WeChat just launched a search engine. Baidu should worry.

By TIA

Chinese search giant Baidu has had it good. For years, the tech firm has enjoyed a near monopoly of the country’s multi-billion dollar search market. Domestic competitors Sogou and Easou trail behind, each with less than 10 percent market share. Google, its most threatening rival overseas, withdrew from China in 2010, citing hacks by the Chinese government.

But now, the tide seems to be turning. Tencent, China’s gaming and social tech titan- and the world’s tenth most valuable company – is focusing its attention on search.

Yesterday, the company’s killer app WeChat launched a new feature conspicuously named “Search.” Created just for the app’s search engine, it lets users trawl through WeChat brand accounts, articles, music, and more. Though it’s simply a new entry point for search queries for now, it signals commitment from Tencent – and perhaps new features to come.

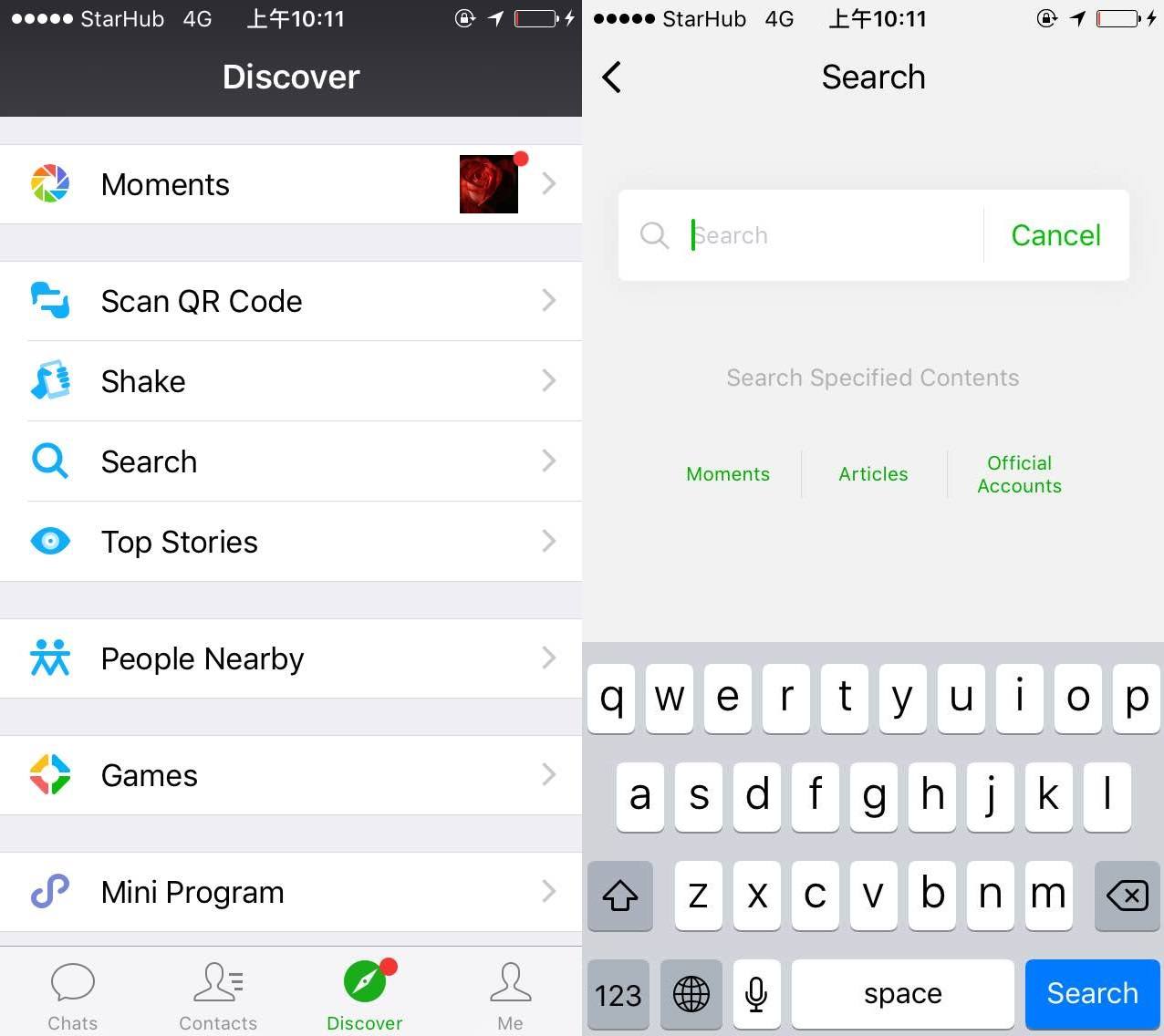

Left to right: WeChat’s latest version includes two new sections: one for its search engine and another for trending stories. WeChat’s internal search function lets users use keywords to look through related articles, brand accounts, mini programs, newsfeed items, and more.

Search-related news about WeChat has been circulating for months. At the end of April, Chinese media leaked information about WeChat’s new search team, which would be responsible for the app’s “search business, content recommendations, artificial intelligence research, and the creation of WeChat’s data platform, as well as related applications.”

The combination of social data, plus payment data, plus search query, will kill Baidu.

In March, the app also launched its own search index, opening up data on popular trends to users for the first time. WeChat has also started beta testing some of its new search features – namely, integration with Zhihu, a Quora-like Q&A platform and one of Tencent’s portfolio companies. That means that for select users, content outside of WeChat is searchable within the app – probably for the first time ever.

