London fintech startup Soldo launches multi-user spending account for families

By Steve O’Hear for TechCrunch

London fintech startup Soldo — founded by tech veteran Carlo Gualandri who previously helped create Italy’s first online bank — is launching a multi-user spending account. The cloud-based service, which has been 18 months in the making and is currently available in the U.K. and Italy, is designed to enable and control the flow of money inside organisations with multiple users.

Initially targeting families for things like dishing out pocket money to your kids, splitting household bills, or giving a domestic worker an expense allowance, Soldo also plans to launch for businesses too.

The startup has built its own tech stack and, although not a fully-fledged bank, holds an electronic money license and is regulated by the U.K.’s FCA. Like a plethora of other fintech upstarts, Soldo is partnering with Mastercard to bring the service to life.

In a call, Gualandri told me, having “been there and done that,” he had no intention to start another bank and instead was interested in solving what he thinks is a mass-market problem not currently addressed by single user “wallets” or debit cards. That is, how to manage the day to day spending of all those needing access to family or company money, while maintaining control of the budget and spending rules.

He says Soldo would consider formal partnerships with banks, perhaps co-branded rather than white-labeled, but also points out that since Soldo is about spending only it complements rather than competes against a bank’s current account or other banking products.

“Soldo is not looking to disrupt the universal banking system, nor is it looking to compete for traditional banks’ customers,” he says in a statement. “We have identified a problem that is common to many families and businesses and created a simple solution that will work alongside customers’ current banking systems”.

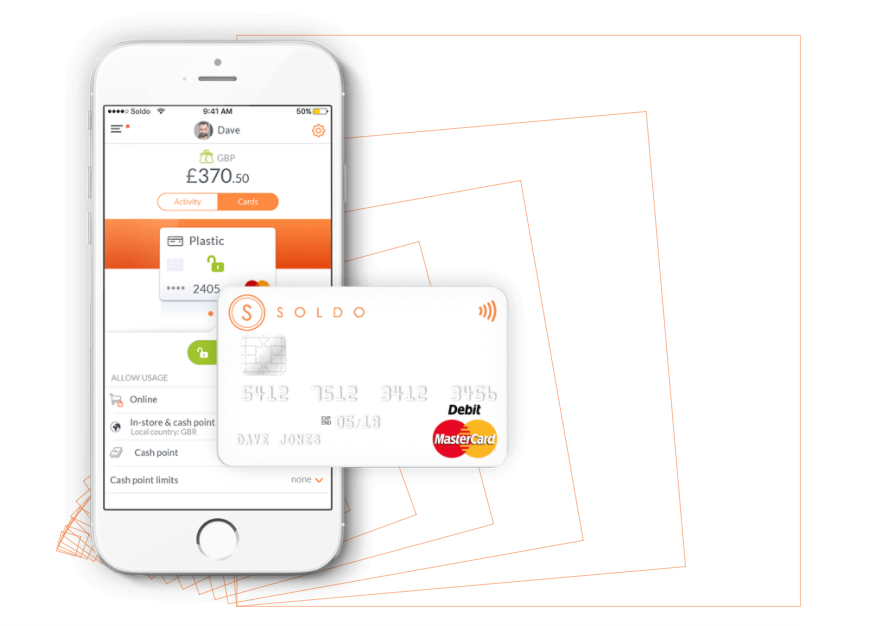

At its heart, says Gualandri, Soldo is an agnostic system of permissions and granular spending rules that can reflect the way a family already operates, but by swapping cash for electronic money. It allows the account holder to define a network of spenders, with each member receiving an digital wallet and a physical debit card. “This could range from a couple sharing their bills or a family managing their children’s spending, to a complex family network that includes parents, children, domestic workers, elderly care providers and anyone providing a regular service to the family,” explains the company.

Those controls include the ability for the account to not only set budgets but also different rules for each person. For example, a partner may have full control over spending limits, a teenage child may have a daily allowance limit, and a childcare provider may have use of the card only during the hours of their employment.

You can also enable or disable online transactions, cash withdrawals and overseas spending within the app, and every transaction comes with a push notification sent to the account holder.

“The evolution of financial regulations and technology, alongside a shift in user behaviour is opening up possibilities for new players such as ourselves to enter the market, offering new and innovative financial services,” adds Gualandri. “We envision our customers will continue using traditional banking services for what they do best and make their lives easier by using Soldo to manage day to day spending for everybody in a family or business environment”.

First appeared at TC