As Hype Wanes, Blockchain Settles into Practical Banking Niches

By Bryan Yurcan for American Banker

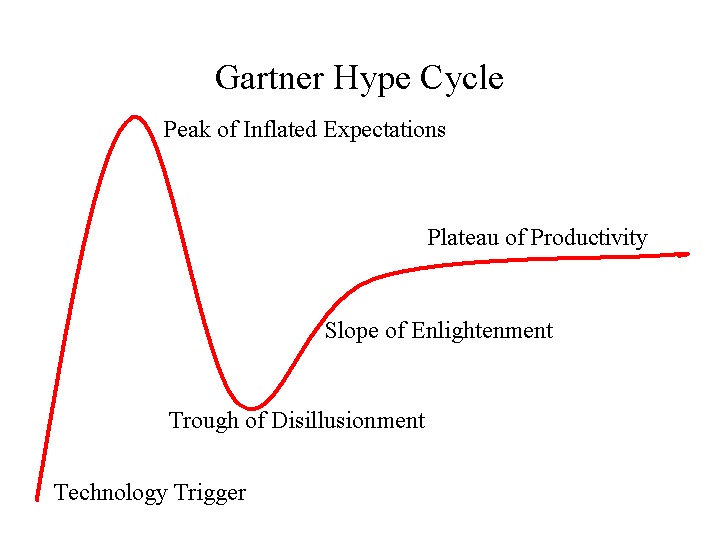

Technologists and bankers may be settling on a narrower range of use cases for blockchain technology than suggested by the euphoric discussions of wide-ranging possibilities a year or two ago.

Or perhaps the hype of blockchain has begun to subside and the real ways it is going to shape banking are starting to crystalize.

Although banks continue to conduct internal blockchain experiments on things like data integration across disparate systems, that might not be the best use of the technology. Its most viable use is likely the common architecture built cooperatively by banks that replaces functions such as those performed by existing clearinghouse and payments settlement entities, some industry experts said.

“I think you’re now seeing an acknowledgement that internal use cases within a bank don’t make much sense,” said Nick Nadgauda, global head of payments, receivables and wholesale cards technology at Citigroup, this week at the D+H Insights conference in New York. “But we are starting to see use cases where we need to communicate with other banks and other untrusted entities. When you start to explore in that space, that is where [blockchain] gets really interesting and exciting.”

Nadguada said blockchain could improve upon current methods of clearing and settlement between banks, usually facilitated by entities such as the Depository Trust & Clearing Corp.

There are some who even disagree with that notion.

The DTCC does not believe blockchain will replace the existing infrastructure, said Rob Palatnick, its chief technology architect. But it is experimenting with the technology. Earlier this year it partnered with the blockchain company Digital Asset Holdings to develop and test a distributed ledger-based solution to manage the clearing and settlement of U.S. Treasury, agency and agency mortgage-backed repurchase agreement transactions.

“While we believe there will be many opportunities to improve the post-trade process by leveraging distributed ledgers, we do not anticipate that the technology will imminently replace the back-office ecosystem,” Palatnick said. “We expect that it will initially be integrated into the current post-trade environment in certain areas where automation is limited or non-existent, and where the technology provides a clear benefit over existing processes.”

Any blockchain project that does eventually change the entire financial ecosystem will likely be one that is cooperatively built by many banks, said James Methe, principal with Capgemini consulting. Like Nadgauda, Methe said blockchain technology will reach its true potential in banking not from individual bank innovation labs, but an industry-wide infrastructure.

“It will first take one bank to say to another, ‘I will innovate with you,’ and then you go from there,” he said.

Of course, this is already happening. Most notably, blockchain company R3 CEV is working with a consortium of banks on a distributed ledger platform, which it has named Corda, designed to manage financial agreements between financial institutions; though current members of the consortium haven’t committed to using it and aren’t bound to it. R3 did not respond to a request for comment for this story.

Blockchain, Methe said, may ultimately best function as the underpinning that connects the financial ecosystem worldwide.

“It can serve as the cargo container for logistics and standardize the way things are moved, in this case information messaging,” he added.

That kind of pragmatic thinking is a long way from the initial hype of blockchain, which “everyone thought would replace all the other technologies,” Methe said.

First appeared at AB