6 fintech startups from Asia that excited us in 2016

By Michael Tegos for TechInAsia

Fintech is going strong in Asia as the year draws to a close. According to the Pulse of Fintech Q3 2016 report by global audit and advisory firm KPMG, venture capital funding in Asian financial technology companies increased, reaching US$1.2 billion – outpacing even the US, where VC investment totaled US$0.9 billion.These are startups that either had a cool idea or a particularly good year.

It should be noted that the number of deals was smaller in Asia than the US and Europe (35 versus 96 and 38, respectively). And the height of investment can be traced to some mammoth deals in China and less to other markets in Asia.

But there is interest in the region, particularly since hubs like Singapore have decided to go all-out supporting fintech. Singapore’s central bank, for example, announced in the middle of the year that it would create a regulatory sandbox in which fintech startups can try out their ideas. More recently, in November, it released financial data as APIs for developers and app creators to use in their services.

Here are six Asian fintech companies that drew our gaze this year, listed in alphabetical order. The list is meant to be indicative rather than exhaustive; the picks are not meant to be the best fintech startups of their markets. They are startups that either had a cool idea or a particularly good year. They also serve as a demonstration of the different problems fintech is trying to solve in different countries, from financial advice to blockchain applications to different forms of online payment.

Alpaca (Japan)

Alpaca was born out of CEO Yoshi Yokokawa’s experience in financial markets and the desire to build his own business after he quit his job at Lehman Brothers. With his team, Yoshi created an artificial intelligence-driven service for image recognition. After selling that product to Japanese electronics company Kyocera, Alpaca turned its tech towards trading advice.

Yoshi (left) and the Alpaca team.

Through its products, AlpacaScan and AlpacaAlgo, the startup helps you make trading decisions by monitoring financial data and even create your own algorithms by “teaching” the system about your successful trades. The startup says this gets your error-prone emotions out of the way of your trading.

In Japan’s fast growing fintech market, Alpaca addresses part of a key financial problem in the country: the lack of financial literacy.

BankBazaar (India)

BankBazaar is an aggregator for loans, credit cards, and insurance. It tracks financial products from more than 30 partners and claims to have over 5 million customers in India, serving 1,336 cities.

It has raised more than US$79 million so far, and its investors include Amazon and Sequoia Capital.

The startup started the year with a bang, breaking out of its home market to set up an office in Singapore. Its value lies in addressing the traditional system’s inefficiencies – especially in helping small businesses and individuals that have difficulty accessing financial services.

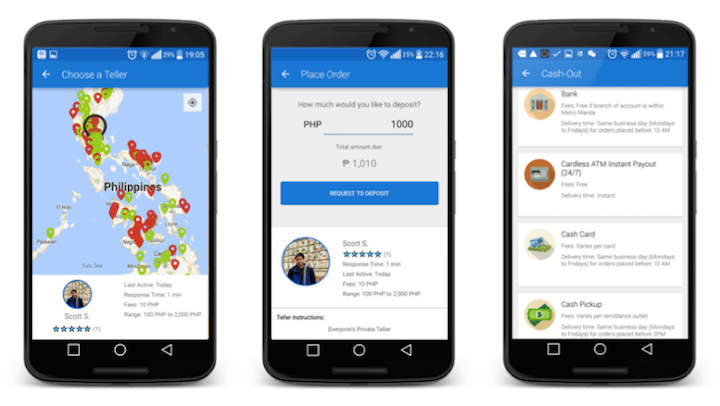

Coins (Philippines)

Coins uses blockchain technology to enable money remittances, bill payments, and mobile credit top-up. Its e-wallet service enables unbanked people in the Philippines and Thailand to transfer and collect cash at partner locations like small stores.

2016 was kind to the startup. It raised US$5 million for its series A round in October to grow its user base in its current markets.

More recently, it announced a partnership with Stellar, a US-based non-profit that supports an open financial protocol. The partnership will allow users to send money to the Philippines from Stellar’s e-wallet to Coins’ system. This could bring in a lot more transactions for the Filipino startup.

Dianrong (China)

Dianrong is China’s answer to US-based Lending Club – a peer-to-peer (P2P) lending platform that allows users to borrow money crowdsourced from the community. Founded in 2012, the company claims to have 300,000 active lenders and has opened 26 offices in China.

Dianrong found itself in the eye of the storm this year, as the P2P lending market in China struggled under Ponzi scheme fraud and tightening restrictions. Dianrong weathered the elements and retained users’ trust, working to restore the image of P2P lending companies in the country. CEO Soul Htite hopes to lead Dianrong to an IPO within the next two years.

MC Payment (Singapore)

MC Payment, founded in 2005, is one of Singapore’s oldest fintech companies. It started out trying to develop mobile payments for feature phones. Over the years, it has produced e-wallet applications, mobile point-of-sale systems, and non-cash payment products.

Managing director of 2W Group, Schwin Chiaravanont (L), and MC Payment founder and CEO, Anthony Koh, at the opening of MC Payment’s office in Thailand. Photo credit: MC Payment.

This year, the company broke a long silence to showcase the work it’s done so far. It raised US$4.5 million for its series B round in August and an additional US$3.5 million in November to fuel its entry into Thailand, its sixth market. It is also active in Singapore, Malaysia, Indonesia, Hong Kong, and Australia.

Founder and CEO Anthony Koh feels the startup’s product diversity and its ability to move quickly and adapt to its needs have contributed to its success and longevity.

Omise (Thailand)

Omise is an online payments provider. It started out in 2013 as an ecommerce company, but after failing to find a satisfactory payment solution, the team decided to build its own, moving away from the ecommerce component.

In July, Omise raised a series B round worth US$17.5 million – one of the largest series B rounds for a fintech company in Southeast Asia, according to the Tech in Asia database. With this funding, the startup wants to take advantage of the region’s budding ecommerce opportunity.

First appeared at TIA