MoneyLion’s redesigned app gives personalized financial advice and instant access to personal loans

By Ryan Lawler for Techcrunch

Personal finance management app MoneyLion was created to help users save money, reduce debt and improve their credit. Today the app is being updated to provide users with more personalized information about how they can improve their financial health, as well as even faster access to personal loans.

Like other PFM apps, MoneyLion works by connecting with all of a user’s bank, credit card, student loan and other financial accounts and then providing them with information about how they could improve their financial health.

One way it does this is by giving users personalized recommendations to encourage positive financial behaviors. By analyzing their individual spending habits and credit, the MoneyLion app gives daily advice based on a user’s most recent financial information.

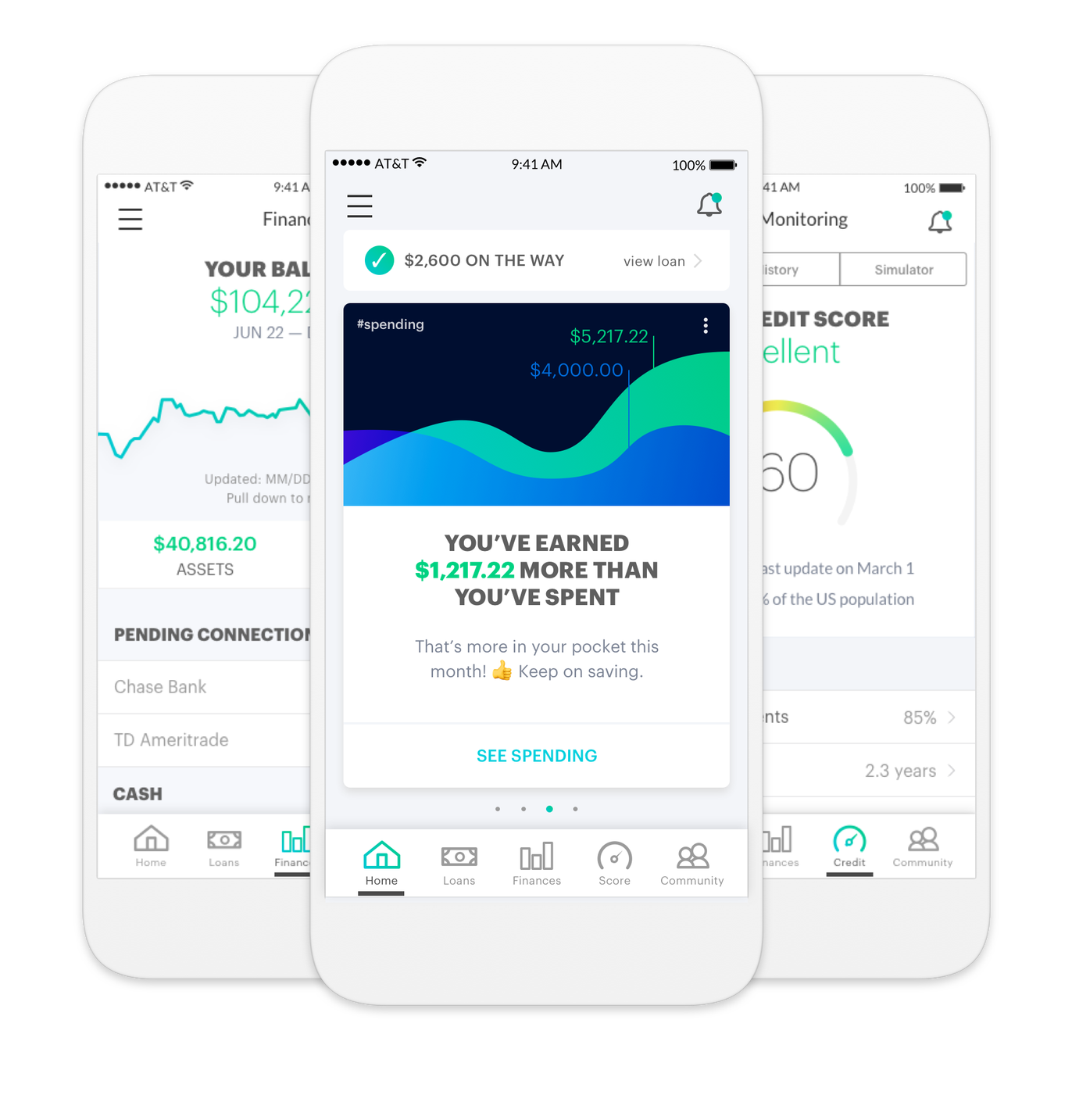

Another way it aims to help users is by improving their credit. It offers free credit reports from TransUnion and Equifax, push notification credit monitoring and access to credit counseling and credit repair services.

The latest version of the MoneyLion app has an updated user interface to make things easier to navigate and provide faster access to the information. With its new UI, MoneyLion’s home navigation now shows swipe-able cards to provide up-to-date information, recommendations and personalized advice.

The app also has streamlined the process of applying for personal loans from MoneyLion itself. Users who are looking to borrow from MoneyLion can now get a loan approved in as little as 15 seconds, and can have funds in their account as quickly as the same business day.

That combination of personalized financial advice and access to personal loans is helping users improve their financial health, MoneyLion says. Customers have saved more than $5 million in rate reductions and rewards by demonstrating good financial behavior, and users save $46 on average in overdraft fees each month, the company says.