Regulation tech challenges and opportunities

By Igor Pesin, partner at Life.SREDA

Regulation tech has become famous in 2016 and financial services industries and governments are looking eagerly at 2017. Despite the fact that the niche is still a new term to describe companies that address some regulatory challenges across industries, there are already more than 6,000 enterprises at different scale offering compliance, governance, and risk management solutions.

Globally, around $80B is today spent on governance, risk and compliance to meet onerous regulatory demands aimed at fighting financial fraud, creating a niche tech market that is estimated to grow to around $120 billion by 2020. And up to date, the main GRC product offerings are coming from the top 5% players like EMC, IBM, Rsam, Nasdaq and such market structure certainly creates a window for tech incumbents.

Both under-banked and over-banked markets struggle with regulation but for different reasons

Challenges for under-banked: Proper identification of potential clients, performing KYC and Customer Due Diligence for new clients and accessing credit risk of unbanked retail and SME clients.

For example, how one should develop lending business in Indonesia where about half of the population not having proper IDs not any credit history and bank account.

Challenges for over-banked: One centralized / shared ledger of KYC data and IDs, driving down KYC costs and increasing efficiency of the process for clients, real time KYC maintenance for better accessing real risks and AML compliance.

For example, in Singapore the penetration of digital services among those with bank accounts is about 95% and customers have multiple digital and banking identities.

Opportunity for governments to increase efficiency and drive costs down

Governments’ initiatives: Creating digital identities for citizens and making these IDs a vital part of the ecosystem via open APIs and cashless payments.

Biometrical IDs / Digital signatures: Biometrics to allow features like using fingerprints to login to services… or to send money, information or documents using their digital identity.

Open API to access citizens’ data: Open APIs to allow others, including the private sector, to incorporate the digital identity features into their services.

E-payments (linked to digital IDs): The ID could potentially be used to receive and send payments, access internet banking and other services offered by businesses.

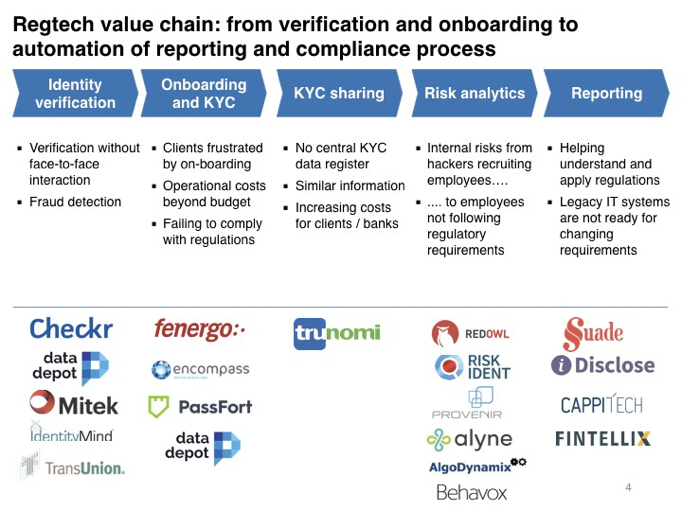

Opportunities for new RegTech start-ups

New companies emerge across whole RegTech value chain from verification and on-boarding to automation of reporting and compliance

Source: Life.Sreda

Source: Life.Sreda

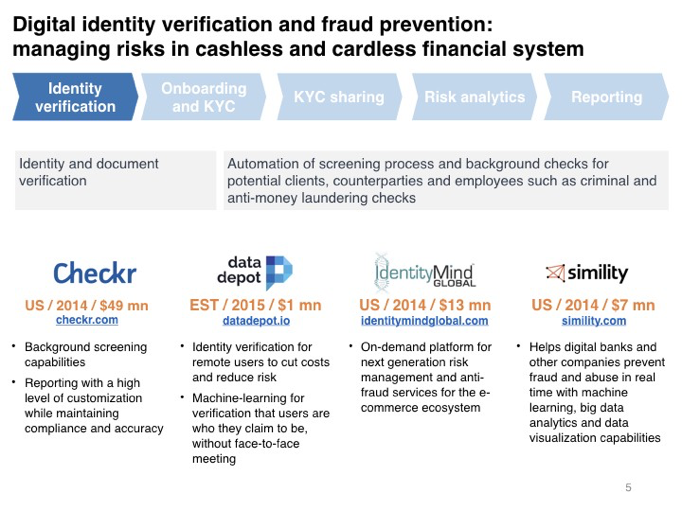

STEP 1. Identity verification: managing risks in cashless and cardless financial system

Key goals:

- Identity and document verification;

- Automation of screening process and background checks for potential clients, counter-parties and employees such as criminal and anti-money laundering checks.

