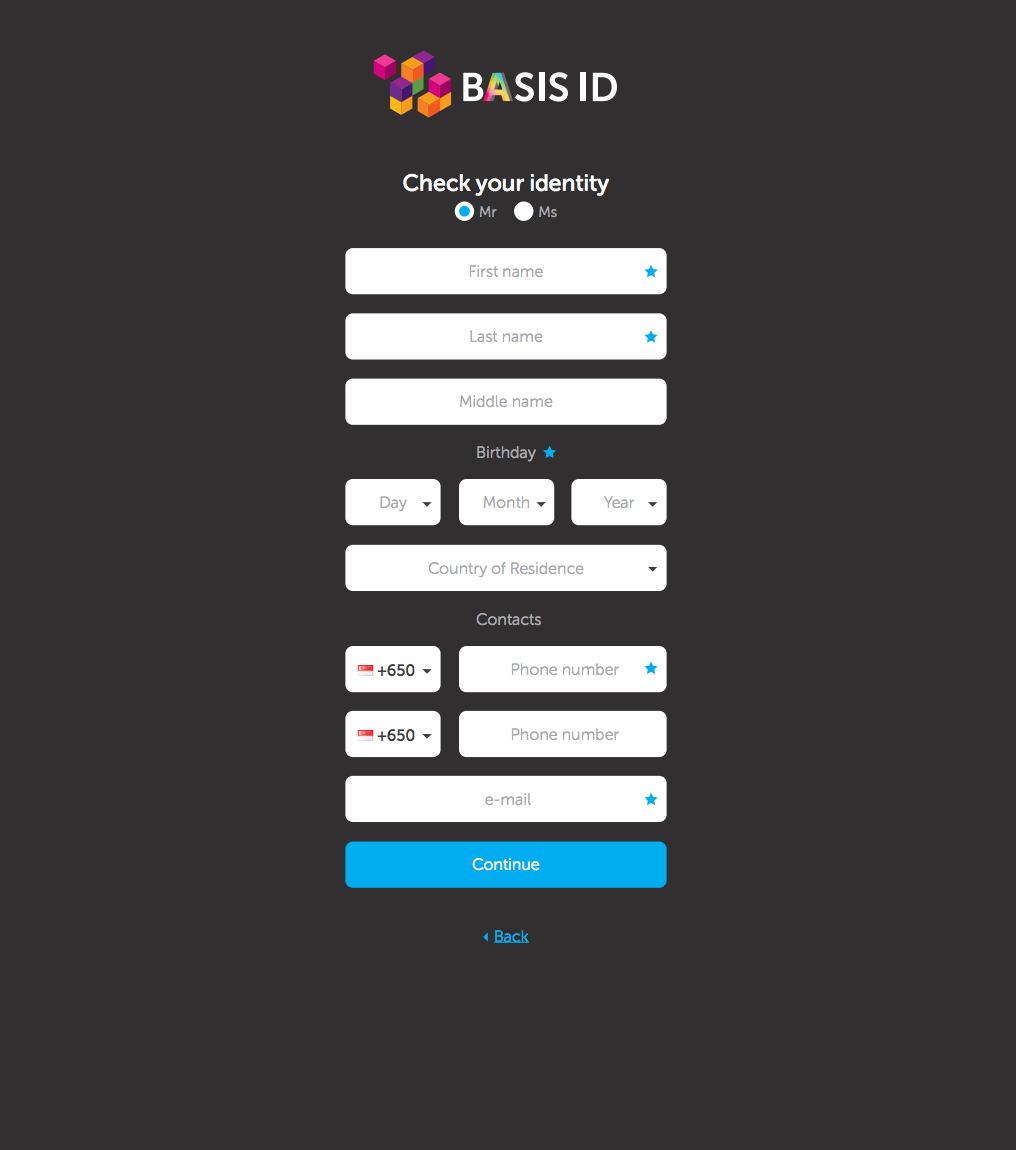

For the major part of financial services, it is not enough just to specify your name, surname and e-mail, in accordance with the legislation, they require a passport and its identification, as well as other personal information. A number of services, for example, Jumio, facilitate quick and cheap passport checks, but often this is not enough because it should be confirmed that this passport was shown by this person, check it against blacklists, as well as verify the phone number. There is no comprehensive solution on the market. As a result, startups ask their clients to visit their offices (which is very inconvenient for customers and most leave the service without even starting to use it), or stop by some partner network (in this case you shift the risk to this partner and share with him your client base), or the startup sends its courier and runs its own compliance service (the cost of verification of each client turns to be from $15 to $30).

