A Simple Macroeconomic Case For Avoiding Lending Club

By Parke Shall

- The case for avoiding Lending Club as an investment is pretty simple.

- We’re at the end of an 8-year short term credit cycle that is going to put pressure on peer to peer lenders.

- They will be first to feel the pain as delinquencies and defaults tick up.

We believe the most commonsense case for avoiding Lending Club (NYSE:LC) as an investment is pretty simple and doesn’t involve a deep dive into the numbers. We think the reasons for avoiding peer to peer lenders can be explained simply and are relatively easy to understand. Lending Club, along with other peer to peer lenders and smaller aggressive regional banks, will likely be a poor investments in coming quarters as a shorter-term debt cycle turns over and the lowest creditworthy types of loans begin to see a spike in delinquencies and faults.

First, a simple question: What type of lender is Lending Club, and where did it come from? The company calls itself a peer to peer lender, but basically all it is doing is lining up people that want to invest cash for a higher yield with people who want to borrow but may not have sufficient access to credit through a banking facility or other means. The whole company is essentially a byproduct of the Federal Reserve keeping interest rates at 0%. People are then forced to go looking for yield in aggressive spots, and the next thing you know we have individual lenders lending money to noncreditworthy individuals.

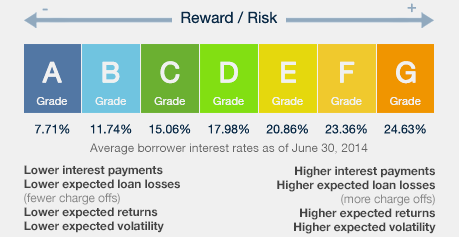

For instance, those that would fit on the “Grade G” portion of this chart provided to lenders by Lending Club:

Like any lender, Lending Club has a place somewhere on the totem pole of lender quality. At the top of this list would be institutional lenders like Goldman Sachs (NYSE:GS) and Merrill Lynch (NYSE:BAC), which lend money to extremely creditworthy individuals, wealthy people, politicians, corporations and the like. Those are top-quality loans with the least amount of worry. At the bottom of the totem pole are people who can’t get credit at all. This is a group of individuals who don’t have access to credit cards and can’t take out any type of loan other than probably a payday loan. Where does Lending Club sit? It is right below the lowest bank on the totem pole and right above people who simply can’t get credit at all. That is the niche that peer to peer lending has carved out for itself.

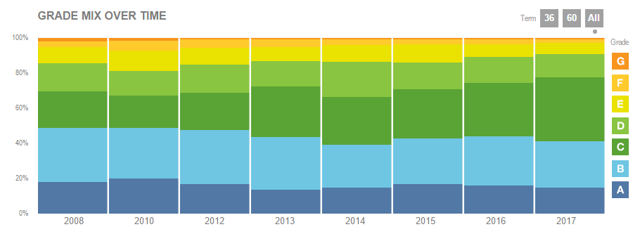

While Lending Club loves to point out to its investors and those who participate in its online marketplace that a lot of its borrowers have great credit scores, the reality of the situation is that the lowest creditworthy people who are denied loans elsewhere will drift to platforms like Lending Club in order to secure a loan they otherwise would not be able to obtain. This is just simply a function of lending markets: the least creditworthy people will find the lowest spot on the totem pole to borrow money. As you can see from this chart sourced from the company’s website, the combined number of “A” and “B” quality loans have drifted lower, while “C” quality loans now make up a majority of Lending Club’s loans.

Then we take a look at the macro economy. Coming out of 2008, the Federal Reserve moved interest rates as low as they could possibly go, because for some reason it is under the impression that more spending equals a healthier economy. This type of ridiculous thinking has led to the “recovery” that we have had over the last eight years, which has basically been institutions issuing more credit for cheaper cost of capital. Banking institutions, universities and automobile dealers have all been issuing credit in record amounts and have all once again perpetuated bubbles in their respective sectors. Lending Club is one of the companies that was born out of the 2008 recovery, and we believe its risky nature has slipped under the radar during this “recovery.”

We know that massive bubbles come around every 20-30 years. This is similar to the bubble that we saw in 2008. In the meantime, however, smaller credit cycles of about seven or eight years also turn over regularly.

This is the point that we believe we are at coming out of the 2008 crisis. We could bore you with our exhausting and overreaching argument that the last eight years weren’t even actually a real recovery, but instead we will just say that once somebody starts to prick the credit bubble, it is going to be the institutions at the lowest part of the totem pole that start to feel the pain first. As interest rates continue to rise, even nominally, and institutions slow on the amount of lending that they offer, defaults and delinquencies will continue to tick upward. Obviously, delinquencies and defaults will be the most pronounced on the part of people who should have never have had credit to begin with.

Enter Lending Club, a pool of investors chasing high yield and borrowers who were likely unable to obtain credit elsewhere. We think the obvious outcome for the broader economy will be significant and continued pressure on all peer to peer lenders, not just Lending Club, going forward over the next couple of years. We think the next few years will be a true test of whether or not the model can even hold up, and we don’t want to be invested in a name when it undergoes that type of volatility and that type of pressure from the broader markets. We would avoid Lending Club and all other peer to peer lenders here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.