Source: Life.Sreda

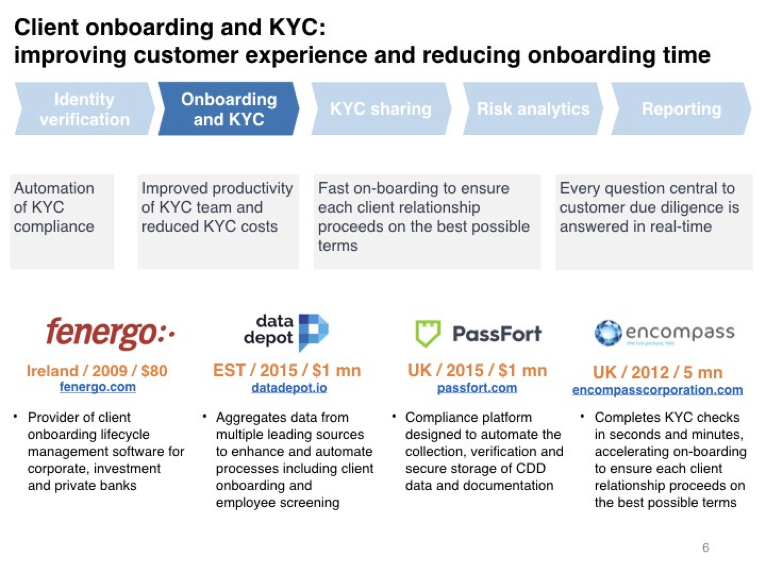

STEP 2. Client on-boarding and KYC: improving customer experience and reducing on-boarding time

Key goals:

- Automation of KYC compliance;

- Improved productivity of KYC team and reduced KYC costs;

- Fast on-boarding to ensure each client relationship proceeds on the best possible terms;

- Every question central to customer due diligence is answered in real-time.

Source: Life.Sreda

Source: Life.Sreda

STEP 3. KYC sharing: monetization of clients KYC data, KYC and AML costs reduction

Key goals:

- Drive down costs;

- Monetize KYC data for clients and for financial institutions;

- Improve efficiency of client on-boarding and quality and speed of keeping KYC records up to date.

STEP 4. Risk analytics: Fighting hackers, internal fraud and mistakes

Key goals:

- Proactive monitoring and mitigation of suspicious human activity inside enterprise and on the client side;

- Reducing company costs and increasing monitoring efficiency;

- Limiting access of employees to valuable data;

- Handling investigations.

Source: Life.Sreda

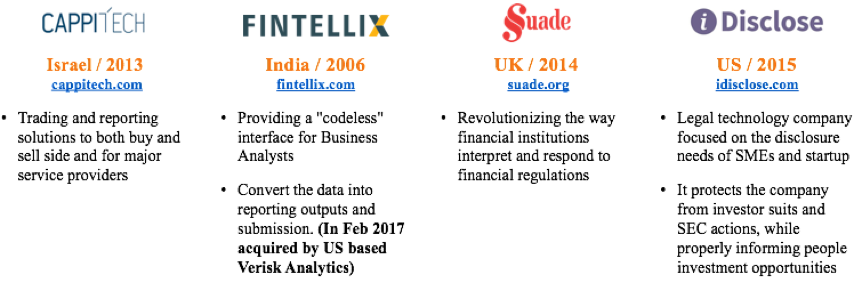

STEP 5. Reporting automation: Reliable & simple compliance for complex multi market regulation

Key goals:

- Lowering costs of keeping track of changing regulation;

- Automation of reporting for compliance purposes.

Source: Life.Sreda

Source: Life.Sreda

To sum up what’s said above, worth mentioning that technology spending in banking and governments has changed dramatically during the past 7 years. It’s IT budgets used to be dedicated to maintain its own existing infrastructure and keep it running. Now, taking into account global digital transformation and growth in mobile and non-traditional channels, areas that were not undertaken by finserv and governments before, now are included in IT spending budgets but managed far outside the IT departments.