Yieldify raises another $6M, appoints adtech vet John Giuliani as chairman

By Ingrid Lunded for TechCrunch

As the web becomes an ever more crowded landscape of things battling for your attention, we’re seeing an increase in marketing spend from companies to help capture it, and that in turn is leading to a rising tide for marketing technology startups building solutions to do just that. Today, Yieldify, a London-based company that builds tools to increase conversions on sites and through email campaigns, is announcing a new round of $6 million to continue building out its products. At the same time, it is appointing a new chairman, John Giuliani, an industry veteran who most recently sold his company Conversant to Alliance Data for $2.3 billion.

Giuliani is also one of the backers in this round of funding, along with a new VC called Binomial Ventures, where one of the partners, Konstantin Stiskin, had previously invested in Yieldify’s seed round. New Look founder Tom Singh was part of this round, and previous investors Hoxton Ventures and Data Point Capital (where Giuliani is a partner) also participated.

You might recall that Yieldify was one of the first investments made in Europe by GV, which partnered with SoftBank Capital to invest $11.5 million in the startup back in 2015. Other previous investors Robin Klein via Index Ventures.

Neither GV, nor SoftBank, nor Klein are part of this latest round, although they remain investors in the company, CEO and founder Jay Radia told me.

The new investor names may not be too surprising: most of the above list has gone through some pretty large shifts in recent times. GV (formerly Google Ventures) has increased its focus on life sciences and AI; Softbank Capital is no more and that fund (through partner Joe Medved) is now managing past investments from Lerer Hippeau; Robin Klein left Index and is now at Localglobe.

Yieldify itself, meanwhile, has been in the news in the last couple of years more for drama rather than its own state of business. A competitor out of the U.S., Bounce Exchange, sued the company for IP infringement, Yieldify fought back and in the end the two settled confidentially. At the same time, the company laid off 10 percent of staff. It’s now at 120 employees.

Now, with all of this behind it, Yieldify is getting back down to business. Radia said that year-on-year growth has been at 174 percent on average for the last four years, and the company currently has around 500 customers, large and medium enterprises that include brand names like CVS, French Connection and Domino’s. It’s not disclosing revenues but Radia told me that the company expects to be profitable by Q4 of this year.