Just imagine that not only startups, but also telecoms, messengers, e-commerce giants, taxi applications are moving to fintech and they have millions in their client bases, but also they do not have the proper tools to quickly and painlessly verify such volumes of people!

DataDepot in cooperation with BaaS-platform BAASIS has developed a unique stand-alone product BAASIS ID. This is an online only solution, which can be easily integrated into any website or mobile application, and the customer does not leave your service while passing the entire procedure. All the data is always available online for you and your client. The data is securely protected, stored on blockchain and can only be disclosed to third parties with the permission of your service and the customer.

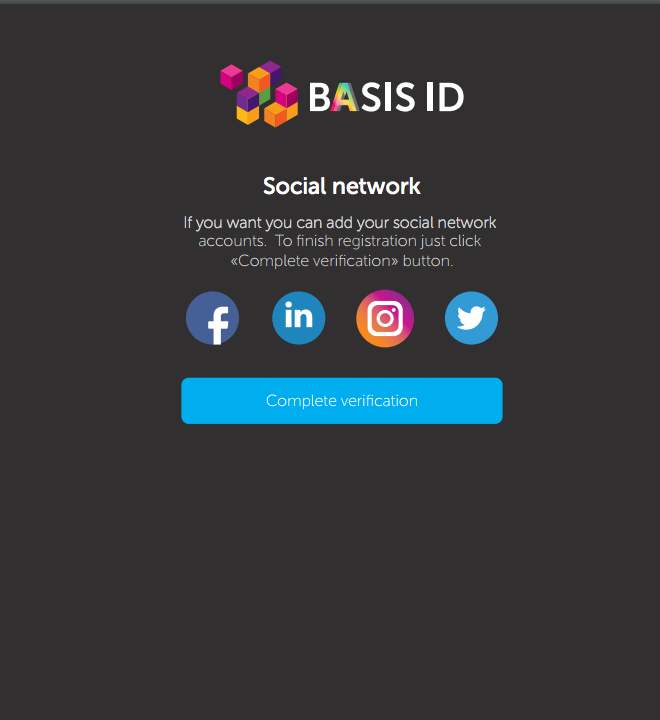

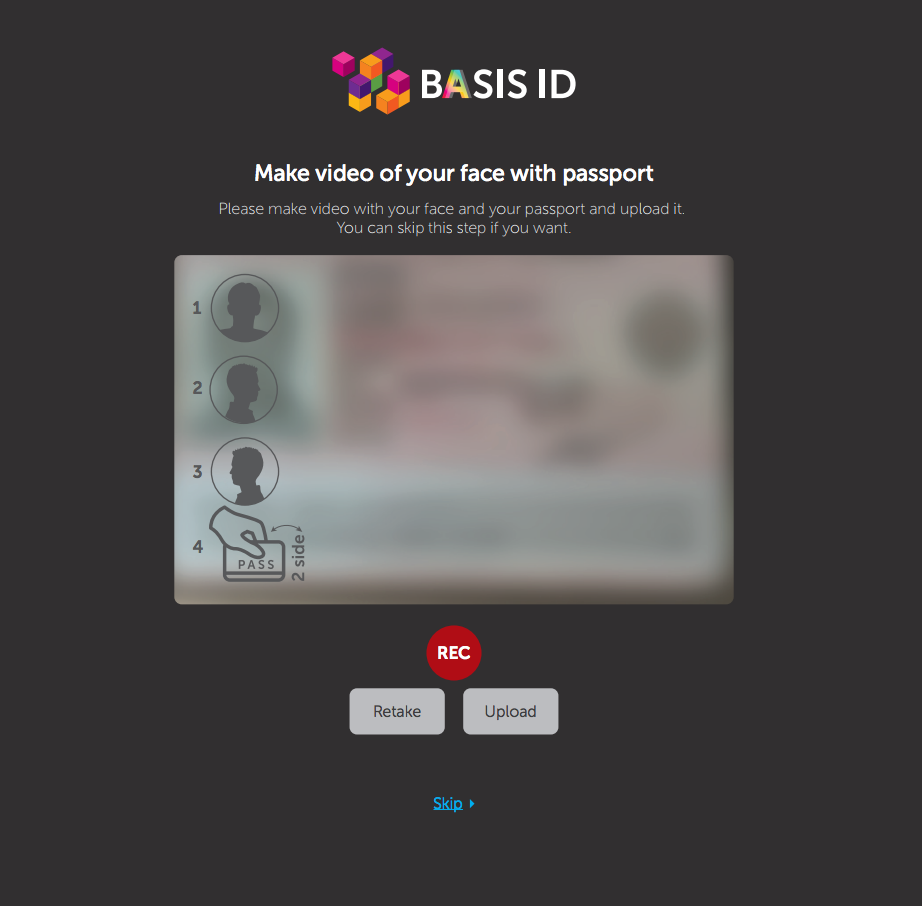

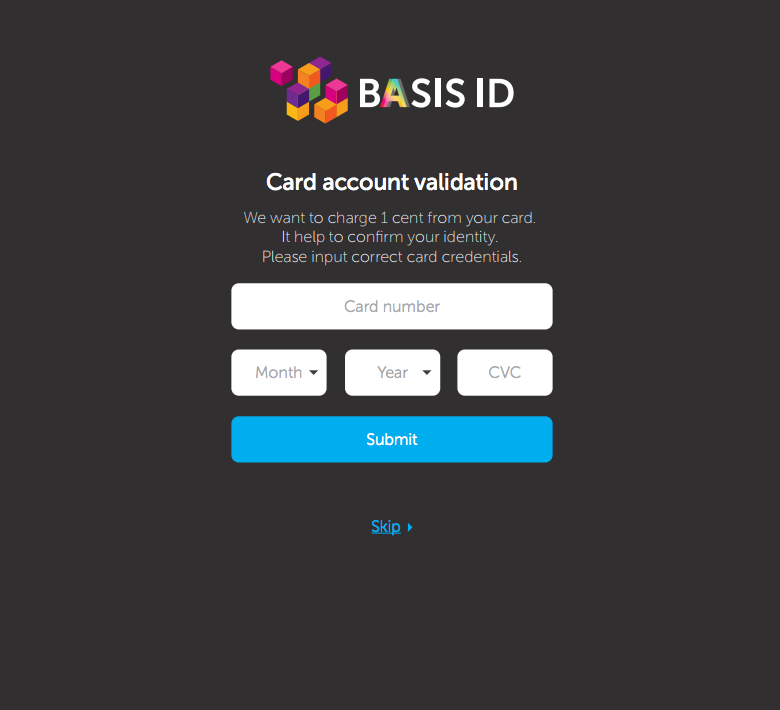

BAASIS ID verifies the first and last name, passport, checks against international blacklists of people involved in money-laundering, criminal or terrorist activity, verifies the mobile number, bank card, residence address, profiles in social networks, and also makes and stores a video record to confirm personal filing, as well to compare the image with a photograph in the passport and social networks. The contract for the transfer, processing, storage, and exchange of this information with your service is signed by an individual with an electronic signature, and this contract is also always available to all participants of this process.

The cost of one verification is several times cheaper compared to the case when you do all the same manually or through partner networks. The online integration compatible with all platforms allows the client to go through all the steps without leaving your service interface, quickly and not wasting time on meetings and commuting. There are no fees for the beginning of the use of the product, monthly subscriptions or advance deposits – you are paying a transparent price for each verification.

DataDepot has filed the entire description of the BAASIS ID process to regulatory authorities of Singapore, as one of the most developed and advanced fintech hubs in the world. No objection has been received from the Monetary Authority of Singapore and the Data Protection Authority of Singapore regarding the implementation and legality of this solution for the market. Most recently the company has filed a similar set of documents to the same regulators in China, Malaysia, Russia, Hong Kong, Australia, Indonesia, …. Within a year the service wants to notify all regulators in the world about how this solution is implemented and get their feedbacks.

BAASIS ID already has the first three international clients for 200,000 verifications in different countries. Details and results of work will be announced separately.