Omnichannels Can Offer Omni-Opportunities

By Roger Niederer for LTP

“The interconnected digital world we live in means consumers are able to purchase nearly any product, however and wherever they want,” writes Roger Niederer, Head of Merchant Services at SIX Payment Services. Retailers need to understand how their customers interact across all channels so as to be able to tailor their payment choices and the added value to the services they offer, thereby maximizing revenue. At the same time, they need to ensure high-security standards and reliability whilst also keeping costs down. How can retailers strike this balance?

In the increasingly connected, digital world, consumers have a significant choice when it comes to how they make purchases and interact with retailers – global brands, small local businesses and everything in-between. The proliferation of social media, online reviews and price comparison websites means that consumers are better informed and more astute than ever. For merchants, this presents opportunities but also challenges.

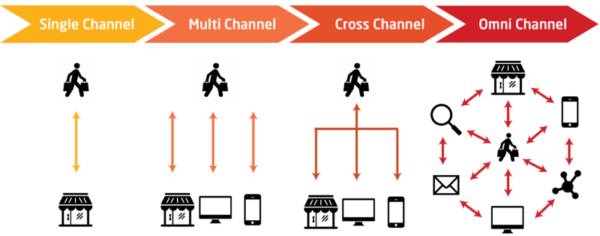

Omnichannel, the multilateral approach in a customer’s shopping experience, is the key to successful shopping. Consequently, successful selling. analyzing and understanding the shopping behavior of consumers and aligning logistics, systems and transactions appropriately are vital for maximizing revenue. Retailers who are able to maximize the business insight from the data they hold will be in a strong position going forward.

From the customer’s point of view, the assumption is that the shopping experience will be simple, efficient and convenient and that products and services will be available as and when they are needed. For the retailer, this presents the challenge of meeting the expectations of customers who wish to purchase goods and services either instore or through one of many ‘distance trading’ channels.

For merchants, here are the requirements:

- ensuring inventory availability – right time, right place

- the ability to accept the relevant payment methods in different channels

- single integration to access payment services

- effective handling of refunds across channels

- consolidated view on all payments

- integration to back office systems

Retailers need to come to terms with the new reality of how their customers shop and adapt to the fact that purchase routes are no longer strictly linear. Take the following example: a customer clicks on an e-mail in her inbox from a store recommending beauty products. Then she looks for reviews from other customers among her social media networks. After this, she searches for her personal voucher code and, finally, completes her purchase on her smartphone or tablet. The customer could then even go into the store to pick up her beauty products in person – and while she is there buy even more.

By understanding key customer journeys, retailers can deliver a more coherent and seamless service. Knowing what customers want is the golden rule when it comes to omnichannel. Analysis shows that revenue that comes through multiple channels is greater than when just one channel is used for purchases.

Merchants should, therefore, look to remove obstacles that block purchase routes. Being able to accept a variety of payment methods – quickly and securely at the point of decision – is key. Today’s customers take it for granted that they will be able to pay via their preferred method be it instore, online, over the phone or by mail order. Retailers should look to implement the full spectrum of payment solutions; credit and debit cards, e-wallet, PayPal, bank transfer and extend omnichannel thinking to the different payment preferences and requirements in different geographies.

Payment methods need to be simple and convenient, particularly for those making online purchases. The number of pages and questions should be minimized. With an increasing share of e-commerce being conducted on mobile devices including smartphones and tablets, it is impractical to expect customers to enter non-essential text into online forms. The objective is a positive and streamlined experience on these devices – one touch payments epitomize this.

In addition to convenience, security is paramount. Customers are becoming increasingly cautious about the amount of personal data that they share and they trust retailers to hold it securely. Merchants are obliged to ensure that customer details are processed and stored securely, and in line with regulatory requirements. Any breach has the potential to be hugely damaging.

On top of this, customers expect to be rewarded for loyalty to a brand, therefore, loyalty programs should be integrated into all channels where the brand is trading. Where possible, they should also be personalized to optimize impact. There also needs to be flexibility. The redemption of bonus points or loyalty vouchers shouldn’t necessarily have to be made in the channel in which they originated. If a customer collects points through an online purchase and wants to spend them instore, he should be able to immediately.

Of course, a key question for retailers is the amount of investment required in order to put the optimal infrastructure in place. Businesses need to balance revenue generation and customer expectations whilst keeping the costs of their payment processes manageable.

Finding the right payments partner who understands your international omnichannel requirements is essential. Expertise in payment acceptance in all channels in multiple geographies to deliver a unified, secure and reliable business model will help drive your business success. It’s also important to consider that, with the market innovating rapidly, any solution that is implemented needs be flexible so as to support needs now and in the future.

Although introducing omnichannel payments flexibility will result in an initial financial outlay, the enhanced customer experience and streamlined internal processes should pay dividends. Ultimately, consumers who are familiar with the benefits of omnichannel have expectations. Retailers who don’t take their needs seriously risk losing them to their competitors.

First appeared at LTP