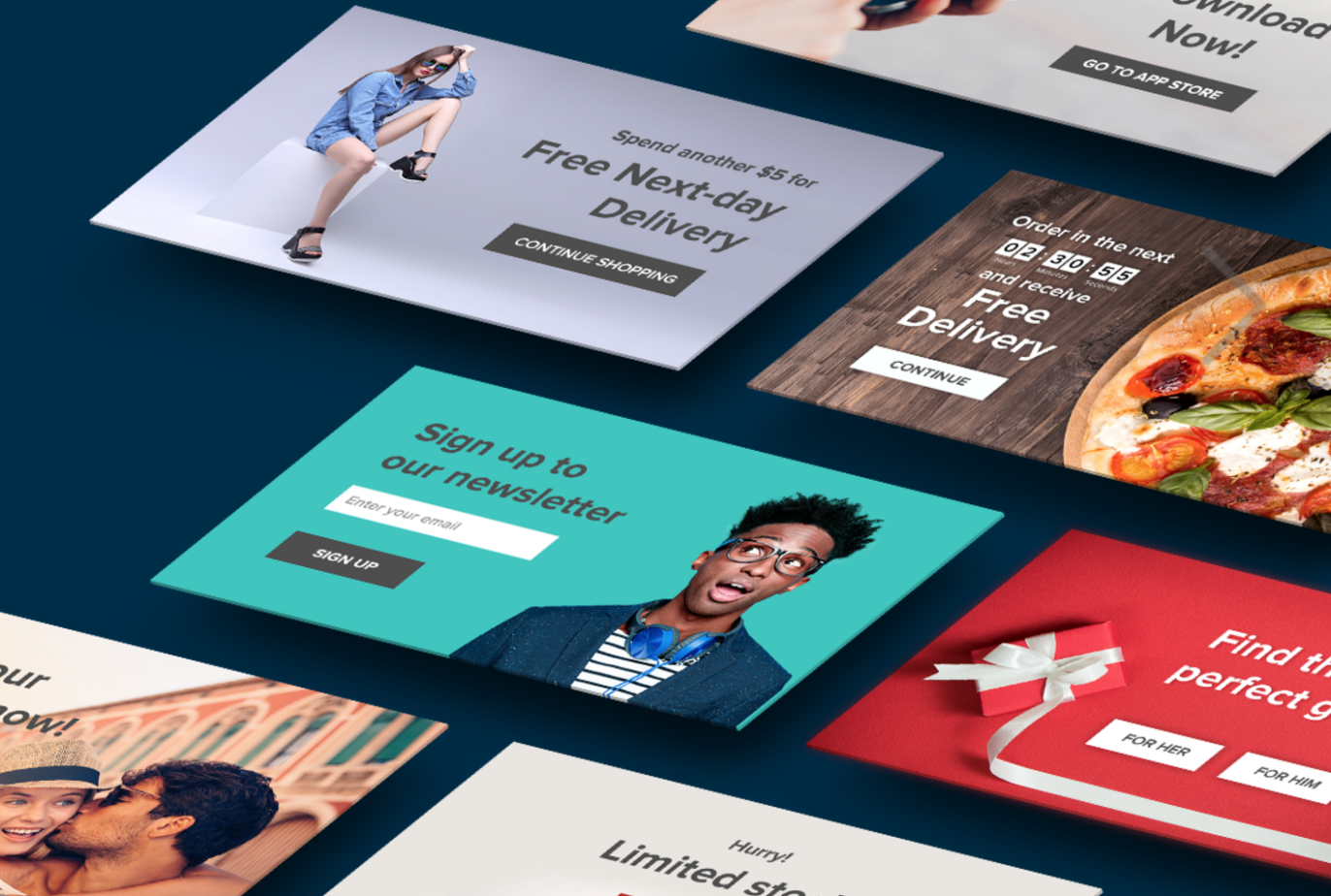

Yieldify today offers a range of products that let businesses market to specific customers who either visit its site or apps, or receive their emails through lists, with targeted messages for discounts and other specific offers based on what you’ve purchased or shown an interest in already. Most recently, in February of this year it launched a new self-service conversion platform for create and measure and analyse campaigns.

More than simple retargeting tools, Radia describes what Yieldify does as a “big data play”: it has racked up 4.7 billion customer interactions and uses that to help analyse behavior in real time.

Unlike many other big data players in the marketing space, today the company does not buy in or sell its data, Radia said. That is something potentially up for consideration in the future, he added, although for now the focus is more on building products based on what Yieldify already has.

“We are focusing on leveraging live data to allow us to create better insights, and we are looking at other channels as well,” he said. “This is all still in R&D phase.” But it should be coming online later this year, he added.

As for other channels, one area where Yieldify is conspicuously not capturing businesses’ audiences is on social media. With Facebook now one of the biggest advertising and marketing platforms in the world, and with social media channels today often the only place where businesses are going in order to spread their name and pick up new business, this seems like a very obvious gap that Yieldify will be looking to try to fill.

Today’s funding takes the total raised by Yieldify to around $20 million. Radia would not comment on valuation except to say that “we’re happy.” Some speculation is out there about the valuation. From what I’ve heard, the company’s pre-money valuation was not to far off $70 million.

With a list of illustrious investors behind it, it’s interesting that Yieldify chose instead to take a different turn and go for less-known names for this smaller round. Radia said that this was a conscious decision.

“It’s my first business and I wanted more hands on investors,” he explained. “The profiles of the people I was speaking to were super hands-on and dedicated.”

Hands-on will have to come from afar, though. Giuliani is based out of Las Vegas, Nevada, while Yieldify is headquartered in London (with offices in New York and Sydney, Australia). Radia says there will be a lot of communication anyway.

“The Yieldify product and the team behind it are breaking new ground in the marketing technology space,” he said in a statement. “The recognition that they’ve received among the clients they work with and the investors they’ve attracted is well-earned and distinguished. This is shaping up to be an exciting journey that I’m looking forward to being a part of.”

While some previous investors may not have put money into this round, they continue to support the company. “With an amazing new platform to scale its products and delivery, Yieldify has positioned itself to be a trailblazer in this space,” said Medved. “We’ve been proud to watch its progress so far, so we’re delighted to now welcome John and the new investors on board to help its leadership team take the next steps to fulfil their vision.”