“As WeChat becomes more and more ubiquitous, it’s quite possible people will start looking for content more and more inside WeChat,” Thomas Graziani, founder of WeChat-focused marketing firm WalktheChat, tells Tech in Asia. The app has a wealth of data “that Baidu couldn’t dream of,” he says, such as the data gathered through WeChat Pay, the app’s digital wallet.

“The only advantage of Baidu is that they are a search engine – so the queries are purpose-driven,” he says. “But if WeChat users start to make search queries inside WeChat, the combination of social data, plus payment data, plus search query, will kill Baidu.”

According to a Tencent spokesperson, WeChat’s new search team – which is now called the “search application department” – is simply a restructuring of an existing group. They declined to comment further on its specific responsibilities or the app’s integration with Zhihu.

How “Trump” has fared as a keyword in WeChat for the past 90 days. The peak is from early April, when President Xi Jinping met with the US President.

Walled garden

WeChat has a lot to gain by building a better search system. Since launching in 2011, it has grown to encompass most functions of daily life in China. You use it to communicate, pay bills, shop, order food, and hail taxis. You can read the news on WeChat, or use it to watch videos and listen to music.

It is a sprawling ecosystem of content and services – and one that will only continue to grow. Both users and service providers would benefit greatly from a more finely tuned search system. And given all the user data WeChat has – transaction data, social graphs, and more – the app is well-equipped to make more targeted advertisements and personalized recommendations.

Tencent is the only one that can capitalize on WeChat’s massive trove of data

Most importantly, Tencent is the only one that can capitalize on WeChat’s massive trove of data. Unlike Baidu, which trawls the world wide web, almost everything in the app is proprietary. It’s designed to be a closed system. When you click on a link, the webpage opens inside the app. Even QR codes, such as those from competing products like Alipay, Ant Financial’s digital wallet, are controlled. You can’t open them in WeChat (and vice versa).

Mini programs, WeChat’s latest feature, are taking that walled garden approach even further. Reminiscent of Google’s ‘instant apps,’ mini programs are embedded inside WeChat and don’t require installation. To develop them, you need to use “wxml” and “wxss,” two WeChat-only programming languages similar to HTML and CSS, respectively. And like Facebook and Snapchat, mini programs even have their own special QR codes.

“Just like AOL, Tencent and Alibaba want to keep users within their own proprietary environment and prevent them from venturing out into the public internet using their mobile devices,” wrote Brian Viard, associate professor of strategy and economics at Cheung Kong Graduate School of Business.

“This goal has led them into an ‘arms race’ to acquire more and more services,” such as gaming, music, ride-hailing, and more, he added.

By investing more in its own in-app search engine, it’s clear that WeChat isn’t planning to open itself to other parties anytime soon. If you want to publish on WeChat’s platform, you have to register an account with WeChat. You have to play by the app’s rules – there’s no third-party way around it, unlike building a website.

Bottom line

To be sure, Baidu’s leading position in China’s search market isn’t purely luck. It could have easily been overtaken by Shenma, Sogou, or any number of domestic competitors in the years that it has maintained its lead. In fact, even when Google was still in China, it never surpassed Baidu, which offered popular local services that the US search giant didn’t, such as bulletin board-style forums.

Of course, WeChat doesn’t have to match Baidu blow-for-blow by indexing and crawling the internet. If it can satisfy users with its walled garden of content – the app is already insanely sticky as it is – there’s no need to compete with Baidu over the same turf.

Instead, it’ll leave that to Sogou, WeChat’s search partner and one of Baidu’s competitors. In 2013, Tencent invested US$448 million into Sogou and merged its own search unit Soso – which hadn’t gained much traction – with it. About a year after the investment was announced, Sogou launched a search engine just for WeChat content.

WeChat could start leaning on Baidu’s main cash cow, search-based advertising.

Most importantly, the Chinese social app could start leaning on Baidu’s main cash cow, search-based advertising, which made up 91 percent of its revenue in 2016. Tencent, which generates about half of its revenue from online gaming, has also made advertising a focus. Last year, revenues from Tencent’s ad business grew by 54 percent – a margin attributed to WeChat Moments, the app’s newsfeed feature, as well as brand accounts and Tencent’s news apps.

An advertisement on Iqiyi, Baidu’s online video streaming site.

Of course, WeChat’s advertising business is nowhere near the scale of Baidu’s. In that sense, Alibaba poses a larger threat, especially since it overtook Baidu’s market share in China’s digital advertising industry late last year. Still, combined with Tencent’s interest in search, along with WeChat’s many other advantages – stickiness, wealth of content, its user base of 889 million monthly active users – the social and gaming giant poses a looming threat.

“In the short term, marketers spending on SEM [search engine marketing] might not shift directly from Baidu to Tencent,” says Mahdi Shariff, chief strategy officer of adtech firm BiddingX. “Content searches are different from product or need-based searches, the latter ones being more monetizable as they can represent direct purchase intent.”

“However, Tencent can still monetize content search traffic, which will support its continued growth of its digital advertising business,” he adds.

In addition to focusing on WeChat’s search engine, Tencent has been quietly beefing up AI-related capabilities.The tech giant opened a new AI lab in Silicon Valley earlier this month, following in the footsteps of other Chinese tech firms such as Baidu and Didi Chuxing. This year, it’s also planning to open-source its deep learning framework Angel, which is currently used to advertise and mine data for Tencent’s video business. On top of all that, Tencent is also expanding its cloud computing footprint with new overseas data centers.

If Baidu continues to languish in search-related medical scandals and can’t find other ways to fund its AI ambitions and business at large, China’s search giant might see itself boxed in – not by smaller search competitors, but the country’s two other tech giants.