On-demand insurance platform Trov raises $45 million ahead of U.S. and global expansion

By Paul Sawers for Venture Beat,

Insurance tech startup Trov has closed a $45 million Series D funding round led by HSB Ventures, with participation from Oak HC/FT, Suncorp Group, Guidewire, Anthemis, and Japanese insurance giant Sompo Holdings.

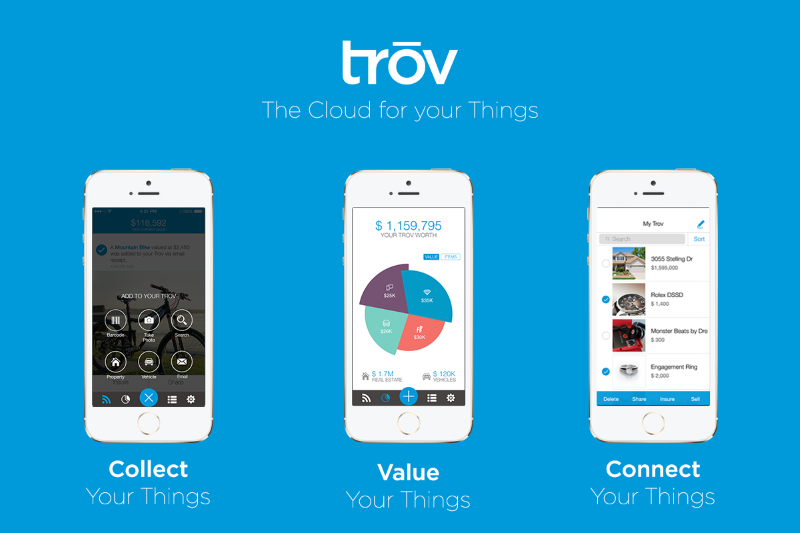

Founded in 2012, California-based Trov sells itself as an on-demand insurance platform “for the things you love.” So rather than insuring the entirety of your possessions, you can choose just a single item or the items that you value most — such as your Fitbit and Xbox One, or just your iPad Air. And it’s all done online or through native mobile apps for Android and iOS.

Above: Trov

Prior to pivoting to become an insurance company, Trov was actually a personal inventory app that allowed users to value and track their various possessions, and it’s still available in the U.S. in that form, minus the insurance element. And this will continue to serve as a core part of the Trov platform moving forward, with users able to organize their belongings in the cloud.

Given the stringent regulatory hurdles across the insurance industry, Trov has been slow to come to market. It originally landed in Australia in May 2016, followed by the U.K. in December, while German insurance giant Munich Re — the parent company of HSB Ventures, which invested in this round of funding — recently won the bid to underwrite Trov’s insurance platform in the U.S. That is expected to kick off sometime in 2017. It’s also worth noting Sompo’s involvement in the Series D round, as we’re told that the company will help bring Trov to market in Japan.

Today’s funding takes Trov’s total equity financing past the $90 million mark and will be used to “power its global expansion and new product development,” according to a statement issued by the company. With that in mind, Trov has also revealed that Munich Re will now be underwriting its policies across many markets in Europe, Asia, and South Africa.

“Trov’s early success in Australia and the U.K. is demonstrating that modern consumers want a new way to protect their things,” explained Trov founder and CEO Scott Walchek. “With the additional capital and extensive partnerships, soon millions of people around the world will be empowered to protect the things that enhance their lives whenever and however they want.”

A number of insurance tech startups have come to fruition in recent times. Peer-to-peer insurance firm Lemonade recently launched out of stealth in the U.S. and is licensed to issue its own policies, rather than requiring a third-party underwriter. Lemonade has nabbed some $60 million in funding to date. Over in Europe, fledgling insurance-focused startups such as Clark, Wefox, and Kniphave raised more than $60 million between them.

Trov follows an “unbundling” trend we’ve seen across the technology realm in recent years. With countless cordcutters paying for individual streaming services, instead of a broad cable subscription; newspapers flirting with pay-per-article revenue models; and micropayments permeating the web, it’s perhaps not so surprising to see insurance unbundled in the way that Trov is doing. And it does make sense — why pay for an expensive insurance plan designed to cover your worldly belongings when all you really care about is your mountain bike and your laptop?

“Trov’s on-demand protection represents a genuine innovation in insurance for an unserved or under-insured market,” said Andy Rear, CEO of digital partners at Munich Re. “Our extensive footprint will surely help power Trov’s rapid expansion to the most active markets around the globe. We’re excited to be taking a deeper role with the industry’s first global insurtech platform.”