China: Citic Goldstone, Huagai Capital back $29m Series B in Tiger Brokers

By Tomas S. Noda III for Deal Street Asia

Tiger Brokers Co, a Beijing-based online brokerage company, has raised up to $29 million (RMB 200 million) in a Series B funding round participated in by Citic GoldStone Fund Management Co Ltd, and Huagai Capital.

Others who joined the round were existing investors Zhen Fund, and China Renaissance K2 Ventures.

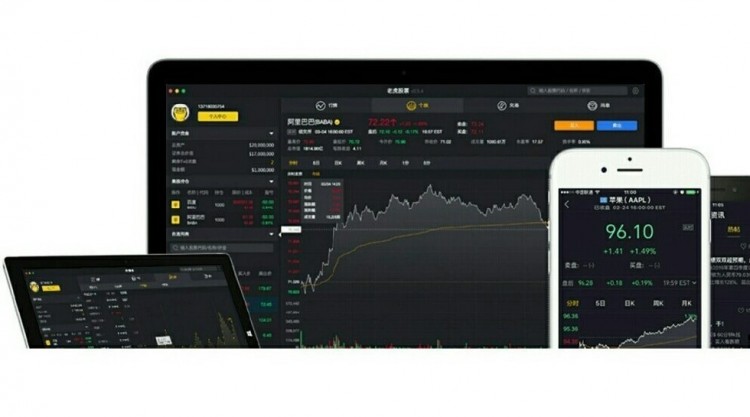

Founded in June 2014, Tiger Brokers, through its web securities and stock transaction platform, enables Chinese speaking investment professionals to invest in securities abroad, like trading on the Hong Kong and US stock main boards.

The international securities startup just announced last week its expansion into Singapore, giving investors access to low-commission cross-border investment choices.

Tiger Brokers aims to use the proceeds for infrastructure development, and boosting its big data capabilities in a bid to advance further its online brokerage services.

Mainland China’s top securities brokers Citic Securities Co Ltd, parent firm of Citic Goldstone, shall serve as mentor of Tiger Brokers.

Tiger Brokers CEO Wu Tianhua said growth in securities trading apps is an inevitable trend, in tandem with the accelerating popularity of smart phones and driven by the demand by Asia-based investors for a more globally diversified allocation of their assets.

“Our goal is to make Tiger Trade the app of choice for any Chinese speaking investor with an international investment portfolio,” Wu said.

Tiger Brokers last year raised $16 million in a funding round backed by China-based smartphone giant Xiaomi Inc, China Renaissance K2 Ventures, and Zhen Fund.

In addition to access to US and Hong Kong stocks, and China A-shares, Tiger Brokers claims to support transactions involving securities margin trading in addition to 13,000 US stocks, share options and ETF products.

First appeared at Deal Street Asia