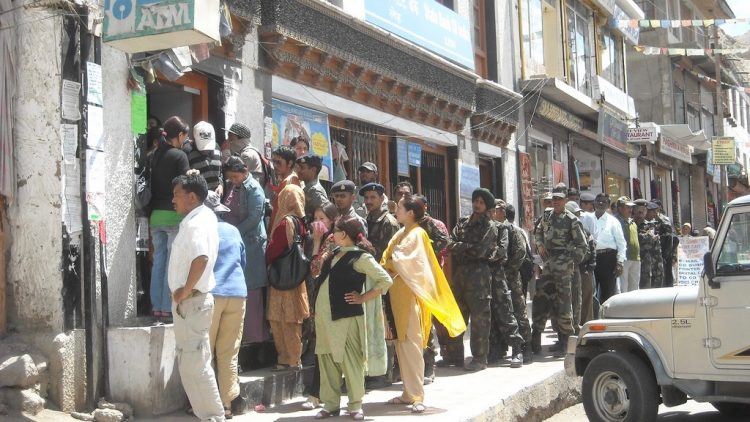

Airtel Bank opens its doors as India grapples with demonetization crisis

By Kylee McIntyre for TechInAsia

You know what they say about demonetization in India, right? It marches on.

Okay, so maybe that saying’s not quite in classics territory yet, but the country’s black money-combatting cash overhaul has ushered in a transition period full of long ATM lines, rather excellent internet memes, and every remotely fintech-related company preaching the good news of cashless payment options.

This, of course, sucks if you’re part of the 47 percent of Indians without bank accounts, because the way to cashless paradise, even if only by debit card, lies by way of an Indian bank account – easy enough to attain but an adjustment for several. (As of a year ago, 43 percent of open Indian bank accounts went untouched.)

In India, 78 percent of the adult population owns a mobile phone of some type.

Today, telco company Airtel has offered yet another avenue toward cashless happiness, involving its subsidiary Airtel Payments Bank and (what else?) your smartphone. The payments bank has gone live in India’s largest state Rajasthan. Anyone with an Aadhaar card (India’s national ID card) can open a bank account on the spot at one of 10,000 Airtel retail outlets, which double as Airtel Bank hubs.

The bank account will give users access to digital banking services, which Airtel says will be accepted by a number of merchants in Rajasthan (Airtel aims to get 100,000 partner merchants by the end of this year.) Through the bank doesn’t offer an ATM or debit card facility (that’s one less place to stand in line at) at the moment, customers will also be able to deposit and withdraw funds from Airtel Bank points.

Users will be able to make money transfers over the phone or from the Airtel Money app, where they will also be able to check account balances and access other services. Customers with Airtel numbers gain access to free money transfers to Airtel numbers that also have accounts with the bank; existing Airtel mobile numbers will double as account numbers.

The bank will also offer an interest rate of 7.25 percent per annum with US$1,500 in personal accident insurance.

Rajasthan will act as a pilot for Airtel Bank, which hopes to launch in the rest of the country. If it works, it could be a huge hit. In India, 78 percent of the adult population owns a mobile phone of some type. A mobile-linked banking solution could catapult quite a few into the digital payment life.

Converted from Indian rupees. US$1 = INR 68.52

First appeared at TIA