U.S. noncash payments are a $178 trillion market: Fed

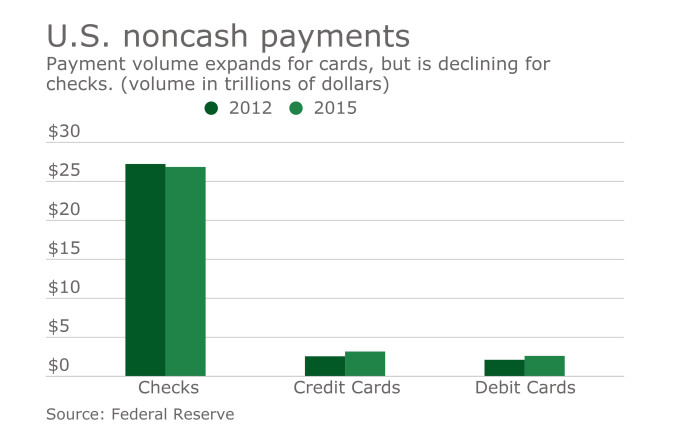

A new analysis from the Federal Reserve shows checks as one of the few non-cash payment types to decline, while many others are on the rise.

U.S. noncash payments, defined as debit card, credit card, ACH and check payments, totaled 144 billion transactions valued at $178 trillion in 2015, up by 21 billion payments and $17 trillion since 2012, according to the Federal Reserve Payments Study 2016.

The study, which was released Thursday, also reports noncash payments increased at an annual rate of 5.3% by number and 3.4% by value from 2012 to 2015.

The number of credit card payments reached 33.8 billion in 2015, reaching a value of $3.16 trillion, up 6.9 billion or $610 billion since 2012. Credit card payments grew at an annual rate of 8% by transaction and 7.4% by value during the same period, the largest growth rate among payment types considered. ACH payments grew 23.5 billion in 2015 with a value of $145.3 trillion, up 3.1 billion by number or $16.3 trillion by value since 2012. Debit card payments reached 69.5 billion in 2015, up 13 billion or $0.46 trillion since 2012.

Check payments in 2015 totaled 17.3 billion with a value of $26.8 trillion, down 2.5 billion or $380 billion from 2012. Checks fell at an annual rate of 4.4% by number or 0.5% by value over the four year period. The Federal Reserve reports that while checks are in decline, the pace of decline is slowing.

The report also found chip cards accounted for only 2% of card payments in 2015, though it notes 2015 was the early stage of chip card payments in the U.S., where the card networks’ fraud liability shift rules did not take hold until October.

First appeared at Payments Source