Top Business-to-Business Wealth Tech Players

By Julie Muhn for Finovate Blog

If you’ve been following our series on wealth tech, you’ve seen our analysis of the industry as a whole, a review of the top trends, and an examination of B2C wealth tech players.

Our wealth tech coverage continues this week with a review of business-to-business (B2B) players in the wealth tech space. These are companies that cater directly to banks, advisors, or brokerages, instead of offering products or services directly to consumers. B2B wealth tech is a large category, so I’ve sub-divided it into four digestible groups and listed my top picks for each category. Since category sizes vary, the number of selections also varies.

Alternative investment services

These are platforms that help advisors connect clients with unconventional investment types, such as private equity, hedge funds, futures, real estate, etc.

- BondIT (FF16)

- DarcMatter (FS15)

- EquityZen (FS16)

- HedgeCoVest (FF14)

- STRATiFi (FKA Sliced Investing) (FF15)

- Venovate (FS14)

- WealthForge (FS16)

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

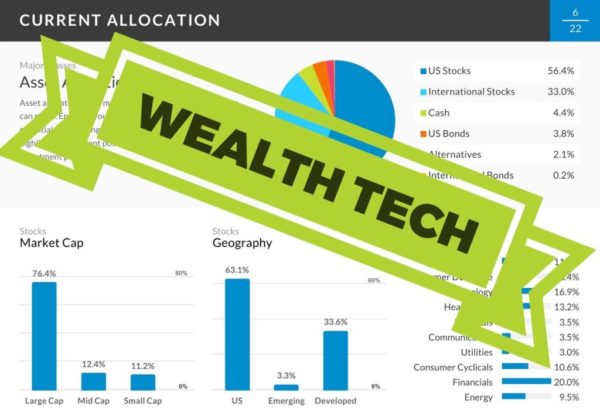

Technology for advisors and brokerages

These are tools available via API, SDK, or web interface to help advisors compete with robo advisors by allowing them to invest with less bias, increase client communication, scale operations, find new clients, and more.

- Advisor Now (owned by Envestnet) (FS16)

- Advisor Software (FS16)

- BaseVenutre (FS16)

- Capital Preferences

- eMoney Advisor (FF14)

- iQuantifi (FF14)

- Polly Portfolio (FS16)

- RightCapital (FF16)

- Totum Wealth (FDSV16)

- Trizic (FS15)

Trizic offers advisors their own digital tools to compete with robo advisors

Trizic offers advisors their own digital tools to compete with robo advisors

Non-U.S. B2B investment and advisor technology

Similar to the above category, these companies offer tools for advisors outside of the U.S.

- Additiv, Switzerland (FEU16)

- Bambu, Singapore (FA16)

- Capitali.se, Israel (FEU16)

- Comarch, Poland (FS16)

- InvestGlass, Switzerland (FEU16)

- meetInvest, Switzerland (FS16)

- Mydesq, Switzerland (FEU15)

- Novabase, Portugal (FF15)

- Quantifeed, Hong Kong

meetInvest helps advisors invest like world-renowned market experts

meetInvest helps advisors invest like world-renowned market experts

News and Information Companies

These are online platforms, APIs, or SaaS offerings that provide advisors market information, show them trending news, or connect businesses with market data to power their own products.

- ForwardLane (FS16)

- Heckyl (FEU13)

- PsychSignal (FS15)

- StockViews (FS15)

- Xignite (FA16, FDNY16)

ForwardLane’s dashboard acts like a private research analyst for advisors advisors, helping them stay current on new trends and funds

ForwardLane’s dashboard acts like a private research analyst for advisors advisors, helping them stay current on new trends and funds

First appeared at Finovate Blog